Mapping Your Card Program’s Fund Flows: A Conversation with Lithic

Managing fund flows and ledgers for card programs can be tricky. Here are four takeaways from a recent webinar with Lithic focused on the fundamentals.

Last week, Modern Treasury co-hosted an online conversation with Lithic, a program manager and backend processor providing APIs for issuing and managing cards. This event spotlighted the connection between central ledgering and cards, with detailed, actionable insights and key considerations for company’s launching a card program.

As our partners at Lithic demonstrated, card programs can entail a host of business benefits. These include increased revenue and brand awareness, as well as valuable data collection and money movement opportunities (crypto cards are a good example of the latter). Card programs can also support financial education, specifically around budgeting and credit-building, and prove beneficial for employee spending.

For companies looking to launch a card program and leverage these advantages, ledgering should be top of mind. Here are four key takeaways from our webinar on mapping the flow of funds for card programs.

1. A Central Ledger Is Vital for Card Programs

Central ledgers are essential to card programs in the following ways:

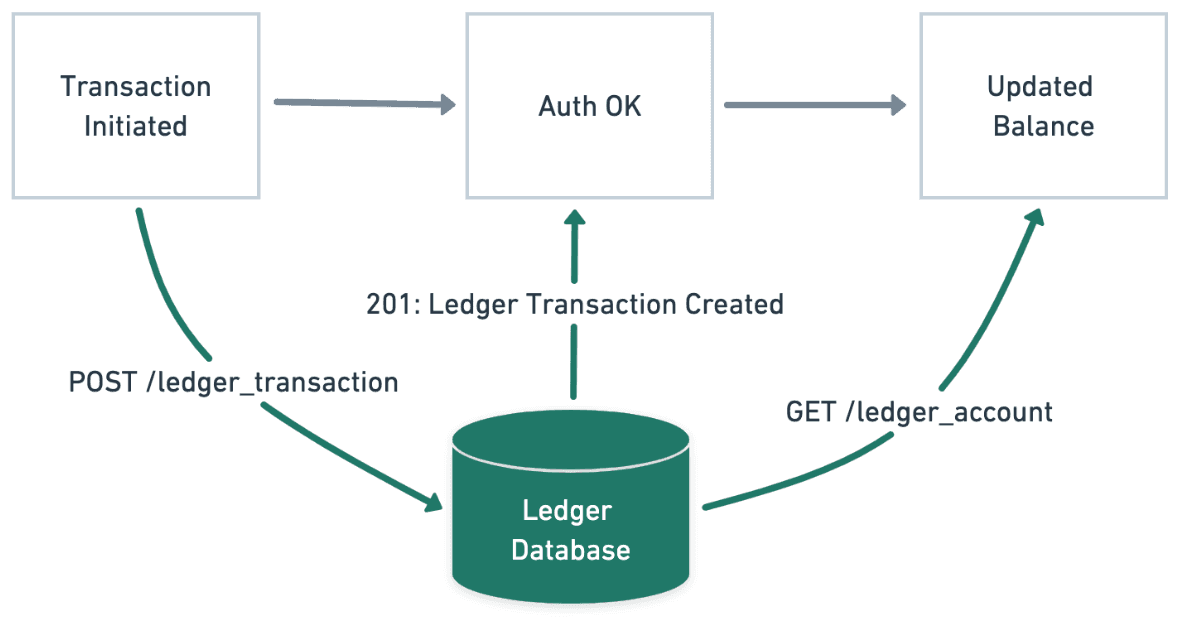

- Enhancing security during authorization. With Modern Treasury, for example, you could create a ledger transaction that is “locked on account balance.” This serves to verify that the available balance (from posted to pending) is sufficient, and either succeed or fail the request to write a transaction.

- Ensuring infrastructure scales. As businesses grow, card transactions occur at greater volume, at closer intervals, and even simultaneously. Having a central ledger in place to serve as a single source of truth (as well as provide benefits below) is key to scaling any company’s card program.

- Minimizing disruptive issues. The right ledgering database can help with potential card program pain points by: (1) preventing lost money, (2) making errors and adjustments traceable, and (3) allowing teams to address and prevent balance drifts.

- Supporting auditability and compliance. A good ledger is designed to act as a central system of record for your card program. In this way, a central ledger makes auditing faster and simpler; it also helps teams actively maintain compliance, serving as an internal touchpoint as well as a sharable data resource for external parties should the need arise.

If you’re preparing to launching a card program, dig deeper into these benefits here.

2. Thoughtful Ledger Design Matters

Whether you’re building in-house (as many companies do) or assessing vendors, it’s important to ask the following questions to determine the effectiveness of your card program’s ledger.

How scalable is it?

A ledger needs to handle concurrent transactions appropriately. Do you need balances to be immediately—or close to immediately—consistent? How will you manage “hot” accounts, or accounts that get the bulk of transaction volume?

How flexible is it?

A good principle in a ledger database is abstracting accounts and transactions as the two core objects. For example, a ledger shouldn’t have a “card” object and a “cardholder balance” object. Low-level logic makes it easier to comply with double-entry.

Does it use double-entry accounting?

There are immense advantages to going double-entry from the start. A double-entry ledger serves as a built-in system for checks and balances, and it dramatically reduces the chance of errors. It also boosts traceability and auditability.

For more on ledger design, check out our three-part series: Accounting for Developers.

3. Ledgers Help With Sponsor Banks

An effective central ledger supports partnerships with banks in several capacities.

- Reconciliation. Accurate reconciliation is crucial to the success of a card program and the bank's biggest concern—should money go missing, your company will be responsible for those funds. A central ledger also ensures a strong relationship with your sponsor bank which is crucial for the success of any card program.

- Data. Although sponsor banks support reconciliation using transaction data from individual ledgers, banks actually treat funds flow and reconciliation at a holistic program level (not on an individual transaction level). For this reason, it’s vital that companies maintain their own record of individual transaction data.

- Account structure. A card program requires several accounts to function, along a wide range—card programs can be built with anywhere between three and 25+ accounts. Ledgers can serve as a source of truth across accounts. The structure of these accounts depends on the bank and how they manage fund flows for their reconciliation. As an example, a basic prepaid or debit model generally uses five accounts:

- FBO: Holds the sum of all available cardholder funds

- Settlement account: Where money is moved for settling with networks and merchants

- Activity (or operational) account: Used to support other program functions (i.e. promotions, chargebacks/disputes, loan offerings, loan repayments, future gift cards)

- Revenue account: Funds made from the program, such as fees charged to end users or interchange

- Negative balance reserve: Used to cover for any range of issues where additional funds are required

Using a ledger to support and sustain your partnership with a sponsor bank, across account types, can make or break your card program.

4. Mistakes Can Be Costly

Alli Nilsen, Senior Technical Program Manager at Lithic, shared a few scenarios that illustrate the significance of a good central ledger.

First, when settlement is due to Mastercard or Visa, for example, the amount owed is non-negotiable. The card networks will send sponsor banks a settlement “request” requiring payment in full, on time, or fees will be charged. A good ledger makes all the difference when it comes to accurate reconciliation (and avoiding fees).

In another instance Alli observed, a company managing a card program launched a promotion and decided to adjust balances in their cardholder ledgers directly. As this was not a central ledger, it required the company to communicate directly with their bank partner on a case by case basis. For this promotion specifically, they failed to communicate that they were adjusting balances. Within one day, the FBO (for-benefit-of) ledger balance was off by $200K—and the program manager had to supply the money to balance out the funds.

Clearly, a proactive, thoughtful approach to ledgering—built for scaling programs and transactions—can help protect your bottom line.

A Ledgering Solution for Your Card Program

A big thanks to panelists from Lithic for joining us in this discussion, and to our audience for great engagement. We hope you’ll access the full webinar recording coming soon to our YouTube channel.

If you have questions about ledgers or want to learn more about how Modern Treasury can help you map card program fund flows, reach out to us.