Customer Stories

The Payments Platform Businesses Trust

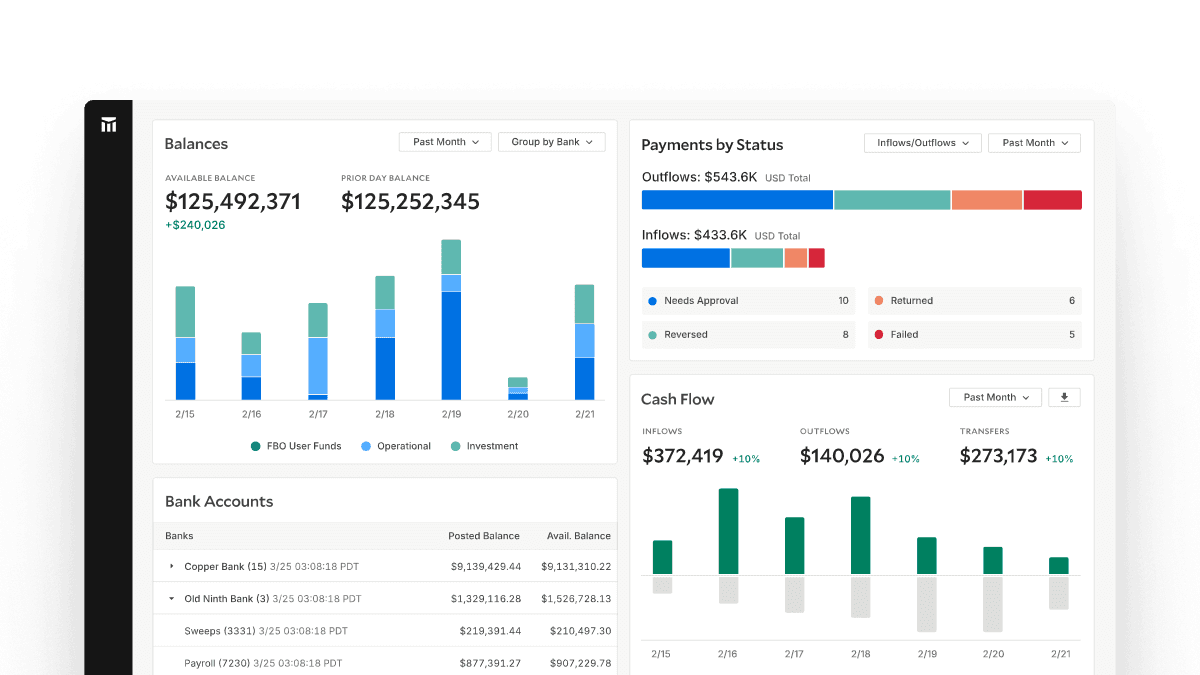

40%

of the company using the Modern Treasury dashboard

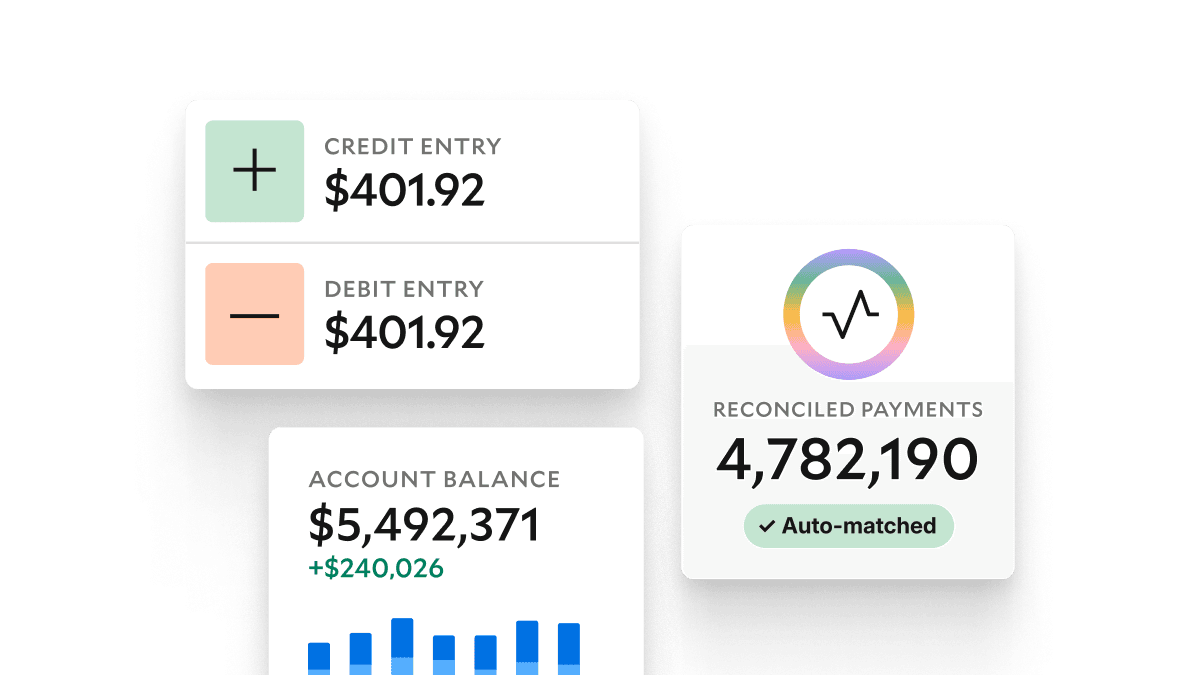

8 weeks

to design, build, and launch Ledgers integration

4 weeks

to complete bank integration and go live with Payments

6 months

of development time saved versus an in-house build

150k

annual savings compared to a homegrown solution