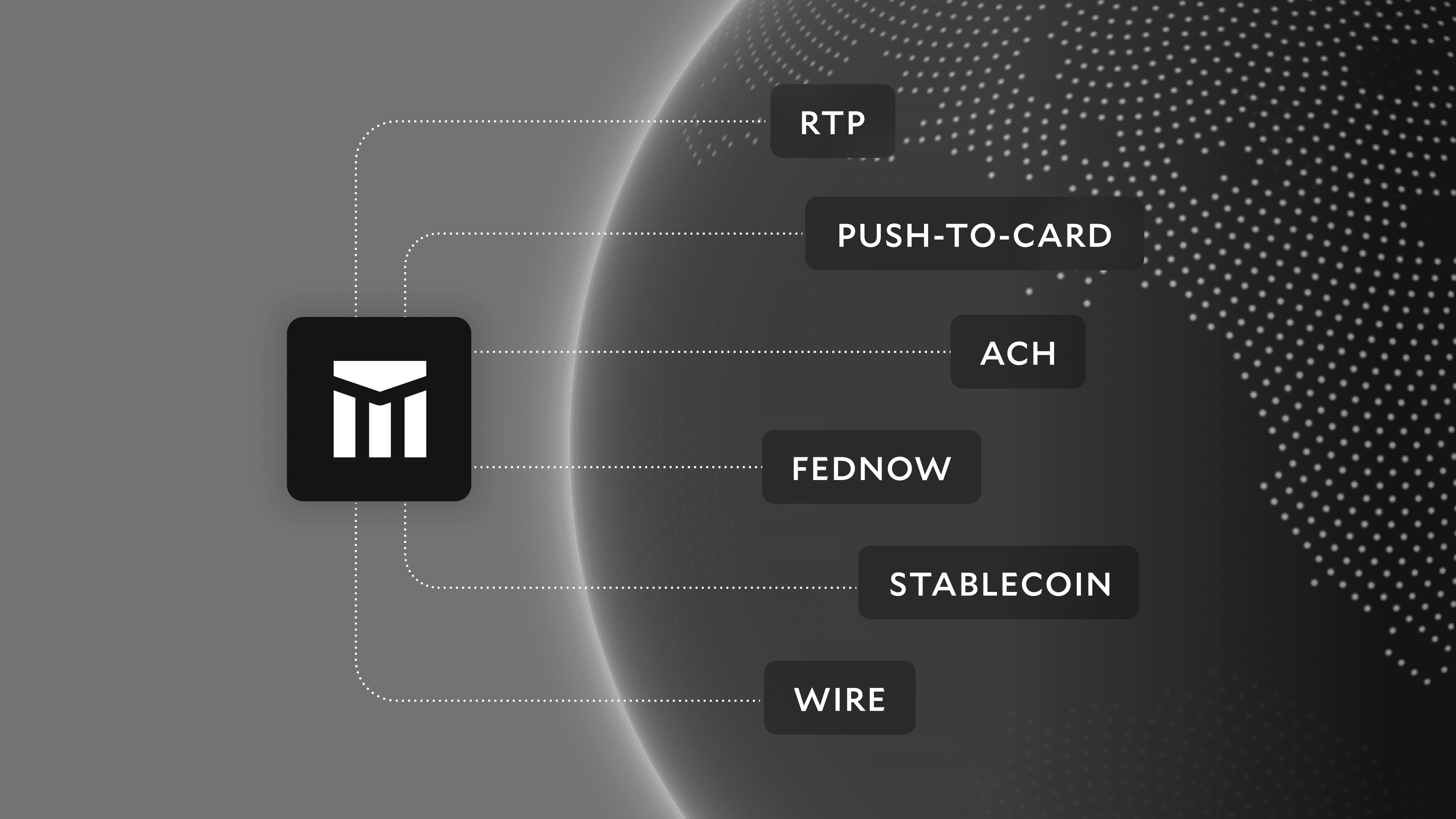

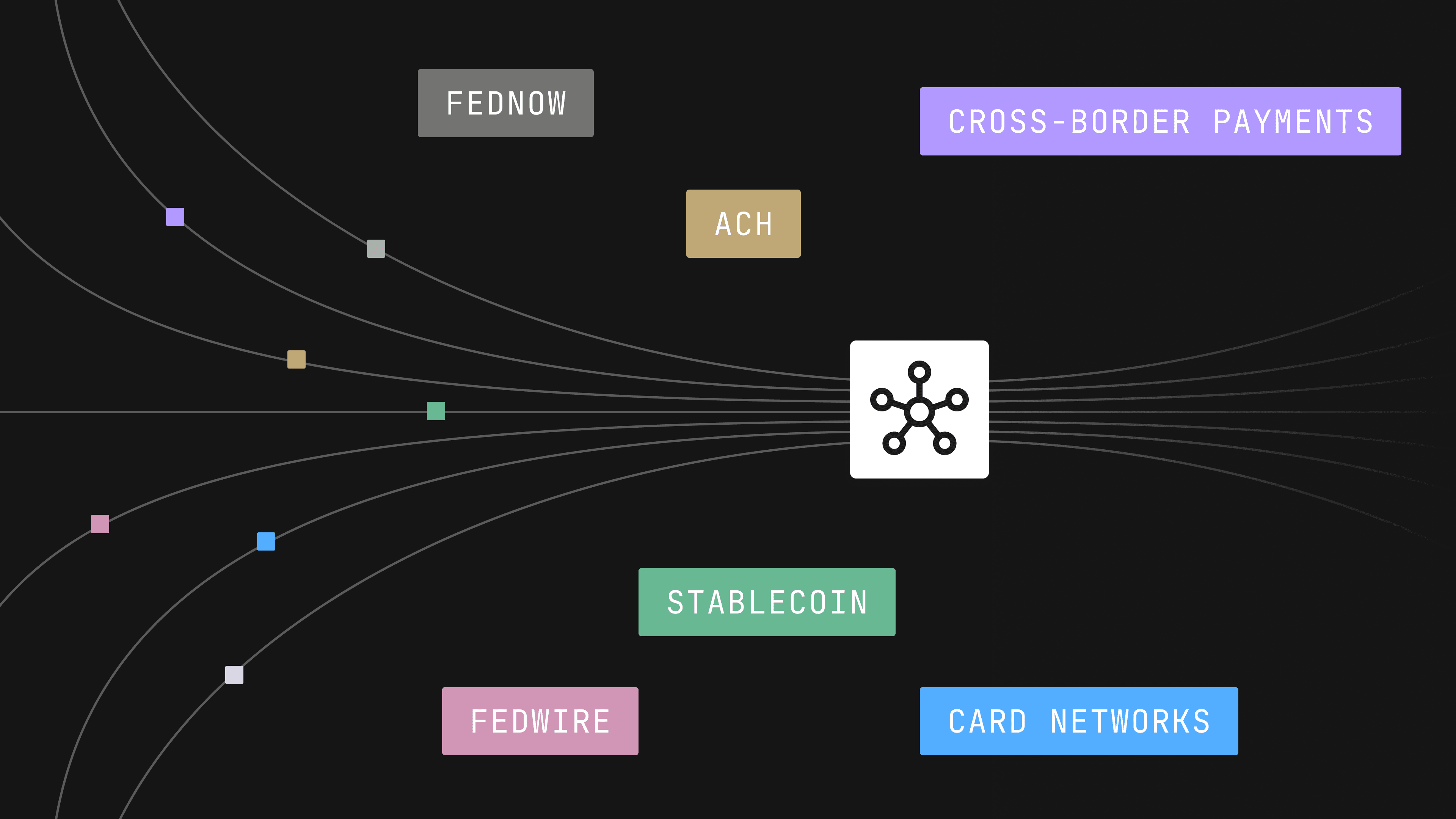

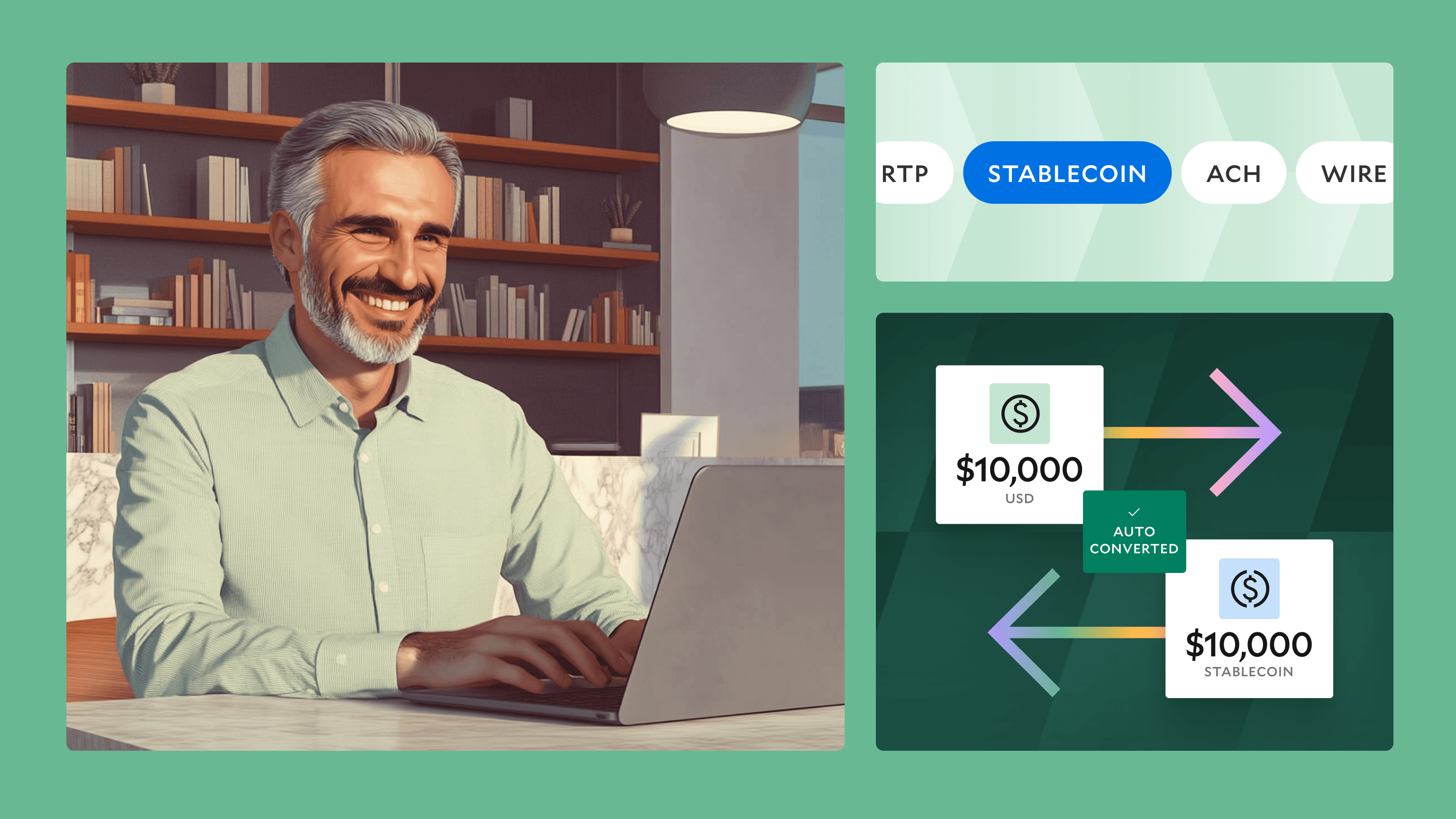

Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

Resources

Journal

→

Journal

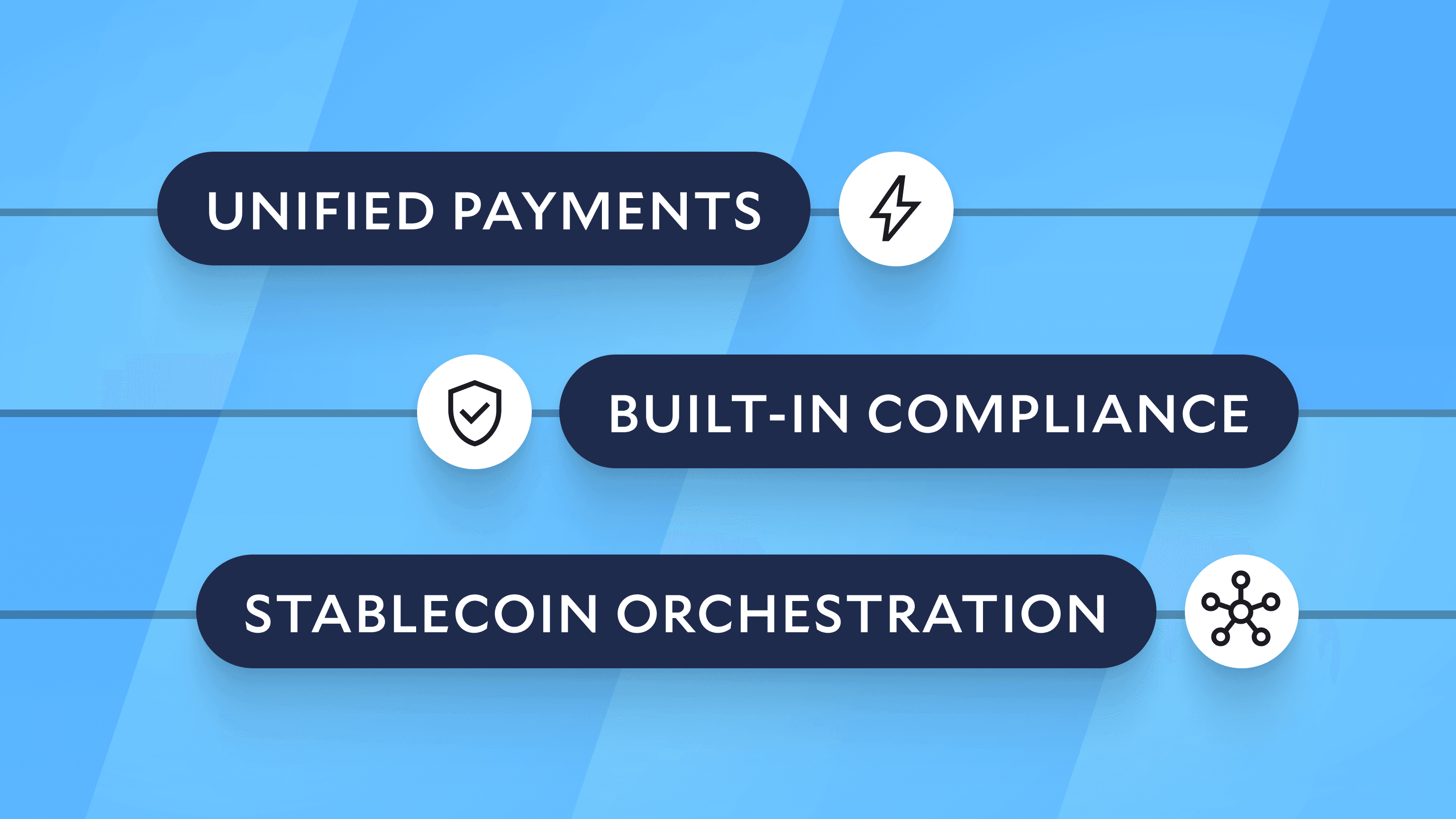

Why We Built Payments

→

Journal

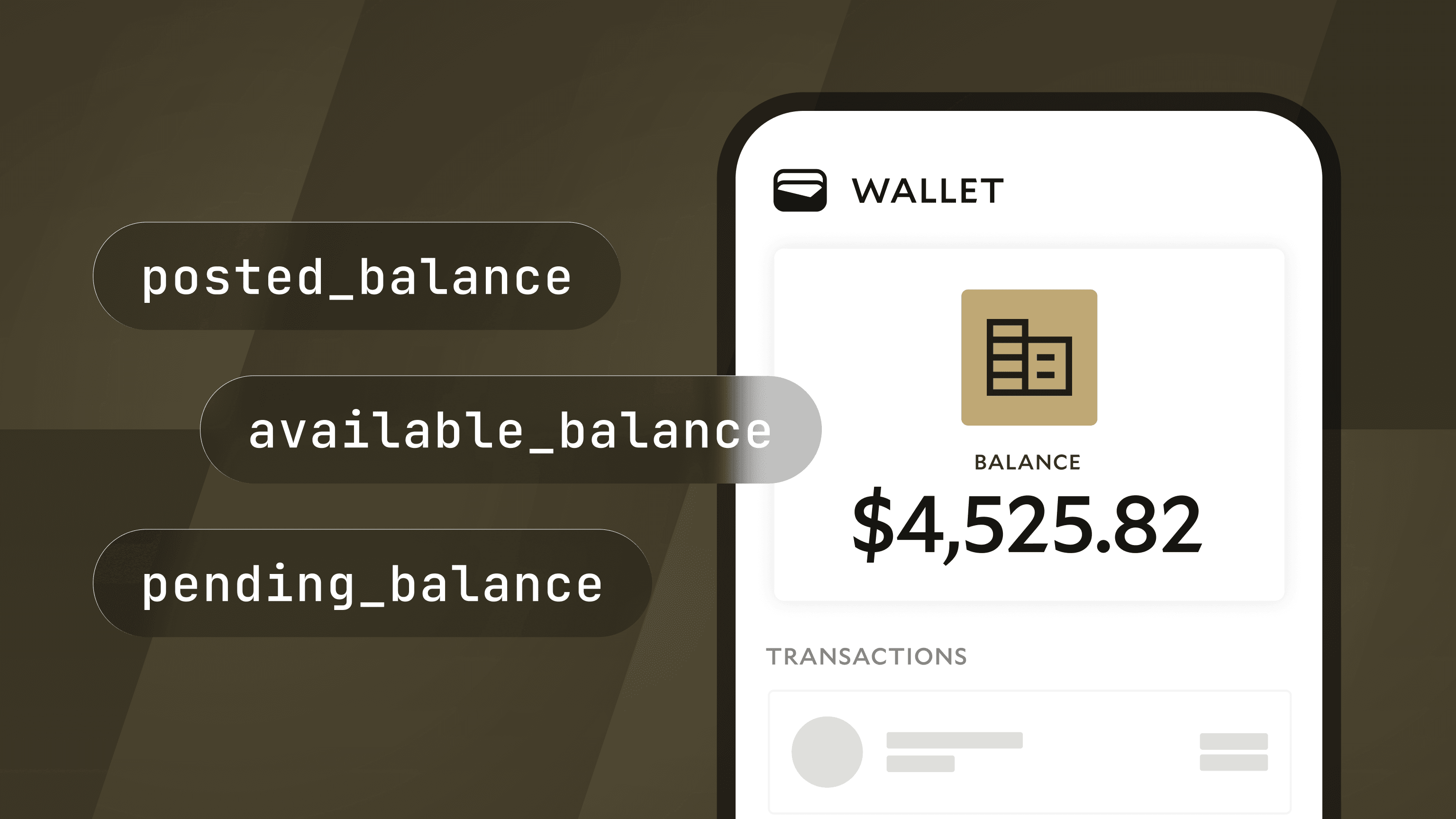

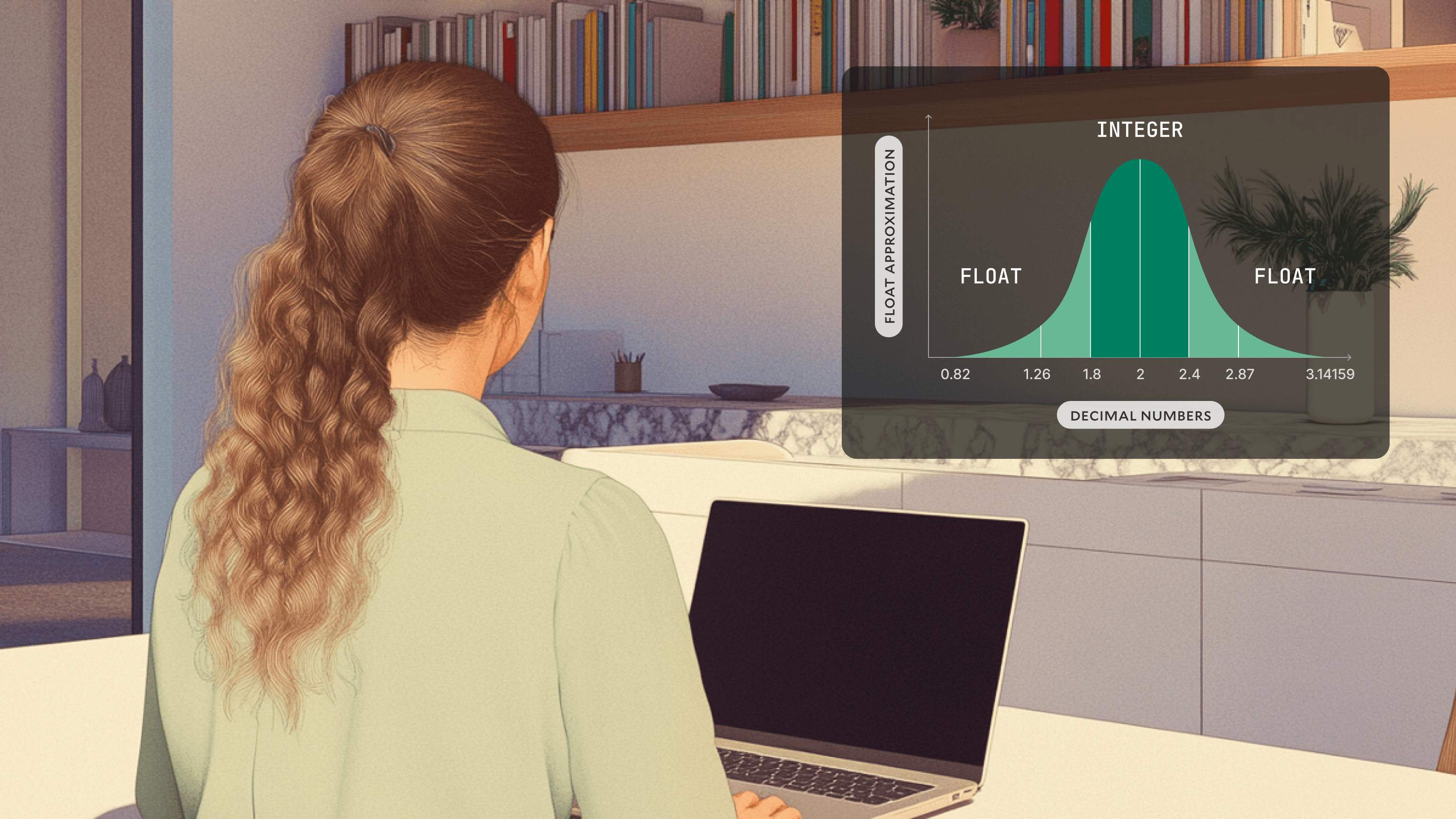

Why Use a Managed Ledger

→

Journal

An Update From Our Founders

→

Journal

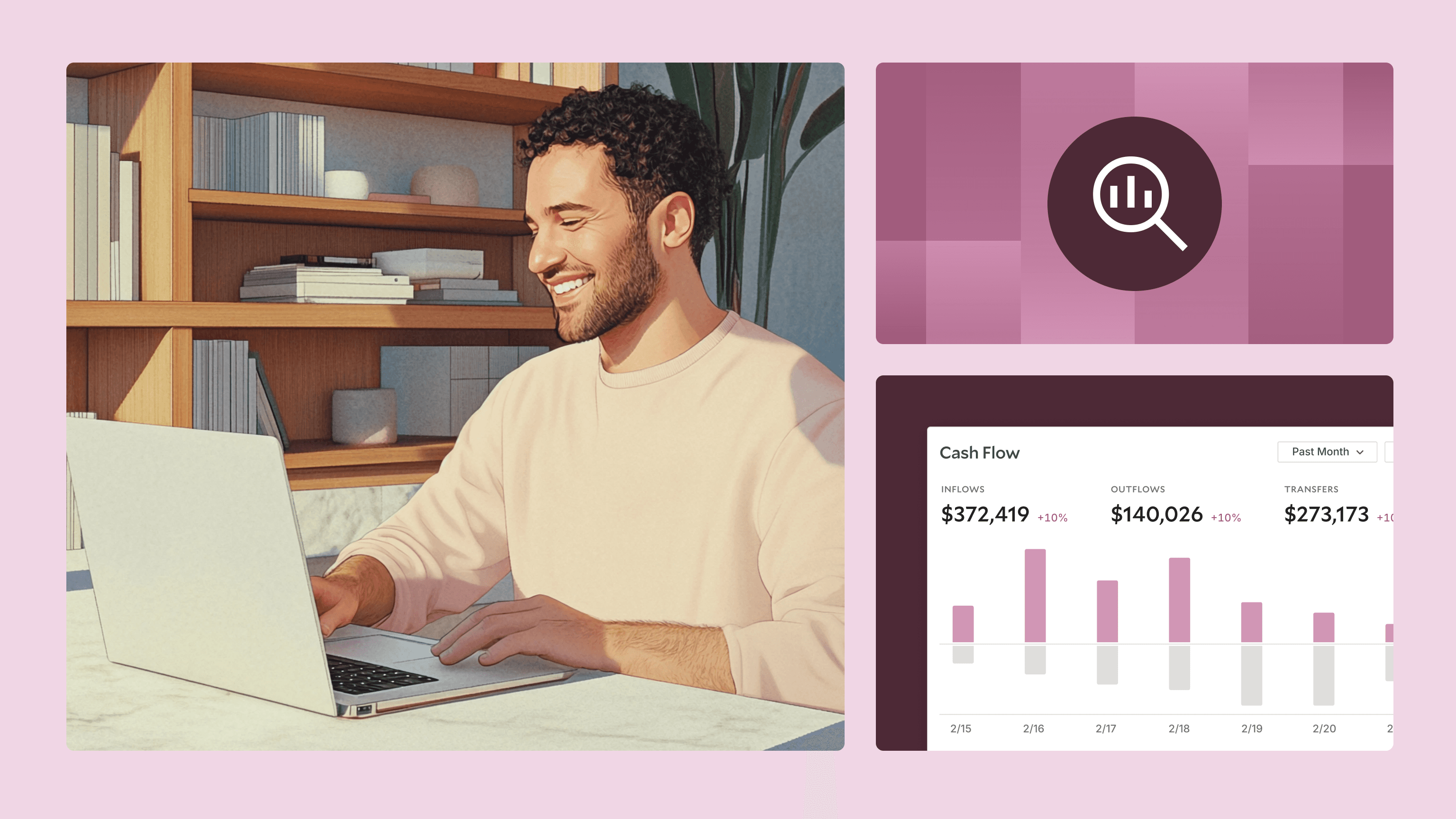

Deduplication at Scale

→

Journal