Join our next live session with Nacha on modern, programmable ACH on February 12th.Register here →

April/May Changelog

In April and May, our product and engineering team shipped several new features including Enhanced Account Views, Pre-Built UIs, Invoicing, and more.

Here is a closer look at the updates and features we shipped in April and May.

Account Groups

Account Groups are flexible filters that allow customers to aggregate and group select accounts. They give finance and treasury teams cash visibility and reporting into specific areas of their business. This allows them to better manage and report on their cash activity in the context of their business.

Sign up here to check out this feature and more.

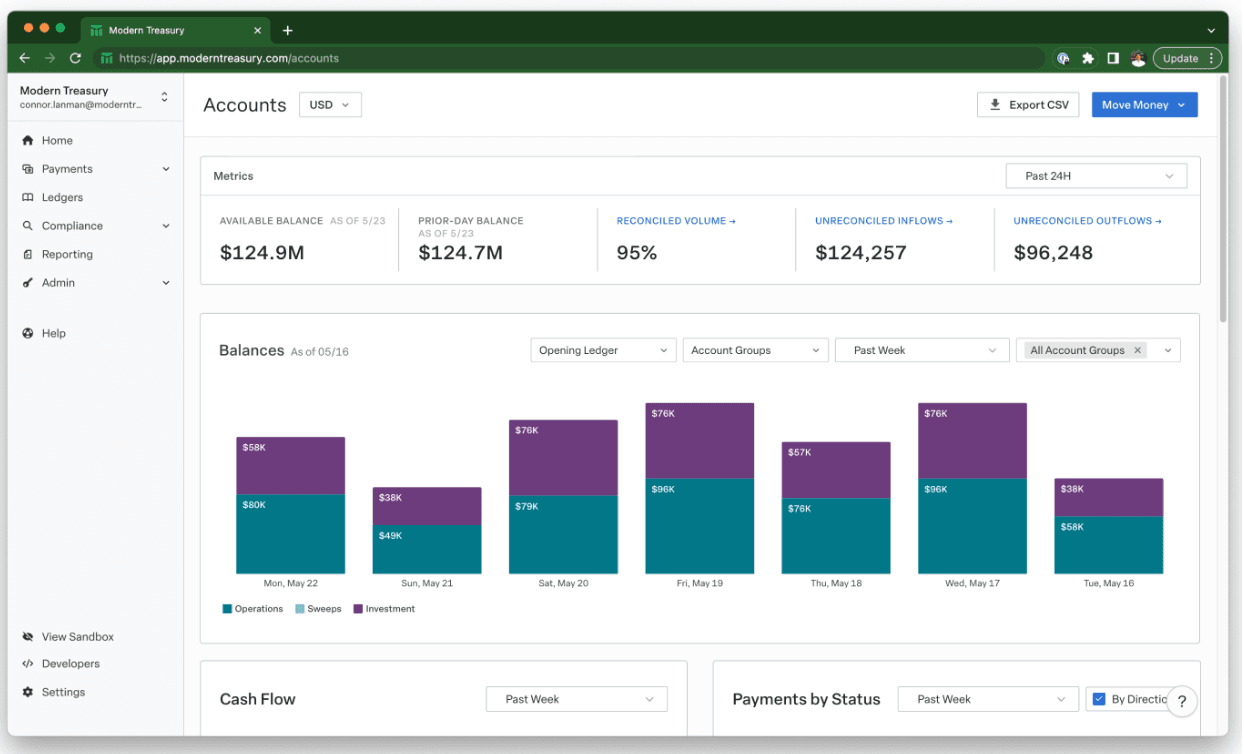

Enhanced Account Views

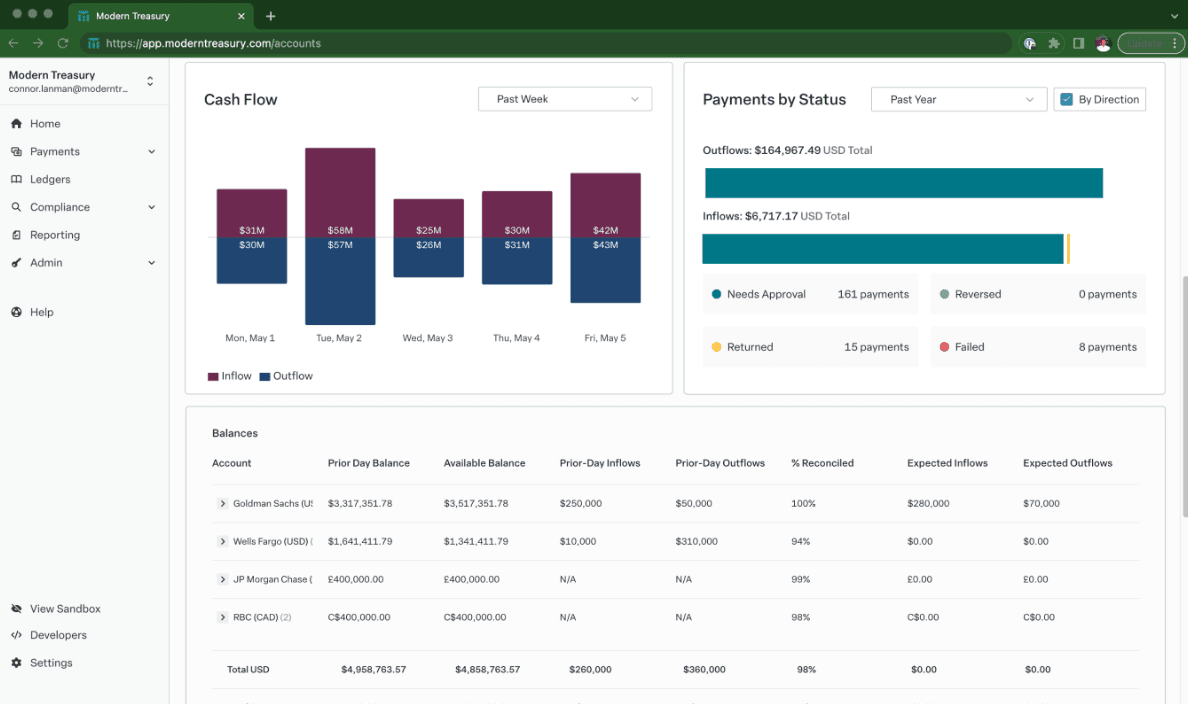

We’ve also released new improvements to the accounts dashboard to provide users with greater visibility and insight into their financial data. This includes new features: Smart Balances Table, Historical Balances Widget, Cash Flow Visualization, and Payment Alerts.

Smart Balances Table

The Smart Balances Table provides Finance and Treasury teams with a summary view of their accounts, including key data such as prior day and available balances, prior day money in and money out, reconciliation percentages, and future money movement based upon queued payment orders. With the Smart Balances table, Finance and Treasury teams can drill down into specific accounts for deeper analysis.

Historical Balances

The Historical Balances feature consolidates balances across banks and accounts into a single view, providing finance users with insight into how their cash states are changing over time.

Cash Flow Visualization

The Cash Flow widget allows Finance Teams to visualize incoming and outgoing cash flows across all their internal bank accounts. This feature helps users understand the flow of funds and its impact on overall balances.

Payments by Status

The Payments by Status feature centralizes Payment Orders and their statuses within their Modern Treasury instance. Users can quickly identify any issues or discrepancies and efficiently review and address them, ensuring smooth money movement operations.

Learn more about all of these Enhanced Account Views here, or reach out to our team to learn more.

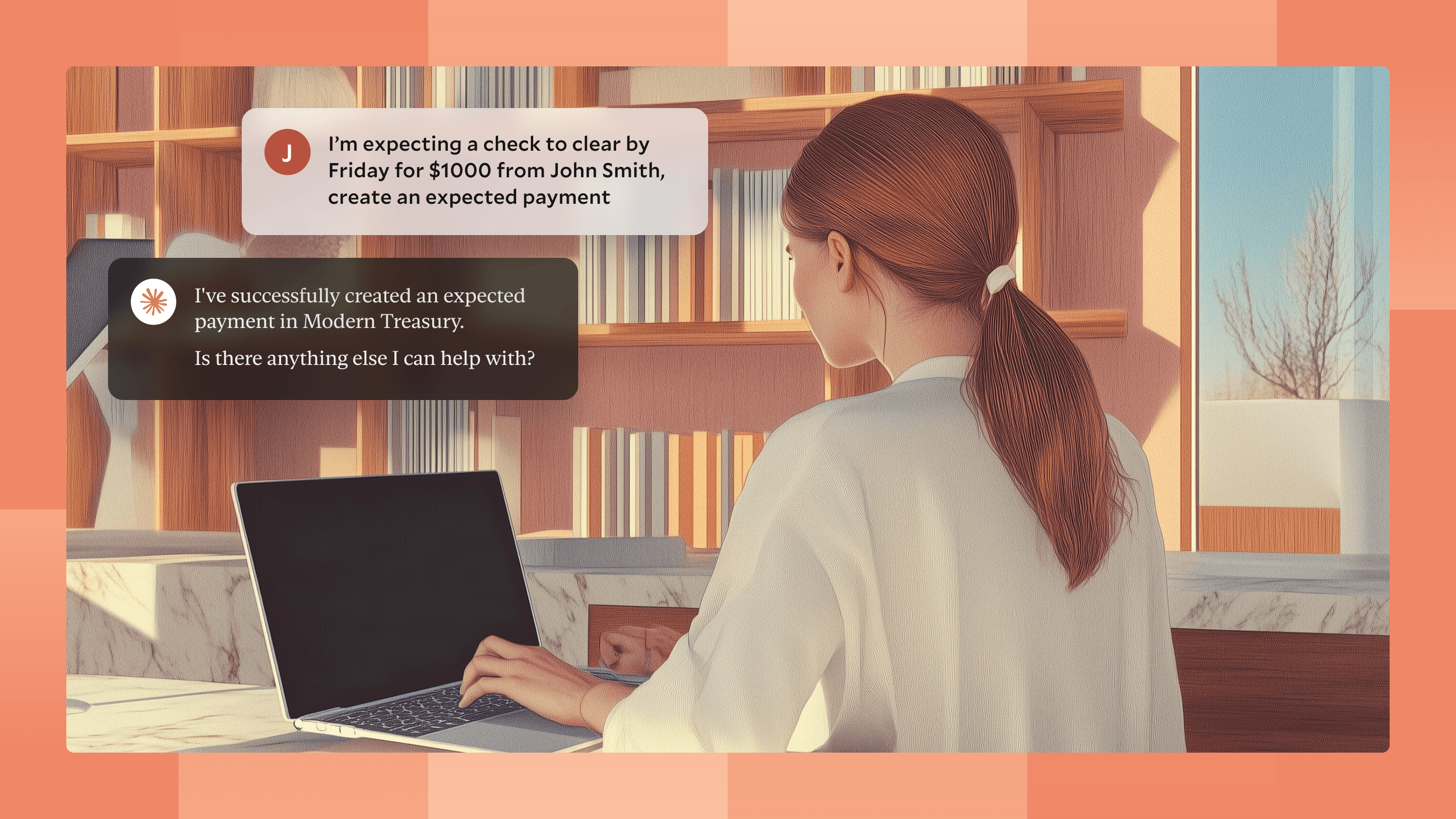

Expected Payment Async Endpoint

We’ve made updates to allow customers to asynchronously create Expected Payments by decoupling request acceptance from request processing & database record creation.

With these updates, customers can create near-infinite Expected Payments, representing internal business records in their systems, such as invoices and payables. Once customers have created Expected Payments using the async endpoint, the Reconciliation Engine will then automatically match those Expected Payments against transactions on the bank statement to provide real-time reconciliation.

Ledger Account Statements

Customers often generate user-facing statements by creating a snapshot of a ledger account’s balances and entries. Ledger Account Statements are a low-friction way to create these snapshots. This makes it easier for customers to retrieve the ledger entries and ledger transaction versions that correspond to that time period and lock version of the ledger account.

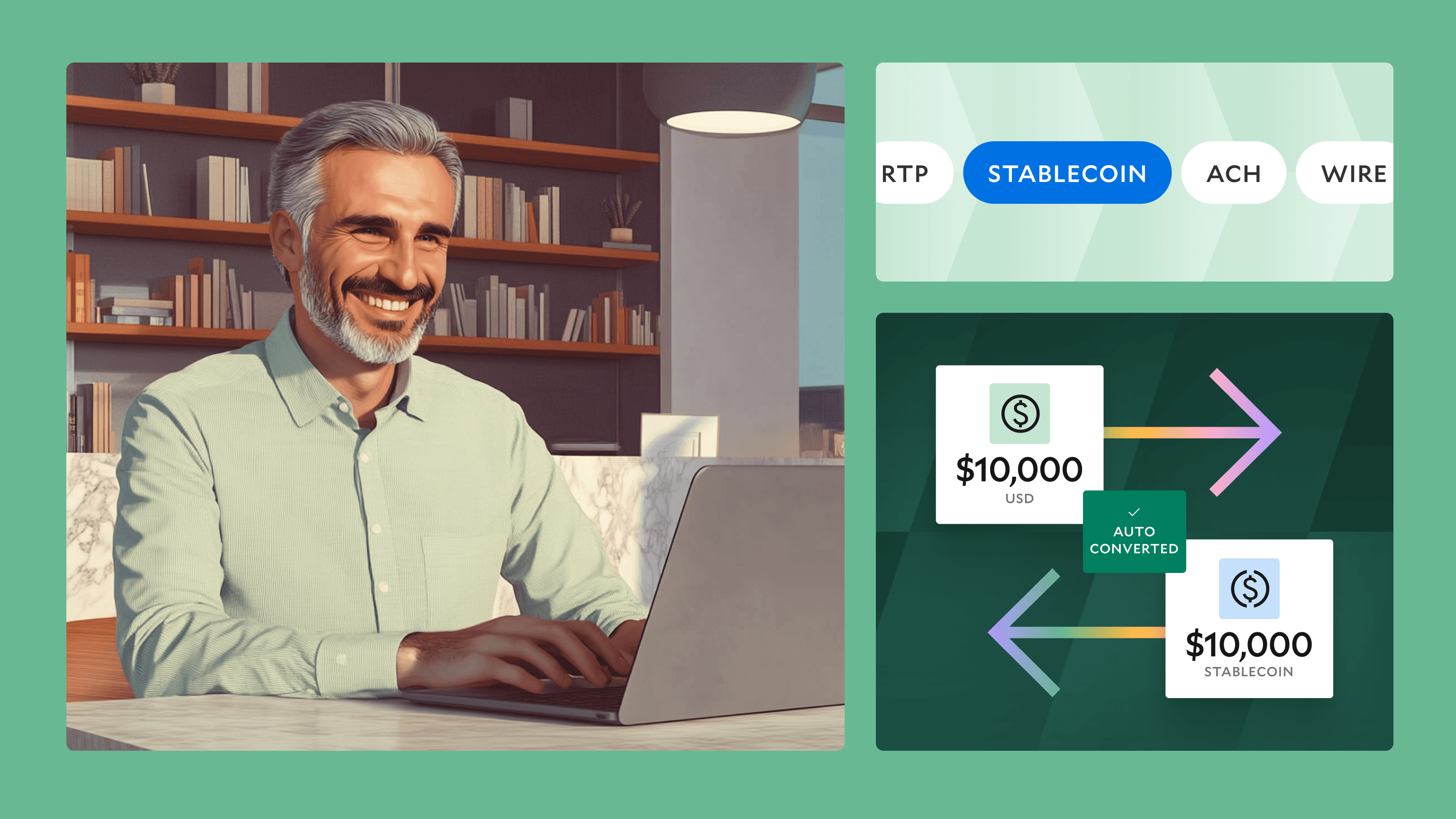

Pre-Built UIs

Our set of low-code Pre-Built UIs are designed to address the complications underlying customized in-app payments. Read more about our Pre-Built UIs in the full announcement and see integration examples for Pre-Built UIs here.

Invoicing

Our new invoicing features are built to enable finance and billing teams to help manage their accounts receivable, invoicing, and payment flows straight from their Modern Treasury dashboard. Learn more here.

Improved Access Control Via SCIM

Modern Treasury now supports managing your users, roles, and groups via SCIM, streamlining and securing user lifecycle management. SCIM helps enterprises better manage access controls in their Modern Treasury instance. You can read more about it here.

Real-Time Audit Log Streaming With SIEM

Modern Treasury provides detailed audit records that are essential for identifying security incidents, maintaining compliance, and tracking user activity. These audit records can be streamed in real-time to Security Information and Event Management (SIEM) or log management solutions. Audit records are enriched with context helpful for investigations. More details can be found here.

Next Steps

If you have any questions or feedback about any of these updates, or if you’re interested in trying one of Modern Treasury’s payment operations products, get in touch.