Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

August Changelog

August has been another busy month for Modern Treasury. In addition to some of the bigger items we shipped like Permissioned API Keys, we’ve shipped a number of smaller features and improvements we’re excited to share.

August has been another busy month for Modern Treasury. In addition to some of the bigger items we shipped like Permissioned API Keys, we’ve shipped a number of smaller features and improvements we’re excited to share.

ACH Improvements

We’re continually improving our ACH payments functionality, this month, we added two improvements we’re really excited about.

First, we now allow our users to customize the Standard Entry Class Code (SEC Code) that is used when originating a payment order. We currently support the following codes: PPD, CCD, CTX, IAT, CIE, and WEB. For more details on how to customize SEC Codes, refer to our guide.

Additionally, users can now customize the originating party name for ACH payments. This can be useful when originating a payment on behalf of someone else. We’ve included a sample API call below which demonstrates how to do this by setting the originating_party_name field.

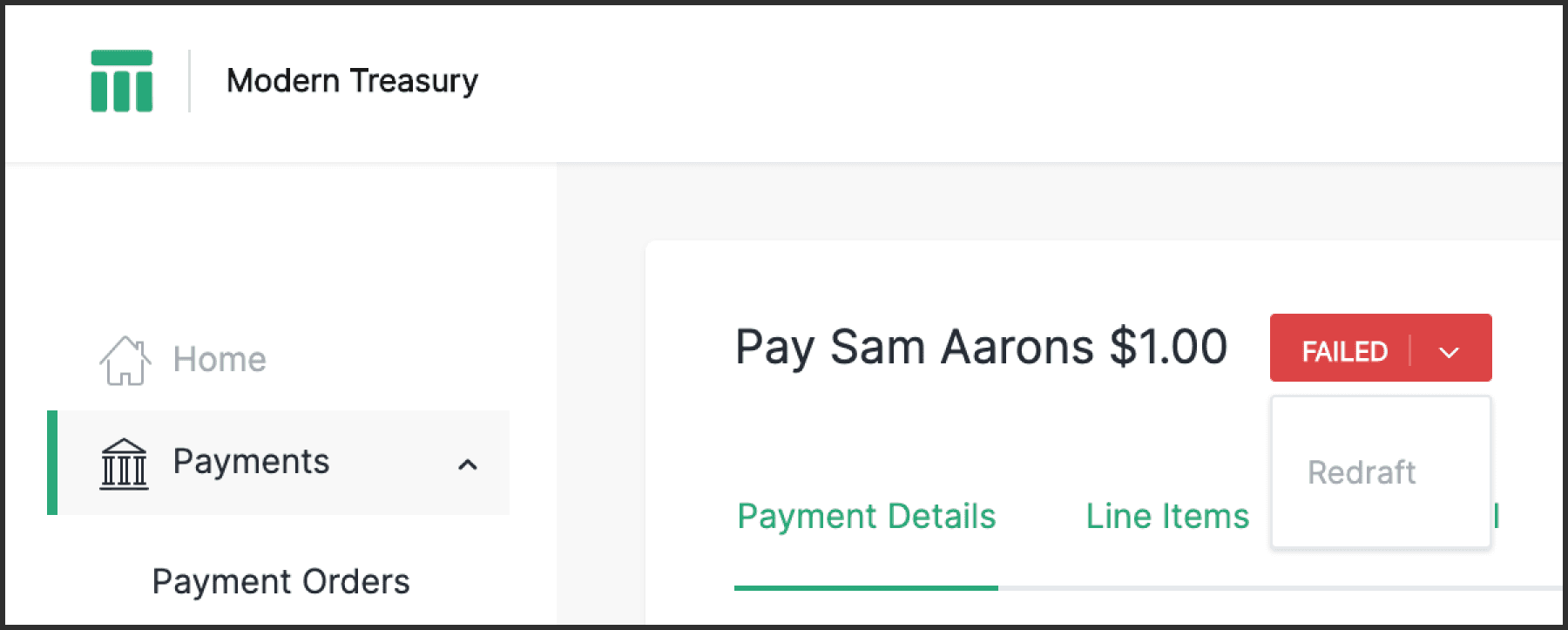

Ability to Redraft Failed Payment Orders

We now support the ability to redraft (retry) a failed payment order. A payment order may fail if there is an error when the bank processes the payment. Although rare, failures most often happen during account setup.

To redraft in the API, you can use .

In the application, you can redraft a payment order by navigating to its page and selecting “Redraft” in the actions dropdown.

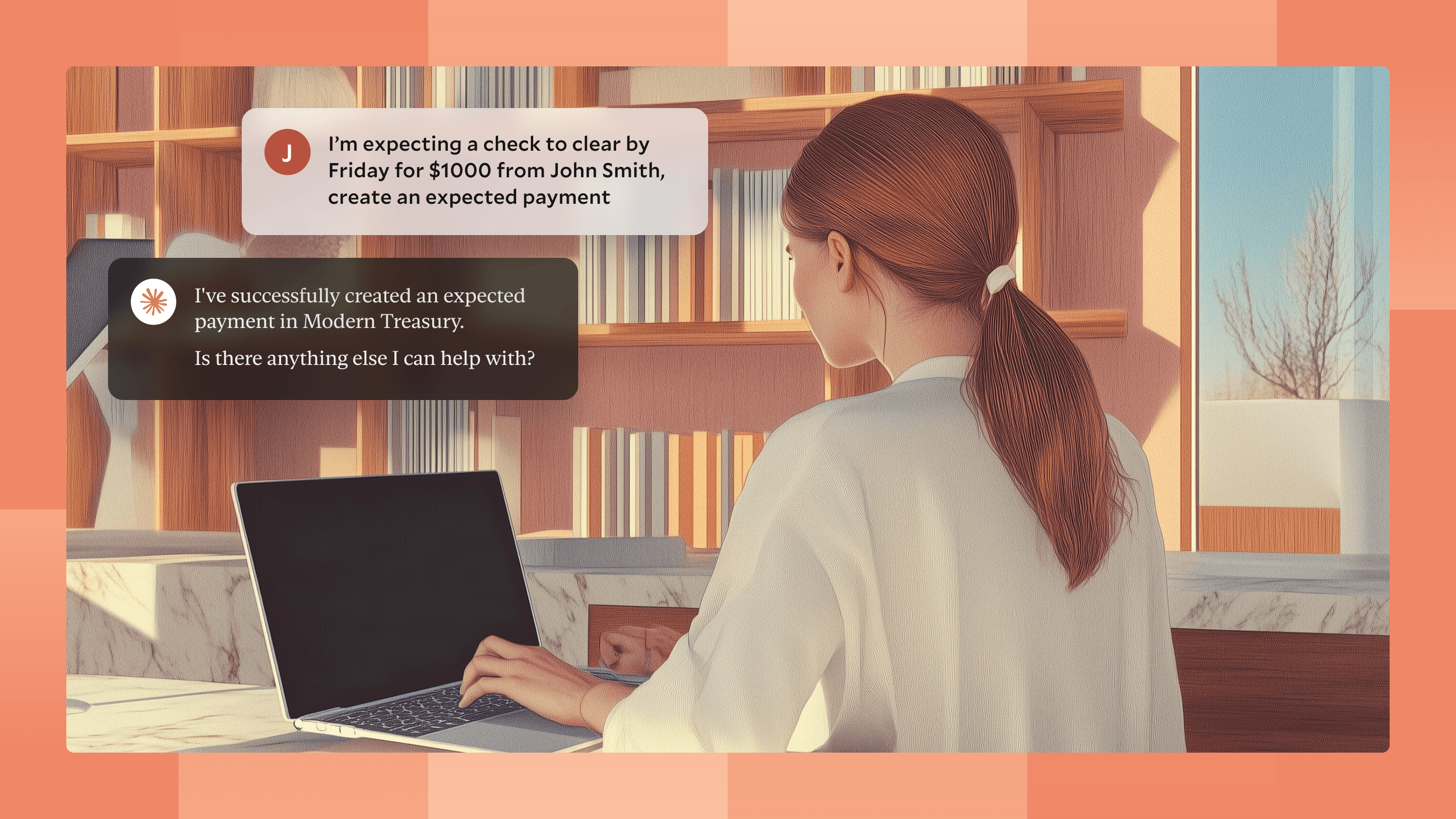

Edit Expected Payments

We’ve added the ability to edit an Expected Payment both via the API and in the application. Expected payments can be updated as long as they are unreconciled. To edit an expected payment in the API, use the endpoint here.

To edit in the application, visit an expected payment’s page and click “Edit” in the top actions bar.

Improved Intraday Balance Reporting for First Republic

We’ve shipped improvements to our intraday balance reporting at First Republic.

For First Republic, we now expose intraday balance activity. This allows our customers to view the balance in their account throughout the day. We receive new intraday balances approximately every 30 minutes. In order to receive intraday balances, ask your account manager to set up MT942 files as a part of your integration.

Intraday balances are accessible via the API and in balances section of the dashboard.

Query Balance Reports API by Balance Report Type

The balance reports API now supports the ability to query for balance reports based on their type. Currently, there are four types of balance reports: intraday, previous_day, real_time, or other. This is documented on the List Balance Reports endpoint.

This can be useful if you only want to fetch certain types of balance reports from our API. A common example would be if you need to get your final daily balances in a workflow tool or an ERP. Before this change, you’d have to sift through intraday records to get to the latest previous day report. Now, you can simply filter to the balance reports you need.

Expose Summary Balances from BAI2 Files

We now expose the summary balances from BAI2 files in our API. These balances are accessible via the Balance Reports API.

BAI2 files are the electronic bank statements that banks provide through direct transmission. BAI2 files include information like the current available balance, the current ledger balance, and transactions in the bank account. They also include summary data, such as the total credits posted to an account yesterday. One use case for using the summary balances is to import them into your ERP or accounting software. Some ERP banking modules require summary balances in order to reflect the latest state of your bank accounts.

Conclusion

We’re continually improving our platform. If you’re interested in learning more about our roadmap or how you can work with Modern Treasury, please reach out.