Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

How to Collect And Verify Bank Accounts For ACH

This post discusses some of the common tactics businesses use to collect and verify bank account details. Ultimately it is up to each business to decide how they want to approach these tasks. The approaches outlined below can be done in tandem or independently.

Explore with AI

This post discusses some of the common tactics businesses use to collect and verify bank account details. Ultimately it is up to each business to decide how they want to approach these tasks. The approaches outlined below can be done in tandem or independently.

Manual Account Collection

One of the simplest ways to collect and verify bank account details is to ask your customer or vendor for their bank account information. Without extra verification, you are placing a high level of trust in your counterparty. This can make sense for interactions with trusted entities like a law firm. If large amounts are being sent, it would be wise to also verify their account information using one of the methods discussed below.

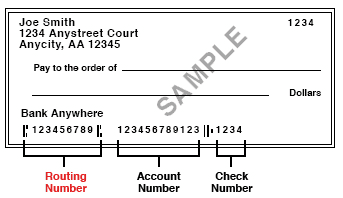

Voided Checks

One of the oldest techniques for collecting bank account details is to ask for a voided check. This approach worked especially well in the day of fax machines (and perhaps should have been left there).

A check contains the information required for a payment: the account number, the routing number, and the account holder’s name.

While this approach provides the necessary information, it can be tedious since it requires voiding and scanning a check. Also, there is potential for fraud as the image of the check can be doctored. It’s more secure to use microdeposits for verification.

Microdeposits

Many financial institutions and companies verify bank account ownership through microdeposits. This requires the entity to already be in possession of the bank account details. In this approach, the institution sends small amounts of money to the bank account they are verifying. The institution will ask the counterparty to tell them the amounts that were deposited. The account will only be considered verified if the counterparty describes the amounts correctly.

The most common way to do this is to send two separate transactions, both under $1. It is important to send different amounts or banks might flag duplicate tiny transactions as fraudulent.

There are some downsides to this approach. It will take a few days to fully complete the process since the counterparty has to wait to receive the funds in their account. There are also likely to be transaction costs associated with the ACH transfers that may exceed the amount deposited.

Some people have even figured out how to scam these systems. In 2008 a man collected $50,000 through microdeposits from Charles Schwab and E-trade. If you take this approach, it is important to have good fraud checks in place.

Prenotification

Prenotification, also known as a prenote, is a $0 ACH payment used to validate the account and routing information before sending transactions of greater value. Like microdeposits, prenotes can take up to 3 days to complete validation, after which live payments can be sent. If the prenote is unsuccessful, the RDFI will send a return or a notification of change (NOC) which will need to be resolved before subsequent payments can be sent.

Instant Verification

The newest approach, pioneered by companies like Plaid, is called Instant Verification. These solutions enable a direct link into the bank to both collect bank account details and confirm account ownership.

The benefits of this approach are that it can be done instantly and with much lower fraud potential. Instant Verification does usually require your counterparties to allow the verifier to log in via their bank. Some individuals and corporations are tentative to provide that level of access.

This solution may experience spotty coverage because the provider does not have full coverage across all the banks. This is an area where microdeposits are superior since they can be sent to any bank account in the US via ACH.

Instead of the ACH processing costs associated with microdeposits, instant verification platforms will usually have a nominal fee associated with each verification.

There are many ways to collect and verify account details for electronic payments. If you are evaluating how to handle this part of your payment workflow, Modern Treasury can help.

Get the latest articles, guides, and insights delivered to your inbox.

Authors

Matt is co-founder and CEO of Modern Treasury. Previously, Matt worked at First Round Capital and Ultimate Kronos Group. Matt graduated with a BS in Computer Science from Dartmouth College, where he was captain of the men’s lightweight rowing team. Matt is an avid hiker and is known to celebrate company milestones with SusieCakes deliveries.