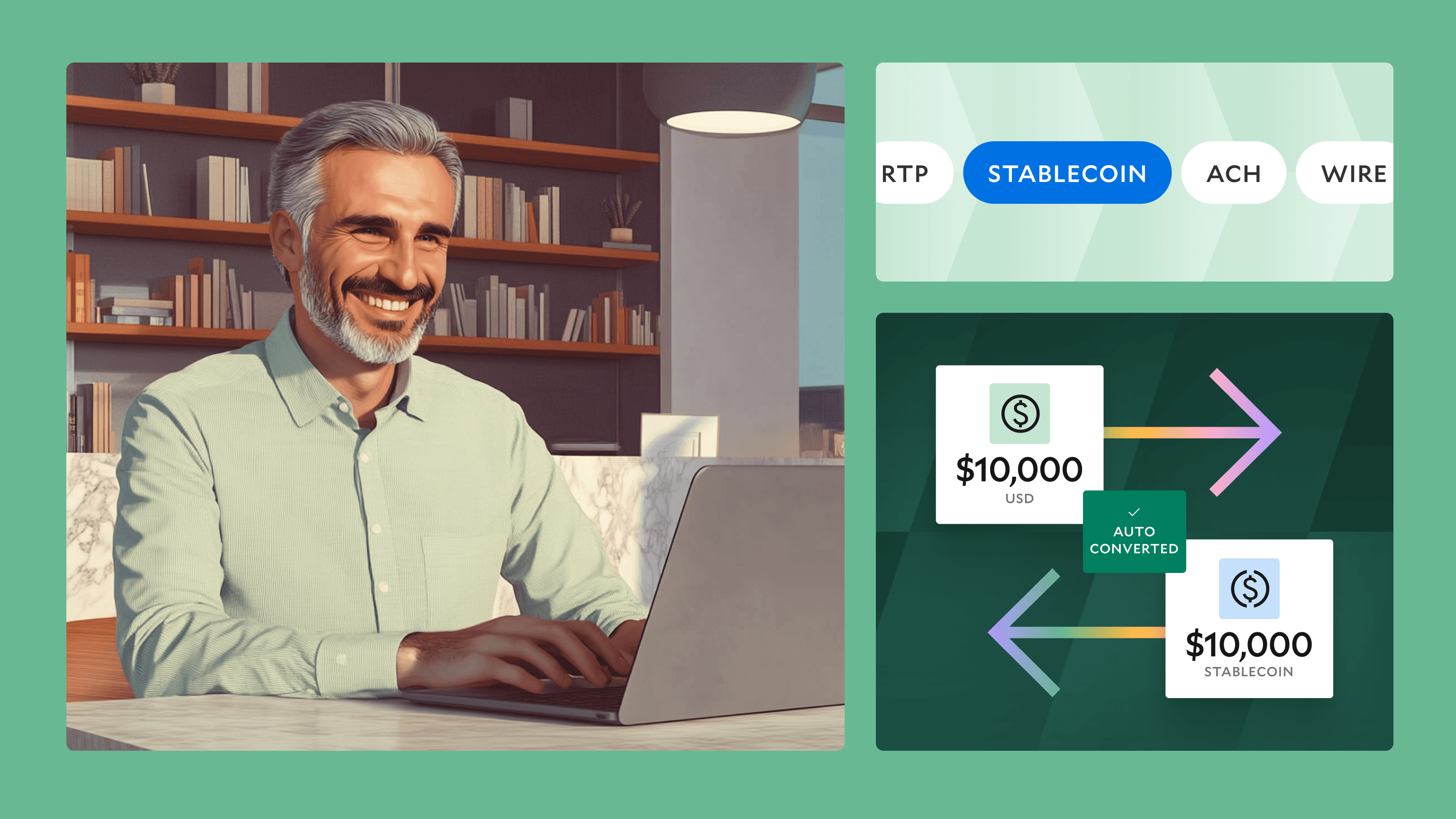

Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

Announcing Support for ACH Prenotes

Modern Treasury now supports sending ACH prenotes as a way to validate account and routing information.

Explore with AI

Modern Treasury now supports sending ACH prenotes.

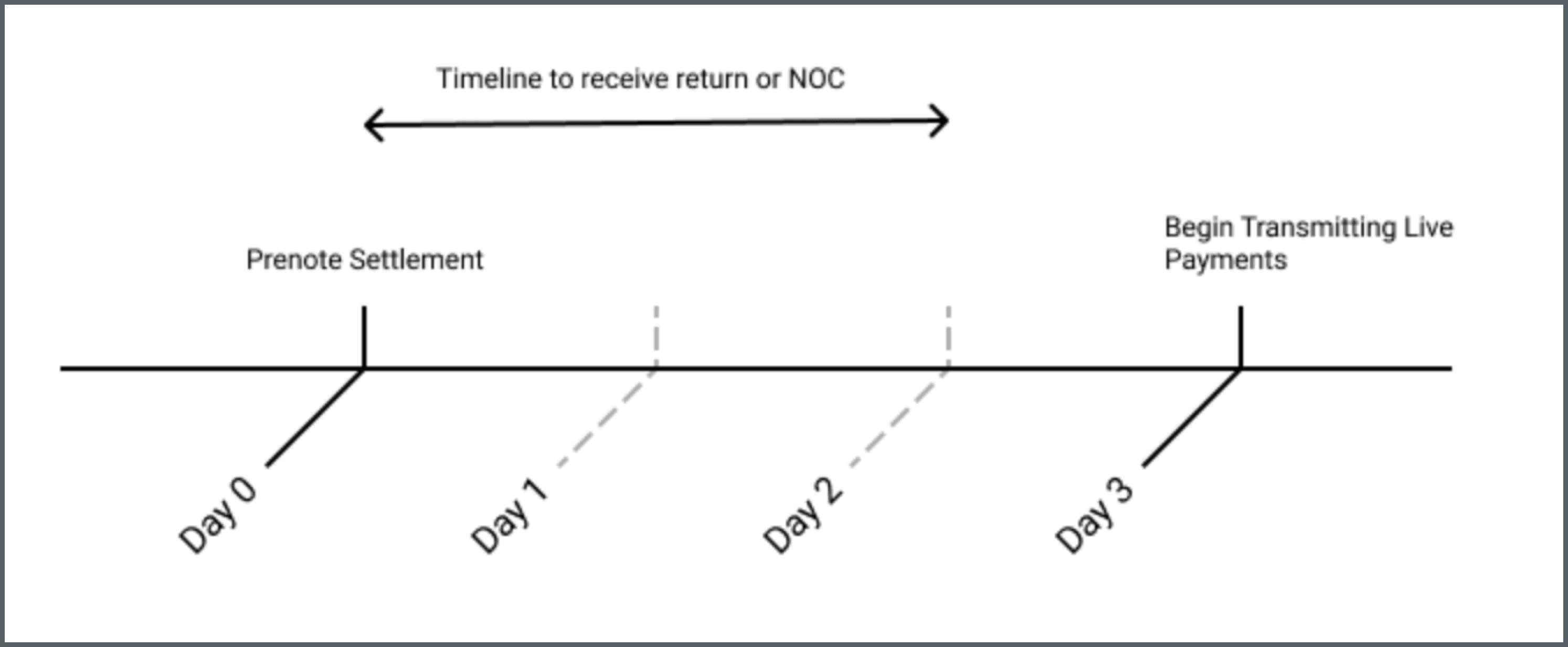

A prenote or prenotification is a $0 ACH payment used to validate the account and routing information of a counterparty before sending transactions of greater value. They are an alternative to other methods of account validation such as instant account verification or microdeposits, and do not require the counterparty to take any action during verification. The disadvantage of prenotes is that it takes about 3 days to complete validation.

Live payments can begin on the third banking day after the prenote has settled, provided no return has been received and any Notification of Change (NOC) related to the prenote has been resolved. If the prenote is returned by the Receiving Depository Financial Institution (RDFI), the issue in the return code must be resolved. Then a subsequent prenote may be transmitted. If the prenote results in a NOC response, Modern Treasury will update the account information automatically and live payments can begin immediately.

Sending prenotes in Modern Treasury is as simple as creating a $0 ACH Payment Order via our dashboard or API.

Payment operations include all parts of the process from counterparty management, through payments, to reconciliation. If you’re interested in how Modern Treasury can help set up your payment operations, get in touch or sign up today.

Get the latest articles, guides, and insights delivered to your inbox.

Authors