How Investing Platforms Use Modern Treasury

Modern investing platforms need robust payment infrastructure to power complex workflows. Learn how Modern Treasury supports these businesses, improving speed, efficiency, and investor experience.

The business of investing is risk-dependent—and investors willingly accept some degree of volatility for the sake of potential gains. Still, investment companies are under pressure to establish trust.

Speed, reliability, and positive user experience are among the table stakes in an industry characterized by competition—investment opportunities in the US continue to abound. And in light of recent market uncertainty and decreased capital for startups, competition between investment companies (especially growth-stage companies) is even more acute.

In this environment, exceptional customer experience and masterful back-office efficiency are survival tactics. Successful payment operations are at the heart of both.

Understanding Challenges for Investing Platforms

Modern Treasury is an operating system for money movement, serving investing companies across use cases. Our payments infrastructure is especially helpful for businesses that sit in the flow of funds and handle a high volume of transactions, including:

- Investing marketplaces

- Trading platforms

- Fund administrators

- Asset managers

Consider a hypothetical investment marketplace, Invest4Success, that supports fractional investments in commercial real estate.

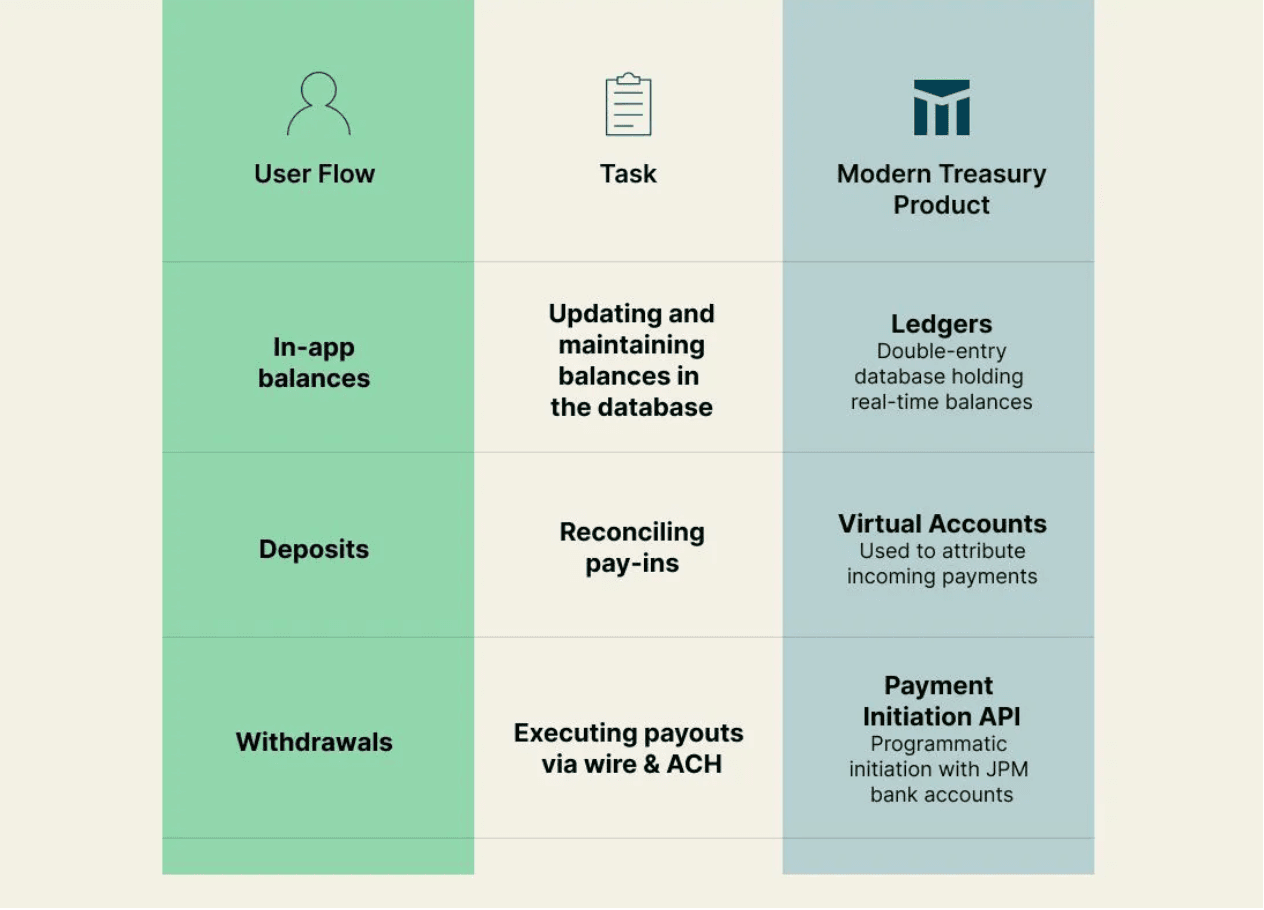

Investors want to be able to invest funds quickly, access real-time account data, and receive payouts easily. Invest4Success needs to accurately attribute funds using virtual accounts and efficiently disperse them. This diagram shows a simplified version of how Invest4Success might organize payments using Modern Treasury.

How Invest4Success might leverage Modern Treasury

Investors would choose the property they want to invest in. Then, with ACH debits (also via incoming wires and ACH), Invest4Success would receive funds and then issue payouts using ACH credits and wires.

While these fund flows may appear straightforward, at scale investing platforms of all stripes face back-office challenges. Namely, managing a high volume of payments means managing a host of operations for every transaction: payment initiation and approvals, failure and returns management, reconciliation, and ledgering (all of which Modern Treasury supports).

In particular, companies need to contend with the following industry realities:

1. Accuracy matters

Trust is paramount for investment companies looking to stand out—and there’s no greater detriment to trust than errors caught by end-users. Businesses need to ensure transactions and balances are accurately displayed at all times, and that money invested is appropriately attributed. This requires foolproof reconciliation and robust ledgering (at scale, homegrown ledgers won’t cut it). Not to mention that a proliferation of tools and systems used for money movement can increase the likelihood of errors and also increase delays.

2. Speed sets competitors apart

Investors opening a new account or funding a new venture are eager to begin seeing yields. The difference between a five-day clearing and settlement process versus same-day or even instant account funding is massive. The same goes for investors moving money to a new venture or seeking a payout—the faster a company can turn funds around, the better the experience for the end-user. Speed requires seamless bank integrations, a choice of rails, and real-time reconciliation for incoming/outgoing payments. And time lost to manual processes, tech stack bloat, and third-party processors can diminish competitive edge.

3. Visibility and control are key

Both investors and investing companies need ongoing financial observability for decision-making. The former needs ongoing access to their latest transaction data, with convenient ways to move money in-app. Visibility is especially important (and a bit more tricky) for investing marketplaces, typically intermediating between two parties—as fund custodians, marketplaces need to offer both parties account data continuously. For investing platforms of all kinds, finance teams require accurate, up-to-date information to make smart choices around cash management.

Companies also need robust controls, including approval rules and webhook triggers to ensure transactions move seamlessly. This degree of customization and oversight simply isn’t possible for payments managed via bank portals, in-house tools, or third-party senders.

4. Risk-management is an imperative

For investing companies, risk mitigation is two-fold. First, companies need to ensure compliance with BSA/AML policy, performing KYC and KYB checks at user onboarding. Businesses also need continuous transaction monitoring and case management tools to streamline the manual review process and provide an audit trail. The second prong of risk-management is a multi-banking strategy, offering security in the case of bank failures but also flexibility for choosing the optimal bank/rail by use case.

How Investing Companies Scale with Modern Treasury

Success for scaling investment companies relies on two key pieces of money movement architecture provided by Modern Treasury:

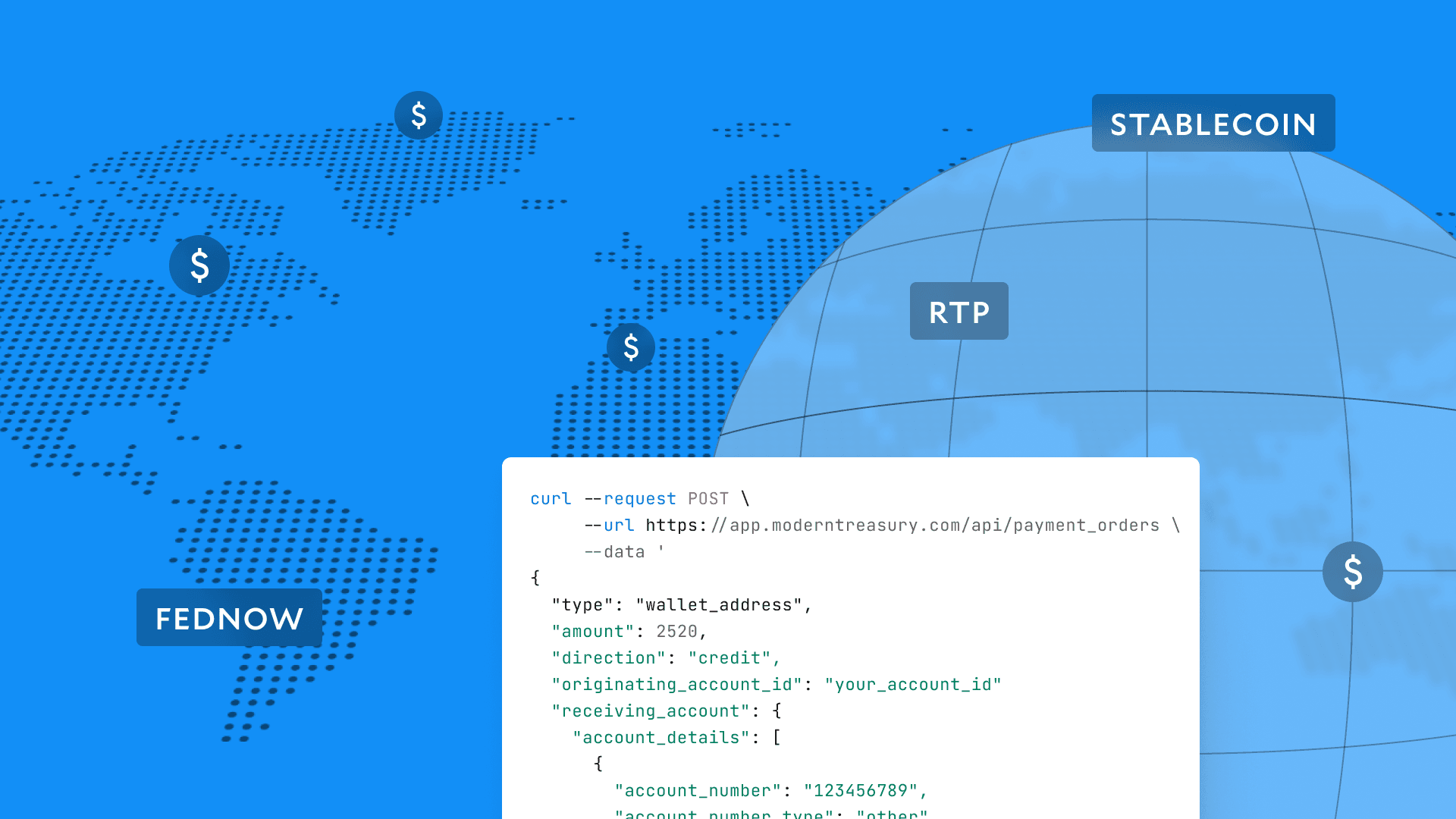

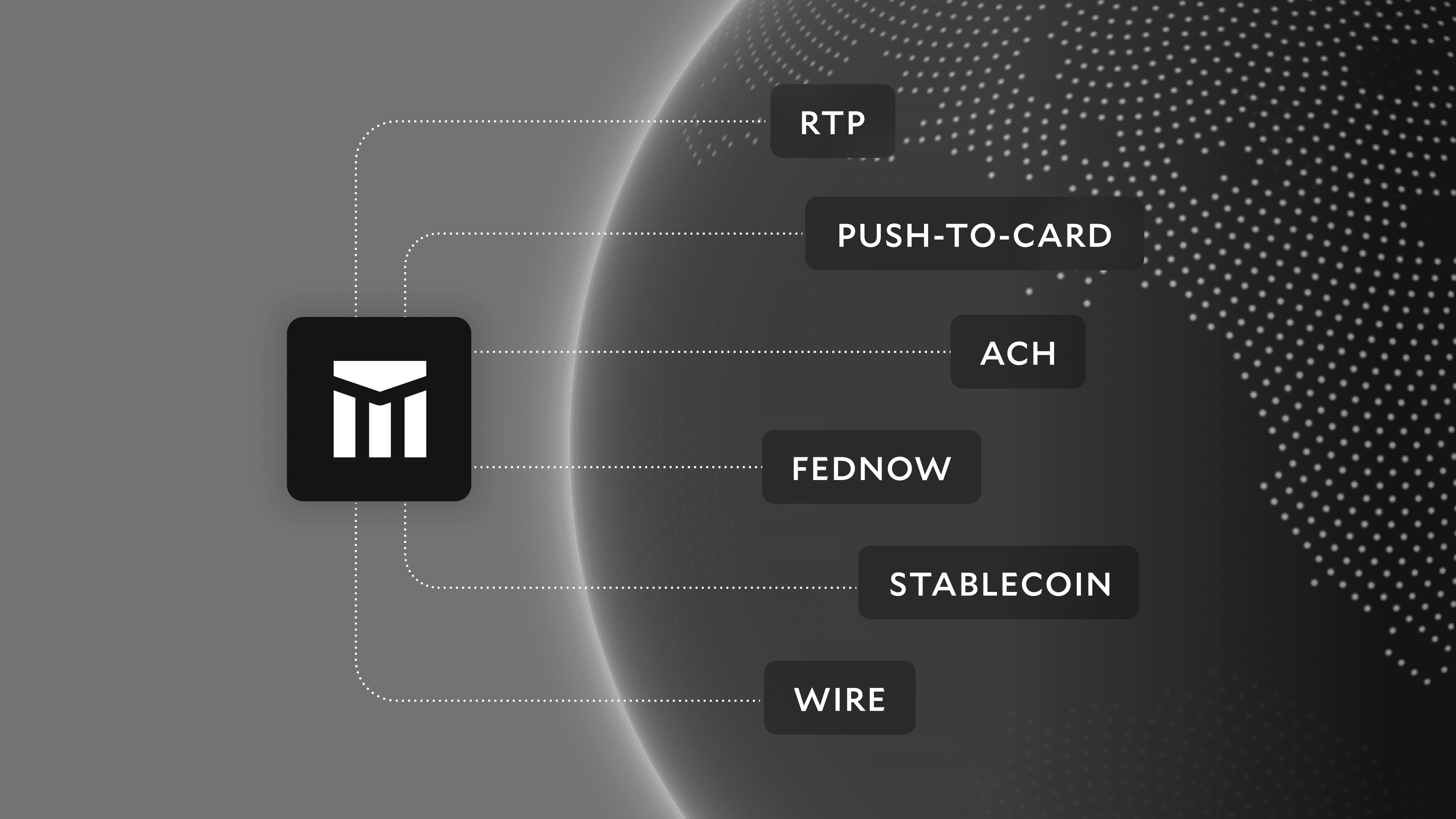

- Programmatic payments. Via direct integrations to 20+ banks, Modern Treasury’s APIs and dashboard automate and streamline global payments across rails, from end to end.

- Continuous reconciliation. Solving for reconciliation across virtual accounts—in an automated fashion—is vital for investment companies managing a high volume of users and transactions.

While all investing platforms need this functionality to manage payments, many also require a high-powered ledger to grow at pace.

Let’s dig into two real-world examples—a trading platform and an investing marketplace—where Modern Treasury’s operating system increased efficiency and unlocked scale.

A Trading Platform: Linqto

Linqto is dedicated to expanding global investor access to private equities. The company seeks to make the process of investing in private equities accessible, affordable, and liquid.

The challenge:

Since launch, one of Linqto’s primary objectives has been to introduce speed to private equities investment—a market notoriously slow and costly to enter, with minimal visibility. Whereas even public markets often require a two-day window, Linqto’s team wanted to achieve same-day transactions and liquidity for investors (at a rate also referred to as T 0 or T-Zero). Manual payment operations, however, was holding the team back from this goal.

How Modern Treasury helped:

Using Modern Treasury, Linqto has been able to:

- Introduce same-day transactions and liquidity (i.e. T-zero buys and sells)

- Provide investors with real-time account balances

- Save fifteen hours per week previously spent on manual attribution and reconciliation of wire payments

- Manage over 6,000 counterparties

- Move an average of $39M per month via Modern Treasury

How Linqto works with Modern Treasury

As VP of Product Management Joshua Peters shares, “With Modern Treasury, we achieved the final pillar of our initial strategy which was to provide accessibility, affordability, and liquidity to private equity. Liquidity is what we were lacking—cash accounts allowed us to achieve it.”

An Investing Marketplace: Masterworks

Masterworks enables the buying and selling of shares that represent investments in iconic works of art. It is the first and only platform to support fractional investments in multi-million dollar work by artists like Basquiat, Picasso, and Banksy.

The challenge:

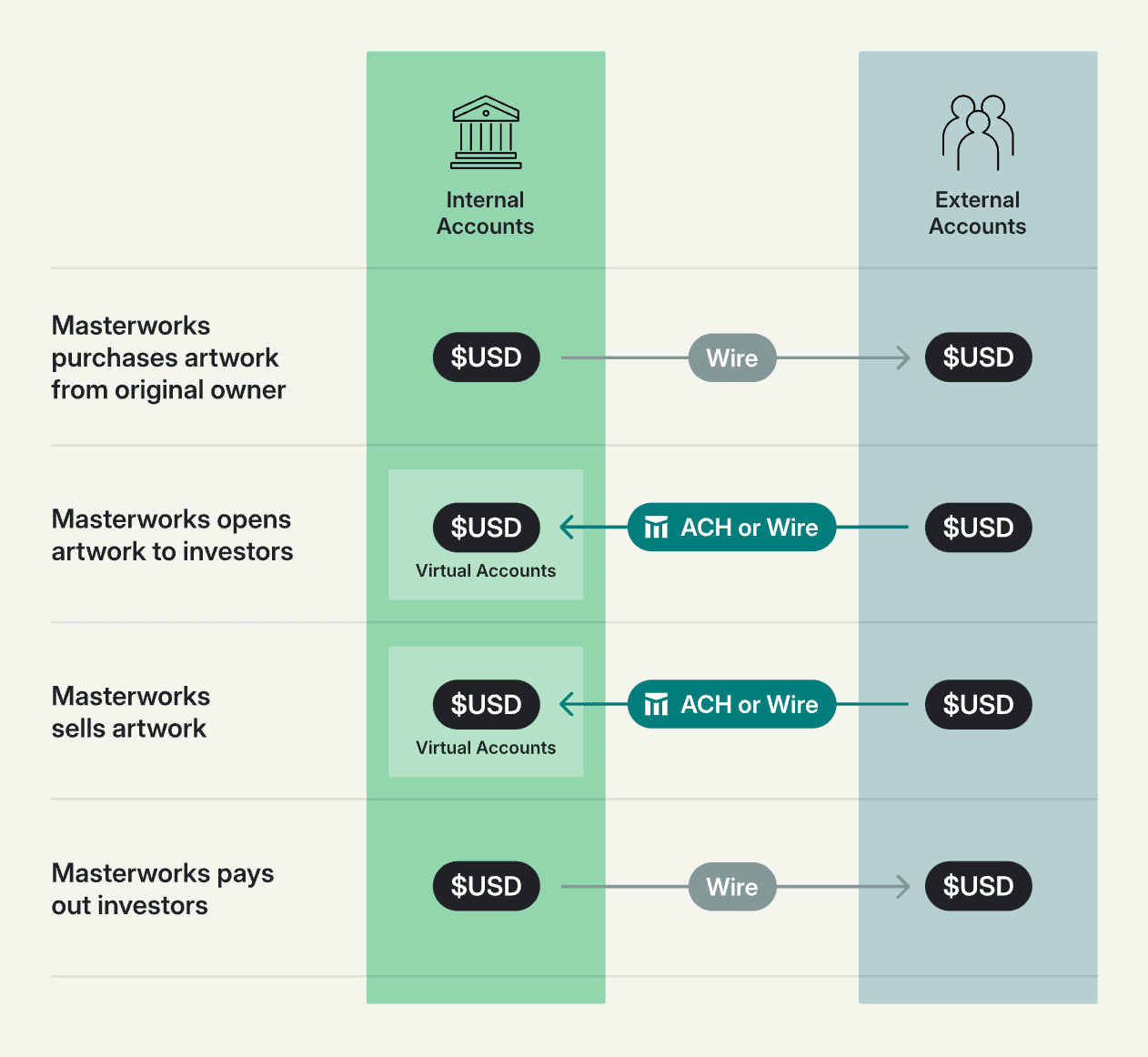

Given the company’s mission—to democratize the art market by offering more investors access to fine art investing—Masterworks needs to manage a high volume of payments. With 350+ investment vehicles (each with hundreds to thousands of investors), Masterworks requires real-time automated money movement and reconciliation, across rails.

Wire payments were a challenge, both in terms of incoming payment attribution and the speed of investor payouts.

How Modern Treasury helped:

With Modern Treasury’s APIs and dashboard, Masterworks has been able to:

- Automate incoming wire payments, with 100% accuracy in identification and zero cash breaks

- Reduce payout times by at least eight weeks so investors get their money (plus any returns back) 80% faster

- Programmatically move money between multiple accounts in batches, looking at the rolled-up of bank balances and reconciling those to an internal ledger

- Improve onboarding and streamline over 2,000 approvals per month

- Oversee an average of $116M in wire transfers each month via Modern Treasury

Masterworks Flow of Funds with Modern Treasury

As Corporate Controller Francisco Meyo shares, “Using Modern Treasury has been a game-changer for us.”

(For another example of Modern Treasury’s impact on investment marketplaces, check out Vinovest’s story).

A Modern Choice for Investment Operations

Investing platforms of all kinds can leverage our operating system to increase speed and scale. Offering faster payments, automated reconciliation, robust controls, and seamless bank integrations, Modern Treasury powers the operations investment businesses need to succeed (and stand out). Reach out to learn more.

Financial decision makers, on average, use six to seven systems (e.g., bank portals, ERPs, spreadsheets, treasury management tools) to manage their payment operations, and more than one-third (35%) use five or more.