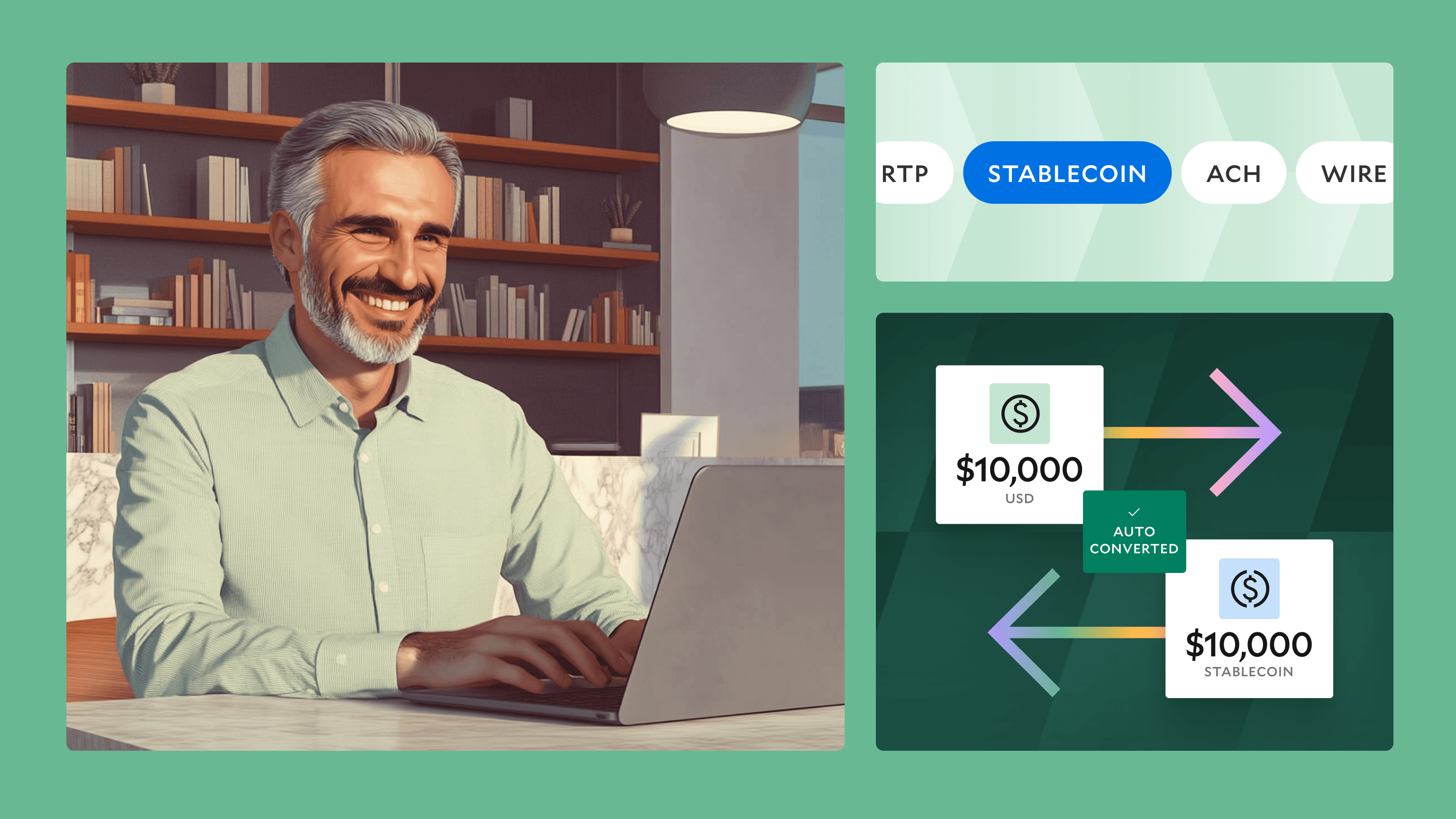

Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

June Changelog

In June, our product and engineering team shipped several new features including updates to our invoicing features, transaction monitoring on incoming payments, and more.

Here is a closer look at the updates and features we shipped in June.

Money Movement

Dashboard Support for Invoicing

We launched a new form in the dashboard which allows customers to create and edit invoices. Previously, invoices could only be created via the API, so this allows finance and operations users to manage invoices and collect payments directly in the web app.

Visibility Into Bank Cut-off Times

Customers can now view information about bank cutoff and expected payment times when creating or approving Payment Orders.

Compliance

Support for KYB (Know Your Business) Checks

Customers can now verify business customers with Modern Treasury, reducing the risk of fraud and compliance issues. Perform identity checks upon onboarding to perform name/TIN verification, secretary of state filing retrieval, address analysis, OFAC sanctions screening, and web presence validation on the business. KYC beneficial owners using email, phone, and SSN data. Businesses are scored and are then automatically approved, automatically denied, or reviewed manually, which improves efficiency. Modern Treasury can also perform ongoing watchlist monitoring to ensure that customers meet BSA/AML compliance requirements from banking partners and regulators. Learn more about integration here.

Modern Treasury Device & Behavior Risk SDK

Device and behavior information is helpful for fighting onboarding and account takeover fraud. This SDK used to be embedded in Modern Treasury’s pre-built User Onboarding flow, and is now available standalone for use when customers have their own user onboarding and payment flows. Customers can flag, for example, if a user is onboarding with the same IP address or device as many other users, copying and pasting stolen information into an onboarding flow, making a payment from a new location, making a payment and a VPN or proxy is being used, and more. For more details, see the API reference here.

Transaction Monitoring on Incoming Payments

Customers with non-originated payments (e.g. if users send ACH credit or Wire payments) can now be monitored with Modern Treasury. This is important to ensure that all payments are scored for risk of fraud and money laundering. Modern Treasury monitors Incoming Payment Details associated with Virtual Accounts and Counterparties. Customers can set up rules to flag, for example, high velocity of money movement or bank accounts not owned by the user. For more details about transaction monitoring on inbound payments, see here.

Compliance Custom Rule Metadata

Customers with data from other providers and systems can now pass data to Modern Treasury for use in KYC, bank risk, and transaction monitoring decisions. The User Onboarding and Payment Order objects have a compliance_rule_metadata field for this purpose. For more details about the rule engine, see here.

Reconciliation

Side-by-Side Reconciliation Case Management

We’ve introduced a new reconciliation case management feature to enable Finance and Operations teams to easily address their unreconciled transactions within the Modern Treasury financial dashboard. With the case-management tool, customers can search for unreconciled transactions and then match those transactions to business objects. Try it out here, or in your dashboard.