Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

June/July Changelog

In June and July, we shipped features such as historical balance reports, a banking holiday banner on the web app, and more.

Our product and engineering teams have been busy this summer. In addition to releases across our products, we also published our OpenAPI specification beta, which structures and documents our API. This first release includes coverage for most Payment routes. Ledgers, Compliance, and other routes will be coming soon. Customers can use our specification to better technically understand API routes, generate code, and create developer SDKs and libraries.

Here’s what else we’ve shipped.

Payments

Historical Balance Reports

Customers are now able to create and export balance reports—for any time range and across any number of internal accounts—while filtering by balance report type. Previously, customers were only able to view the current balances summary in the web app dashboard, with no option to export to a CSV format. Entries in this new report also include more detailed breakdowns of balances. Historical balance reports can be created and managed from the reporting section on our web app.

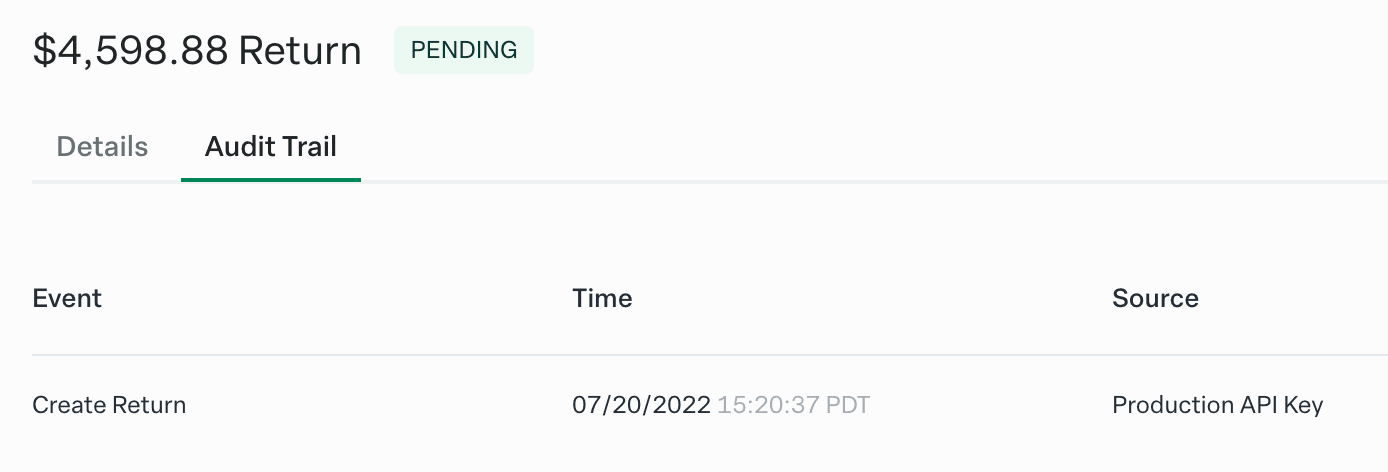

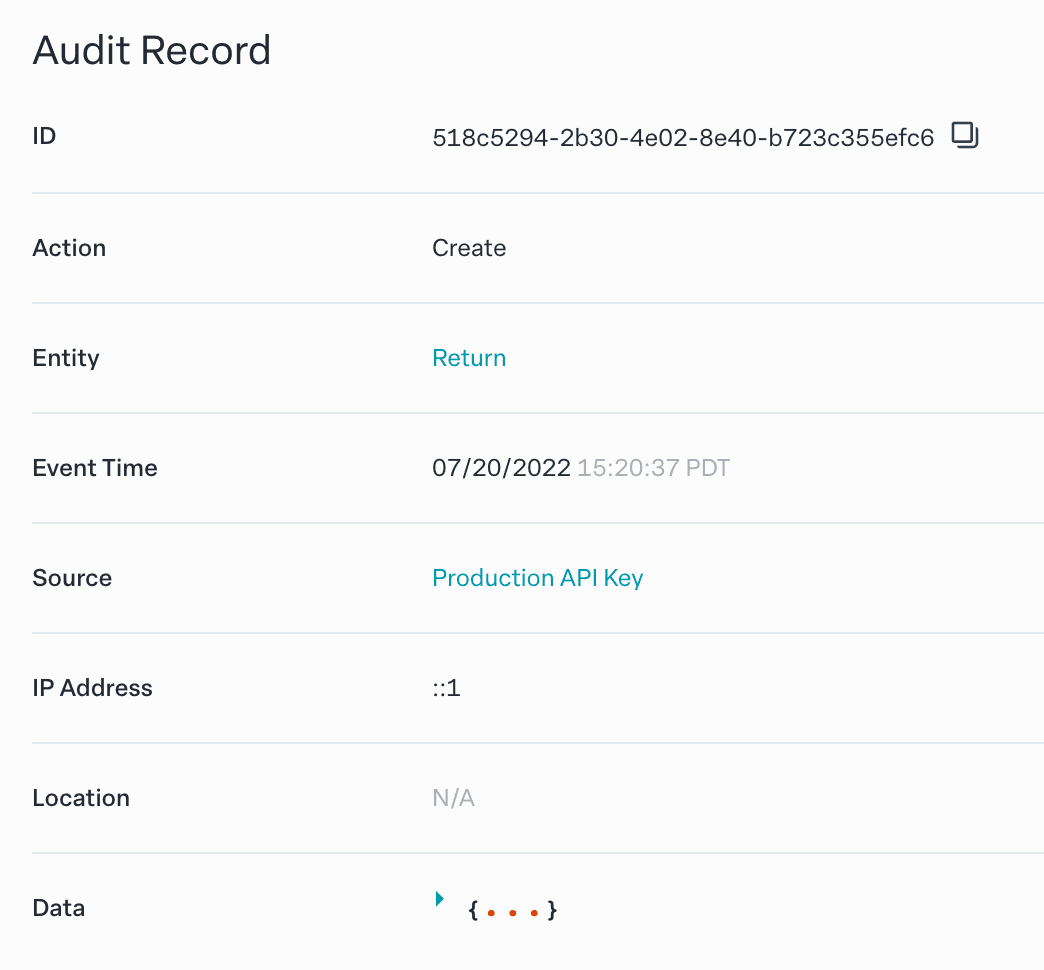

Returns Audit Trail

We’ve enabled audit trail creation for originating returns, making it easier to track the history of a return. Customers can now view details of each return with audit trails when they click on a return transaction in the returns table. Further details about each audit trail event can be seen upon clicking on the respective audit trail event.

Additional currency support

Customers with eligible bank accounts can initiate payment orders in all currencies, and be assured the payment order will go through as long as the originating bank supports the currency. Prior to this update, our customers had to contact us each time they wanted to initiate a payment order with a new currency.

Banking Holidays Banner

To ensure customers are updated on banks and transaction times that may be impacted by banking holidays, we have added a notification of banking holidays banner at the top of the screen. If one of an organization’s vendors are impacted, their names will be listed directly.

Ledgers

Write transactions conditional on account balance

To prevent a double-spend situation, customer ledgers need to be able to record transactions that are conditional on the state of an account balance or account version. The Ledgers API already supports locking on the account version. We’re excited to ship support for account balance locking to make it even easier to handle concurrency in customer ledgers.

Customers can specify a required balance (range or exact amount) when writing an entry to the ledger account. The transaction will only be created if the ledger account balance would be within the specified range after the transaction is created. See this guide for more details.

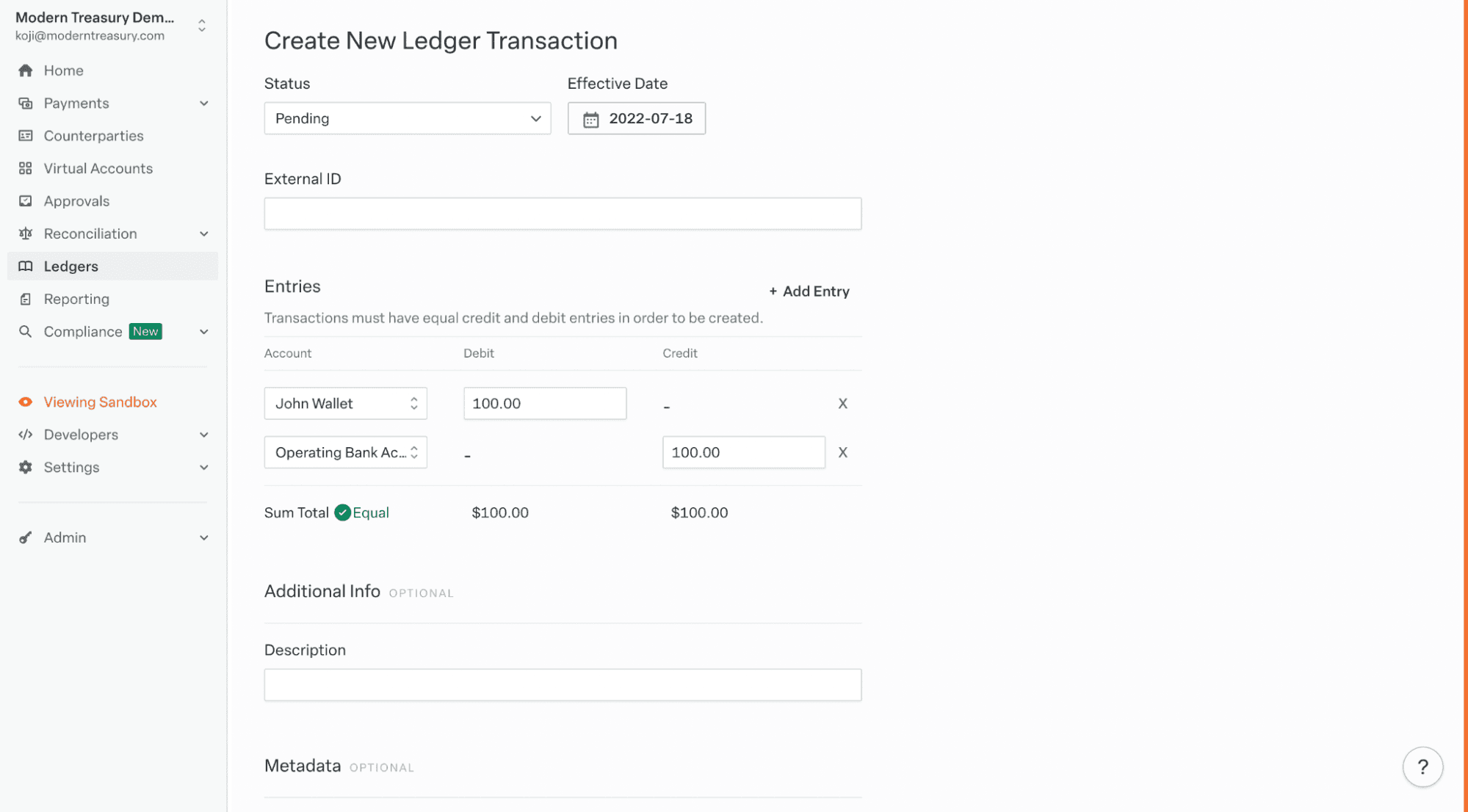

Create ledger transactions in the web app

Customers can now create ledger transactions in the web app dashboard—for example, to represent any manual corrections or one-off payments. Previously, this was only possible using the API. By filling in a user-friendly form, customers can set status, effective date, external ID, entries, description, and metadata, and can add multiple entries in a single transaction. The form can check if entries are balanced automatically. Roles with Write access to Ledgers can create ledger transactions.

Next Steps

If you have any questions or feedback about any of these updates, or if you’re interested in trying one of Modern Treasury’s payment operations products, get in touch.