Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

Key Learnings from our Panel Discussion with SVB and Settle

With SVB and Settle, we participated in a panel about Scaling Payment Operations. This journal digs into some key points from the discussion from what payment operations are to how to evaluate a payments solution.

Explore with AI

Introduction

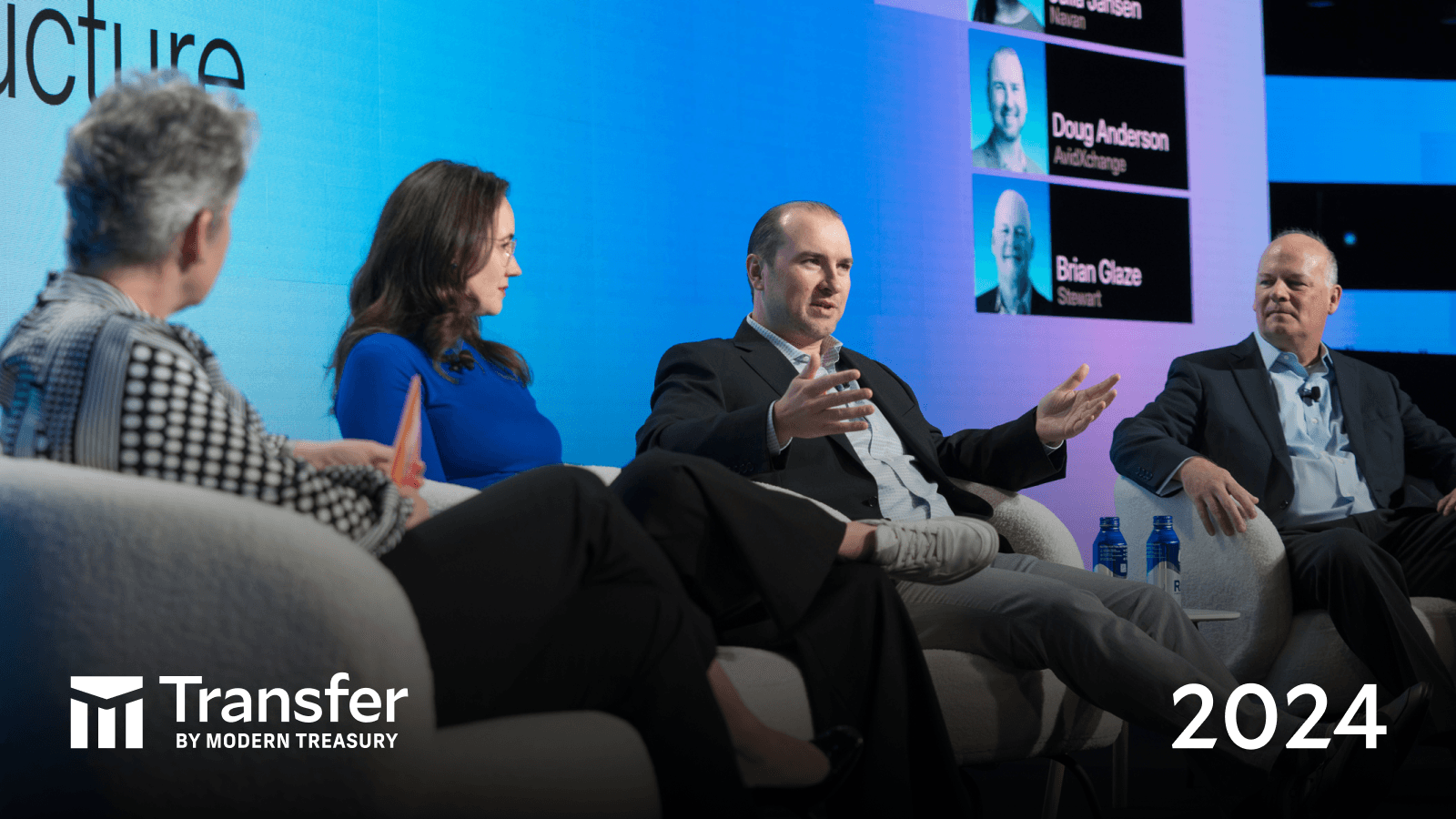

On Tuesday, in partnership with Silicon Valley Bank (SVB) and Settle, we hosted a panel discussion on how to effectively build and scale a payments platform. The panel, which was moderated byJoanne Hoangof SVB, included Kourosh Adlparvar, a Senior Payments Strategist at SVB, Aleksander Koenig, the CEO of Settle, and me.

We answered questions and shared first hand insights on how to evaluate payment partners, solve reconciliation and reporting issues, and implement the right payment rails for different business models. This journal post will dig into some of the key learnings from the discussion.

Background

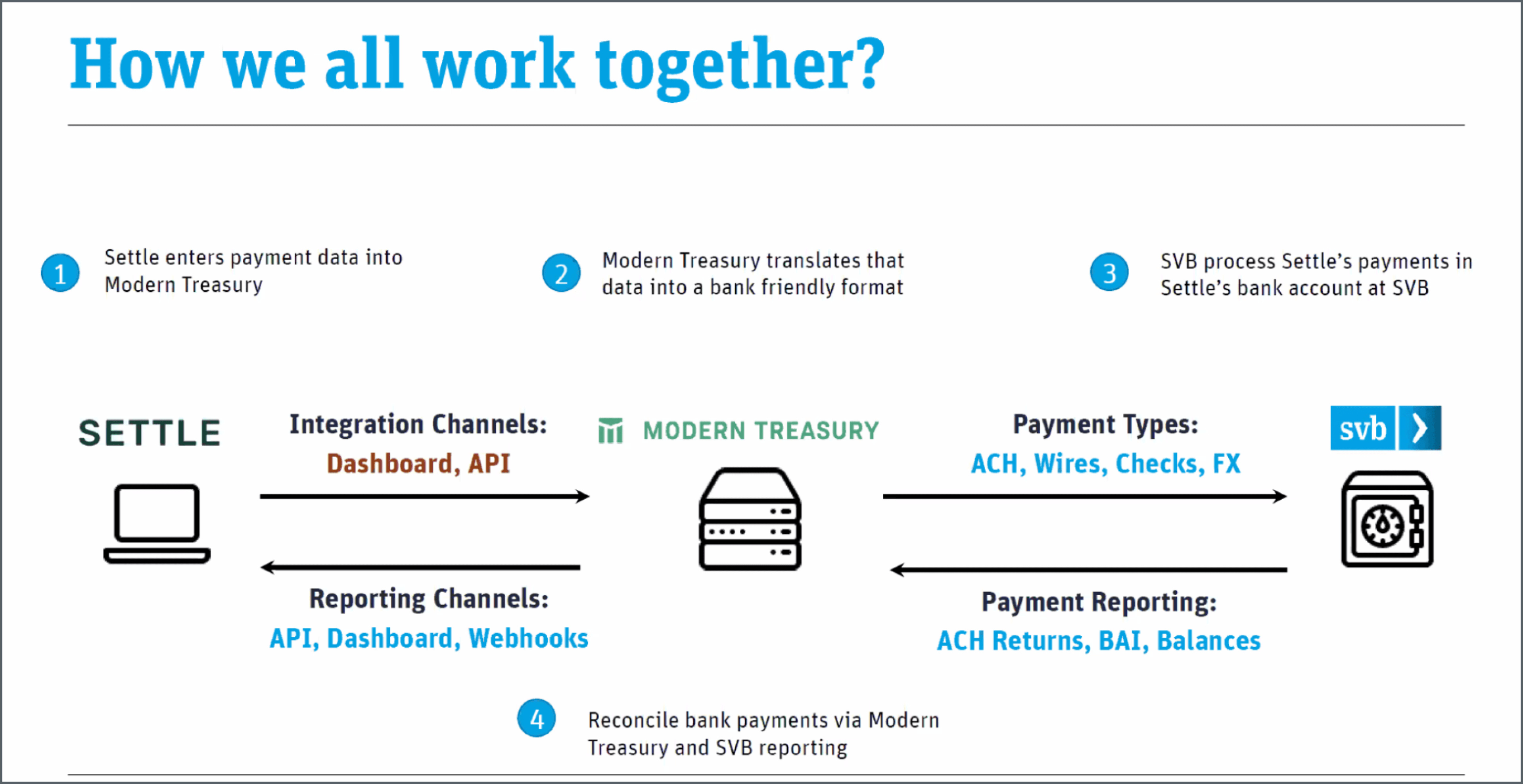

It might be helpful to set some context around how Modern Treasury and SVB come together to help our mutual customer, Settle, handle their payment operations process. Settle provides a cash flow management platform for e-commerce companies; they bank with SVB and use Modern Treasury for accounts payable and invoice factoring payments.

When Settle wants to initiate a payment on behalf of vendors and customers, they input the payment order information—counterparty sending and receiving bank accounts, amount, payment rail, and any other relevant metadata—using Modern Treasury’s API or web app. Modern Treasury then translates that information into a bank-friendly format for SVB to process the payment within Settle’s SVB bank account. SVB sends payment reporting back to Modern Treasury who automatically reconciles the bank statement with the payment and relays that information back to Settle through webhooks and web app.

The complexity of managing payment operations increases with the number of customers and transactions on their platform. This is why it’s important for Modern Treasury and SVB to provide the best payment operations capabilities to enable Settle to scale in a frictionless way.

Key Takeaways from the Panel

1. What is payment operations

When we talk about payment operations, we’re talking about all of the work flows around the lifecycle of money movement from initiation, approval rules, to reconciliation. Many companies—in fact, just over a third according to a recent survey we conducted with The Harris Poll—still have manual payment operations processes. And despite all the pain points, it remains a need for every business. As Senior Payments Strategist, Kourosh Adlparvar put it:

“Every company needs some variation of payment operations...Obviously the level of operations is going to differ from one company to another. If you’re making payments on behalf of others...or if you need to help users make payments for a savings app, those are going to have high volumes of payments and require more operations. But even the average SaaS company that needs to pay suppliers or integrate with their ERP, that also requires some level of operations, whether it’s creating the file to pay the vendors or reconciling that back into that system of truth.”

While there was massive innovation within the card and consumer space in the 2000s and into the 2010s, we haven’t really seen meaningful change in B2B payments via payment rails until recently. More and more businesses are embedding payments into their offering as a value add and differentiator, so we’re seeing a secular change in how Marketplaces and Platforms serve their customers. And there needs to be a manageable, scalable way to handle these payment types. After all, they represent the lion’s share of how most businesses pay businesses—$750T are moved via ACH and wire per year vs. $4T moved via card.

2. How to evaluate a payments solution

Every company approaches their payment operations differently; some opt to try to build everything in-house to maybe capture more economics, while others opt to use software to integrate with banks and automate payment flows from the beginning. It depends on where your company sits in the payments lifecycle, and where you can make an investment in the short term that will have the most impact in the long term.

The issue that often comes up with a build-it-yourself solution is that bank integration can be difficult and has a high opportunity cost. It lacks a standard protocol, requires dedicated engineering for payment delays and failures, and necessitates a separate integration to receive the bank statement. When it came to finding the right solution for Settle, CEO Aleksander Koenig said:

“Focus on your strengths. Our strengths are accounting software, lending. The payment operations piece really just enables this and makes it all work together, but is that our expertise? No…Right when we started, that was before we even had product market fit, so we didn’t want to spend 6-12 months to build it all out and have it not work at all. But with Modern Treasury and SVB, we went live within 3 weeks so we could test the product, and focus all our engineering on building the product.”

If you decide instead to move forward with a payments partner, you want to ask questions that give you an accurate picture around simplicity, speed, and cost:

- Simplicity: This is pretty straight-forward: Is the solution thoughtful and does it fit your needs? What payment methods are supported? Do you get visibility into all of your funds, and can you customize fund flows to support your business? Is it easily scalable?

- Speed: This is a bit more nuanced because there’s two “speeds” to consider: What is the time to value—how long does it take to get started? What are the payment speeds—how long will payments take to settle? The answer to the second question can vary by several days if you choose a third party sender who sits in the flow of funds, or a third party service provider who allows for payments to flow directly to and from your bank.

- Cost: In my experience, this is where many companies underestimate various cost components. There’s not only payment cost—how much will I need to pay for each transaction? But also implementation cost—what is the lift for product, engineering, finance teams to execute? Opportunity cost—how much time will it take to “go live” with this partner and what will it cost my business to wait? Ongoing costs—what time is lost reconciling and accounting for payments? What are engineering support costs? What if we want to do this for a different bank? Or a different payment method?

3. Scaling Payment Operations

We talked about scaling payment operations with Settle as the use case. As Alek pointed out, when they first began transacting, they were making maybe 1 payment per day for about $5,000. That was in late 2019. Today, they’re moving over $40M per week.

At that volume, reconciliation has been key. The partnership has allowed Settle to see where all their money is coming from, the amount, date, invoice number, and any metadata attached to it. Eventually, they may even enable virtual accounts to remove manual tagging.

Our goal has been to automate the payments processes from end to end. And working with Settle, who are at the forefront of innovating in this space, both SVB and our team have been able to discover the gaps in our products and services and quickly solve specific pieces of the payments flow.

On the flip side, Alek said, the partnership they established with SVB and Modern Treasury has allowed them to “scale quickly without degradation in service.” They’ve spent a lot of effort proving out the payable side of the product, and are looking ahead to building out a product on the receivable side—letting vendors generate invoices and requests.

Reflection

Besides the panel, we had a great Q&A to answer questions about SVB, Modern Treasury’s products, and Settle’s trajectory. All in all, this was an illuminating event in which to participate. Thank you to SVB for co-hosting, and to Alek from Settle for joining us on the panel, and thank you to all who attended for the thoughtful questions and engagement.

If you have lingering questions about payment operations, or want to learn more about how Modern Treasury integrates with banks, reach out to us at banks@moderntreasury.com.

Get the latest articles, guides, and insights delivered to your inbox.

Authors