November/December Changelog

In November and December, our product and engineering team shipped several new features including updates to reconciliation, ledgers, UI/UX, and more.

Here is a closer look at the updates and features we shipped in November and December.

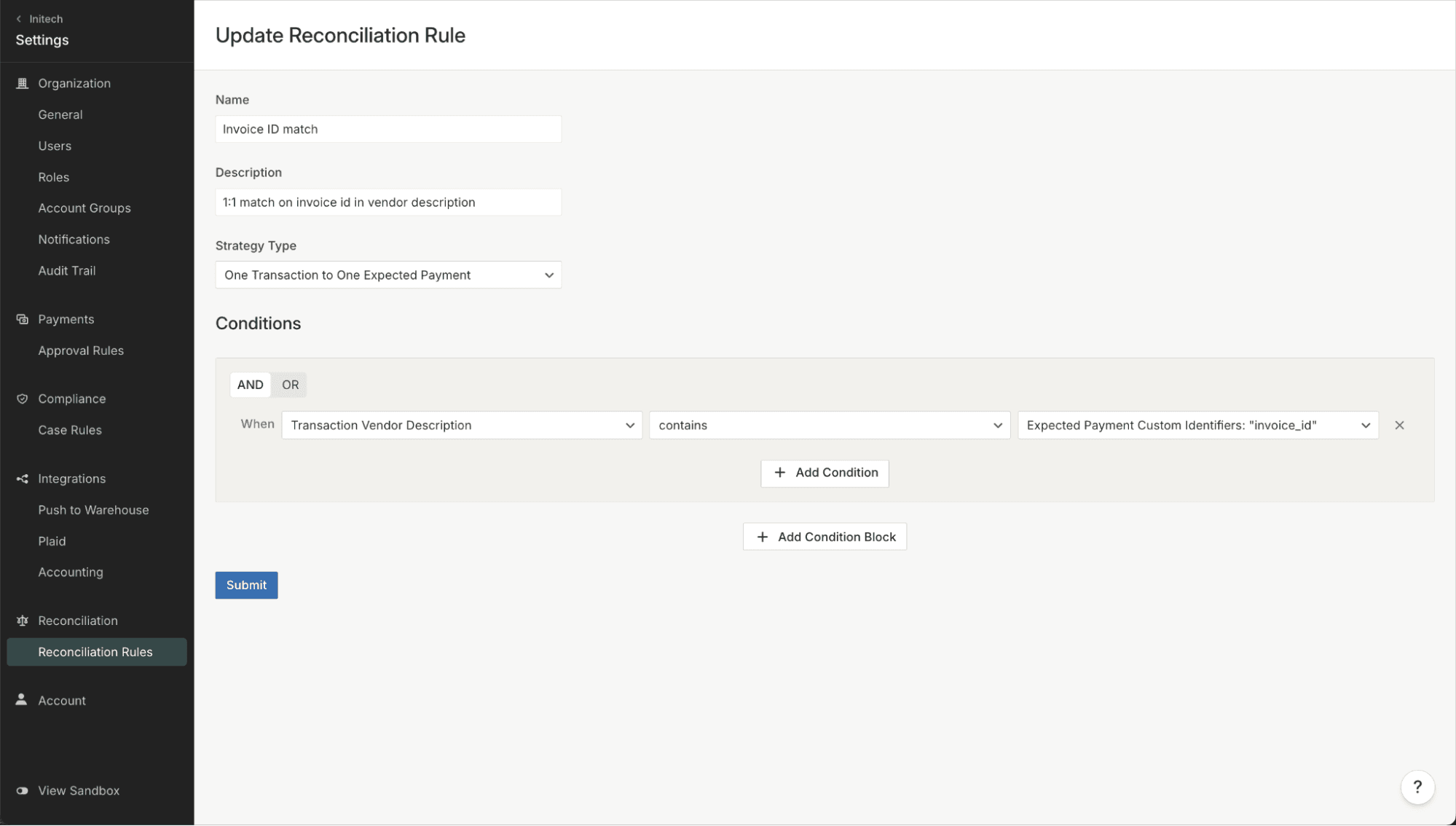

Reconciliation: Create Reconciliation Rules in the UI

Customers can now configure Modern Treasury’s reconciliation engine to automate the reconciliation of non-originated payments (e.g., inbound Wire or ACH) based on their unique payments data and preferences. Especially for customers with a high volume of non-originated payments, this new functionality helps finance teams streamline reconciliation directly from the UI, without engineering support. Learn more in our docs here.

Sample custom reconciliation rule. In this example, the user is matching Transactions and Expected Payments based on a specific metadata field (invoice ID).

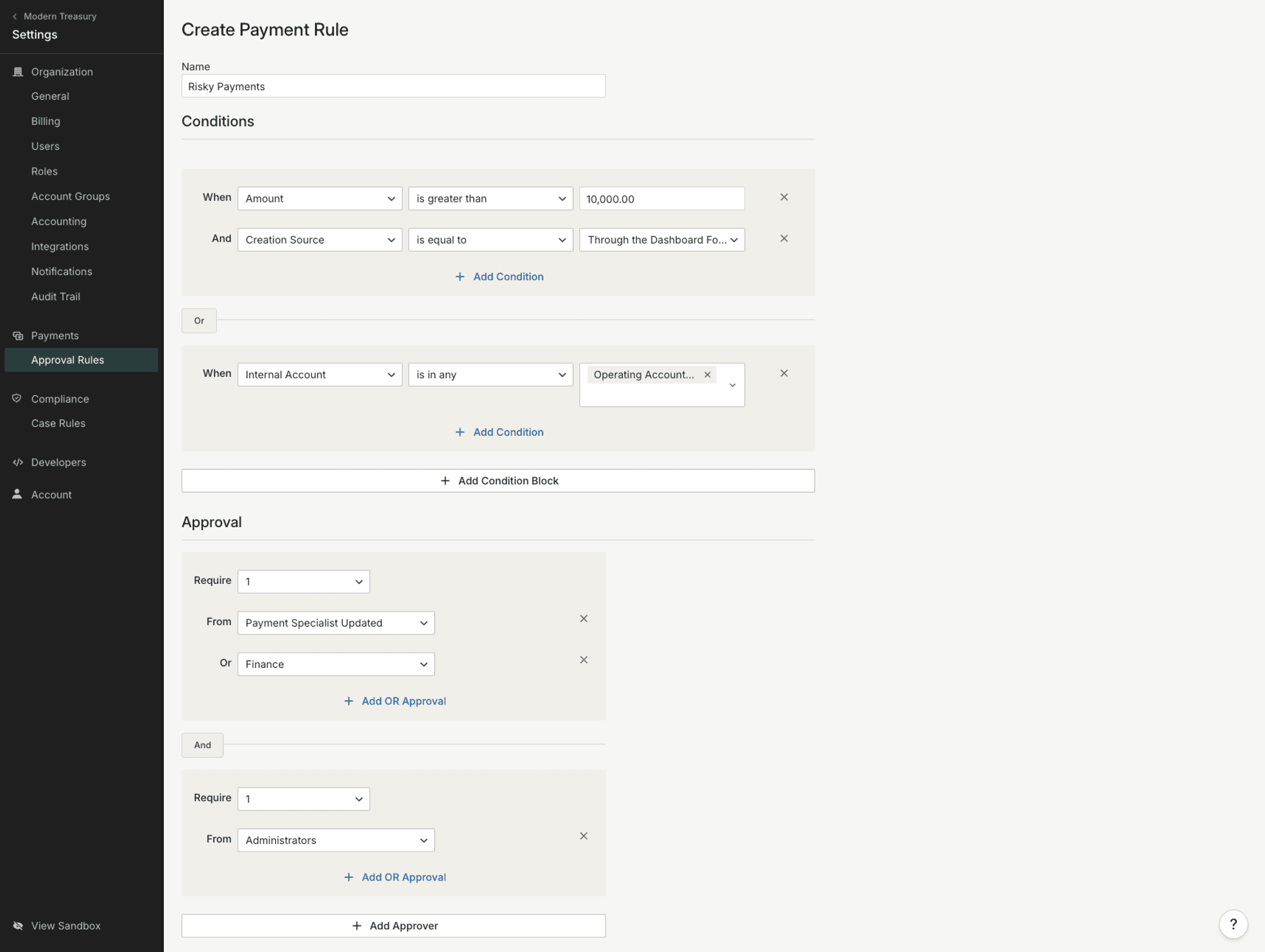

Approvals: Improvements in Transparency and Conditional Logic

Modern Treasury has enhanced transparency for payment approvals to reveal which rules have been triggered, which roles require approval, the status of approvals, and any blockers to customers approving payment orders. This release has also improved control for customers in multiple roles and those with administrator override privileges. Additionally, with enhanced conditional logic, customers can now create more complex approval rules.

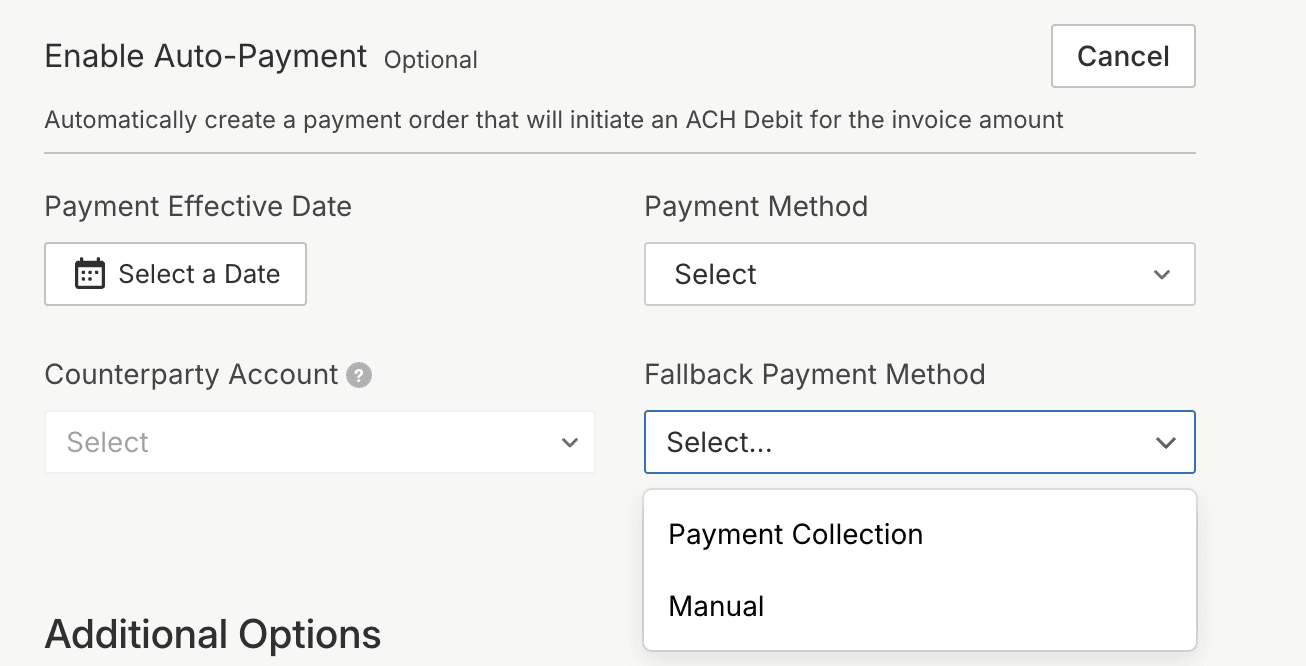

Invoicing: Manual Reconciliation & Fallback Payment Methods

Customers can now easily reconcile an unpaid invoice, with a side-by-side view of their reconciliation page and the Expected Payment association with the invoice. Customers can also select a fallback method for automatic invoice payments that fail, including an embedded UI requesting manual payment.

Fallback method selection for failed automatic invoice payments

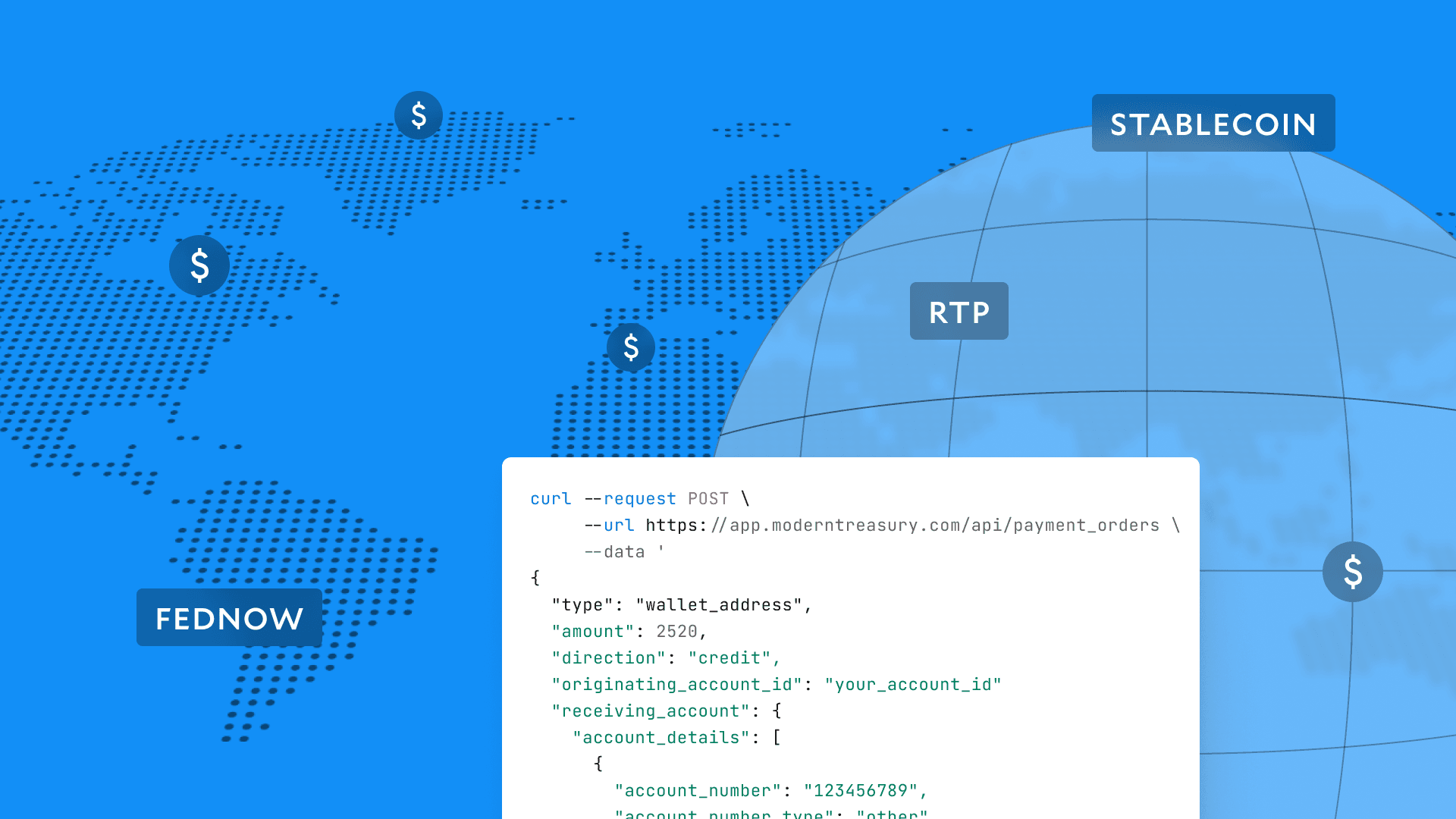

Bank Coverage: Global Payments at Citibank

Modern Treasury is now officially live with 20 new currencies at Citibank. This allows customers including Navan to send cross-border, SWIFT wire, and SEPA payments through their Citi accounts to local bank accounts in supported countries. More information is available here.

Bank Coverage: RTP Support at SVB

Customers at SVB can now send RTP payments and use instant microdeposits at Silicon Valley Bank.

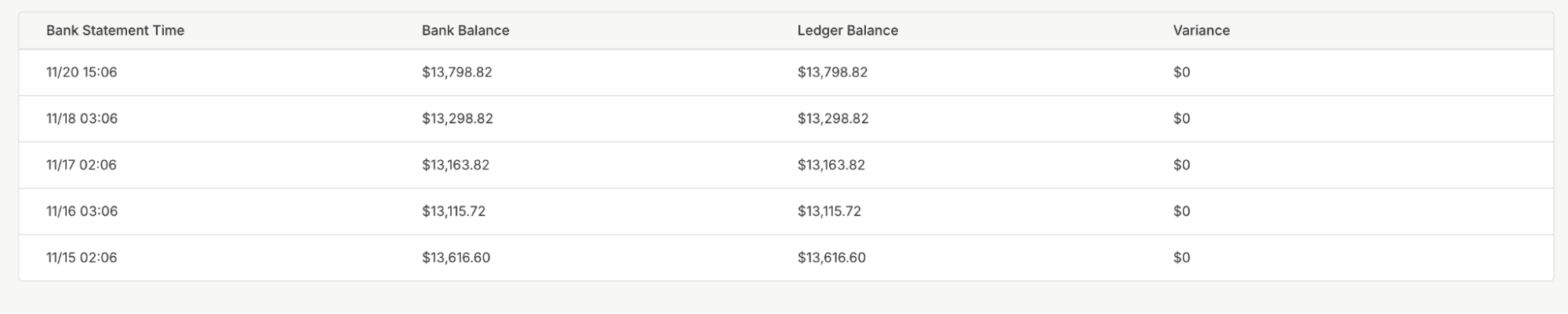

Reconciliation: Bank Account Balance Comparison

Customers using both Payments and Ledgers can now link a ledger account to an internal account and view the two balances on the internal account page in the Modern Treasury dashboard. For customers subledgering an FBO or other omnibus account, this allows the ledger account to be reconciled to the bank account balance as statements are received. As payments are created with corresponding ledger transactions, the ledger account balance will reflect the balance of these payments. Learn more here.

A ledger account linked to an internal account for balance reconciliation

Reconciliation: Linking Ledger Account Settlements & Payment Orders

Customers can now link a Settlement and a Payment Order together so that customer accounts can be settled in the ledger and executed via a Modern Treasury payment. After creating a Ledger Account Settlement, pass its corresponding Ledger Transaction ID into a Payment Order creation. This will ensure the Settlement and Ledger Transaction statuses are automatically updated as the Payment Order goes through its lifecycle. Learn more here.

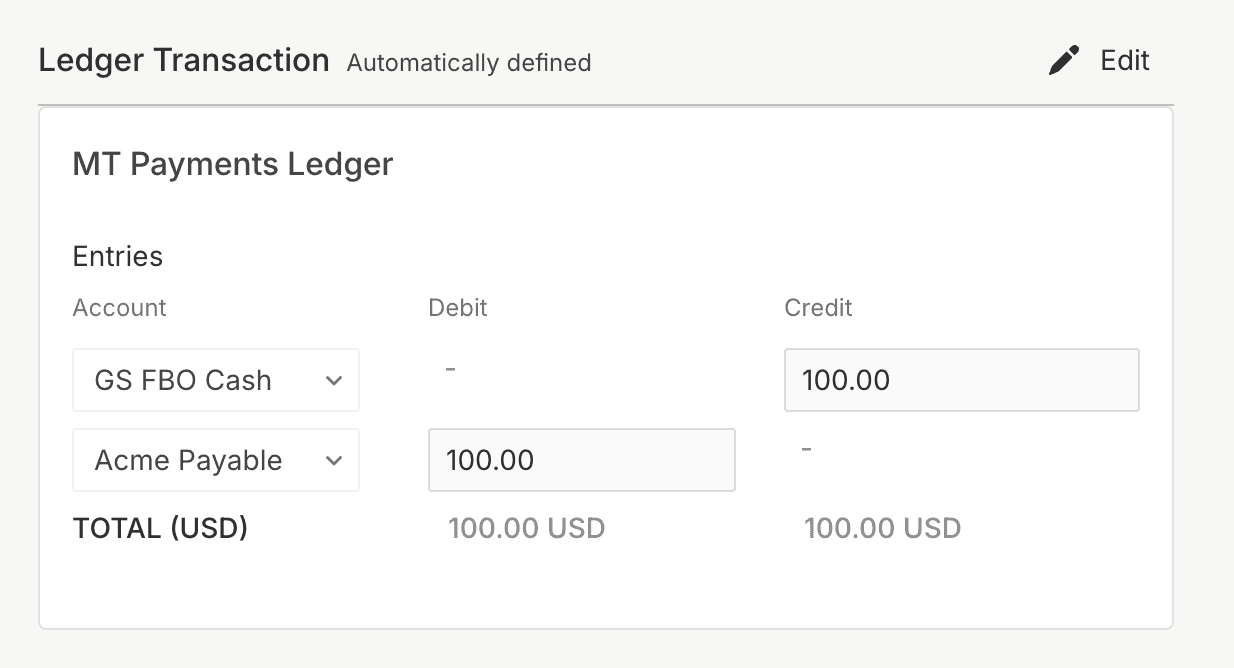

Reconciliation: Ledgering Payment Orders in the Dashboard

When creating a Payment Order in the dashboard, customers can now view a Ledger Transaction prefilled with the appropriate entries. This Ledger Transaction can be edited or created as suggested alongside the Payment Order. The Ledger Transaction will only be prefilled if the bank accounts involved in the payment are linked to Ledger Accounts. Learn more here.

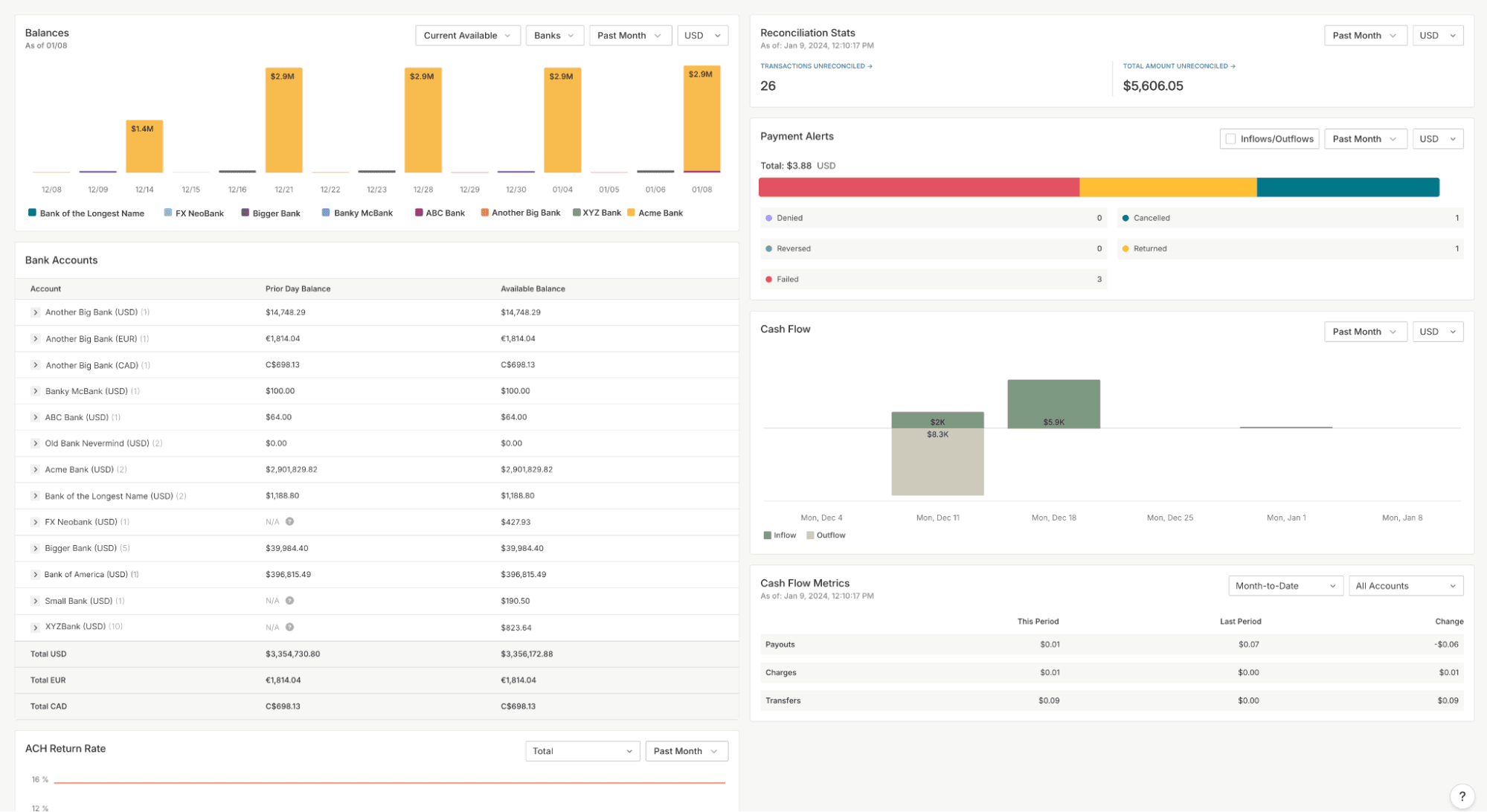

UI: New Dashboard

Customers can now use a new version of our dashboard. This update includes widgets to help customers gain fast insight on cash balances and payments history, as well as easily navigate to other areas of the app.

New dashboard with convenient widgets

UI: Persisted Custom Columns

When using our dashboard, our users can customize which columns are visible when viewing a report. Now, custom columns are persisted so that when a user navigates back to a report or view, the same columns will be visible.

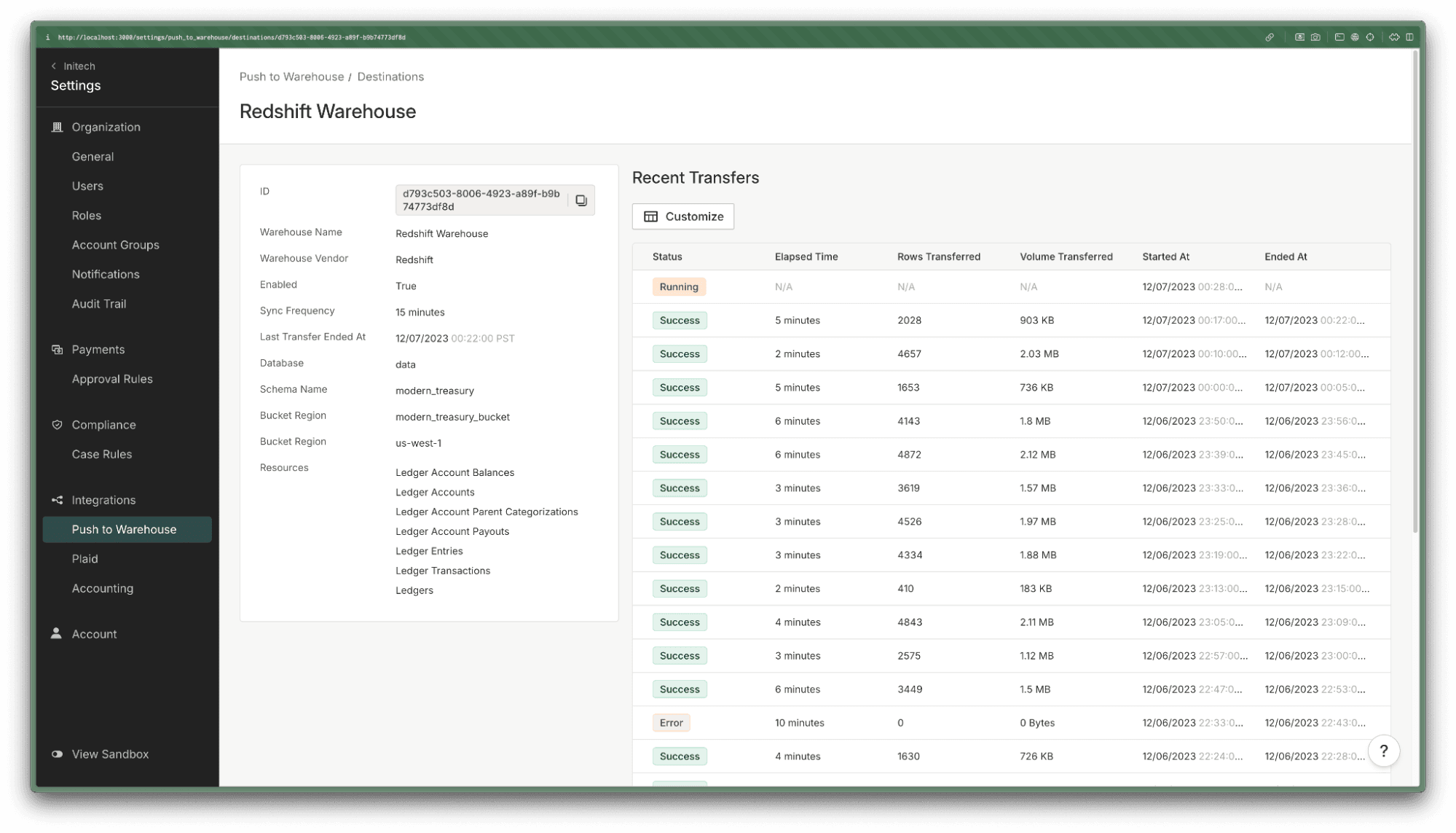

UI: Push to Warehouse Panel

This new UI gives customers visibility into their push to warehouse integration, with access to warehouse configuration settings, as well as recent transfer details for up to 2 weeks.

Push to warehouse panel

New Docs

Modern Treasury has improved its documentation to ensure all resources are clear, complete, intuitive, and align perfectly with our current product. You can access the new docs here.

PCI Compliance

Modern Treasury recently earned a Payment Card Industry Data Security Standard (PCI DSS) Level 1 certification. This achievement indicates that our systems were determined trustworthy and secure for customer cardholder data. Learn more here.

Next Steps

If you have any questions or feedback about any of these updates, or if you’re interested in learning more about Modern Treasury, get in touch.