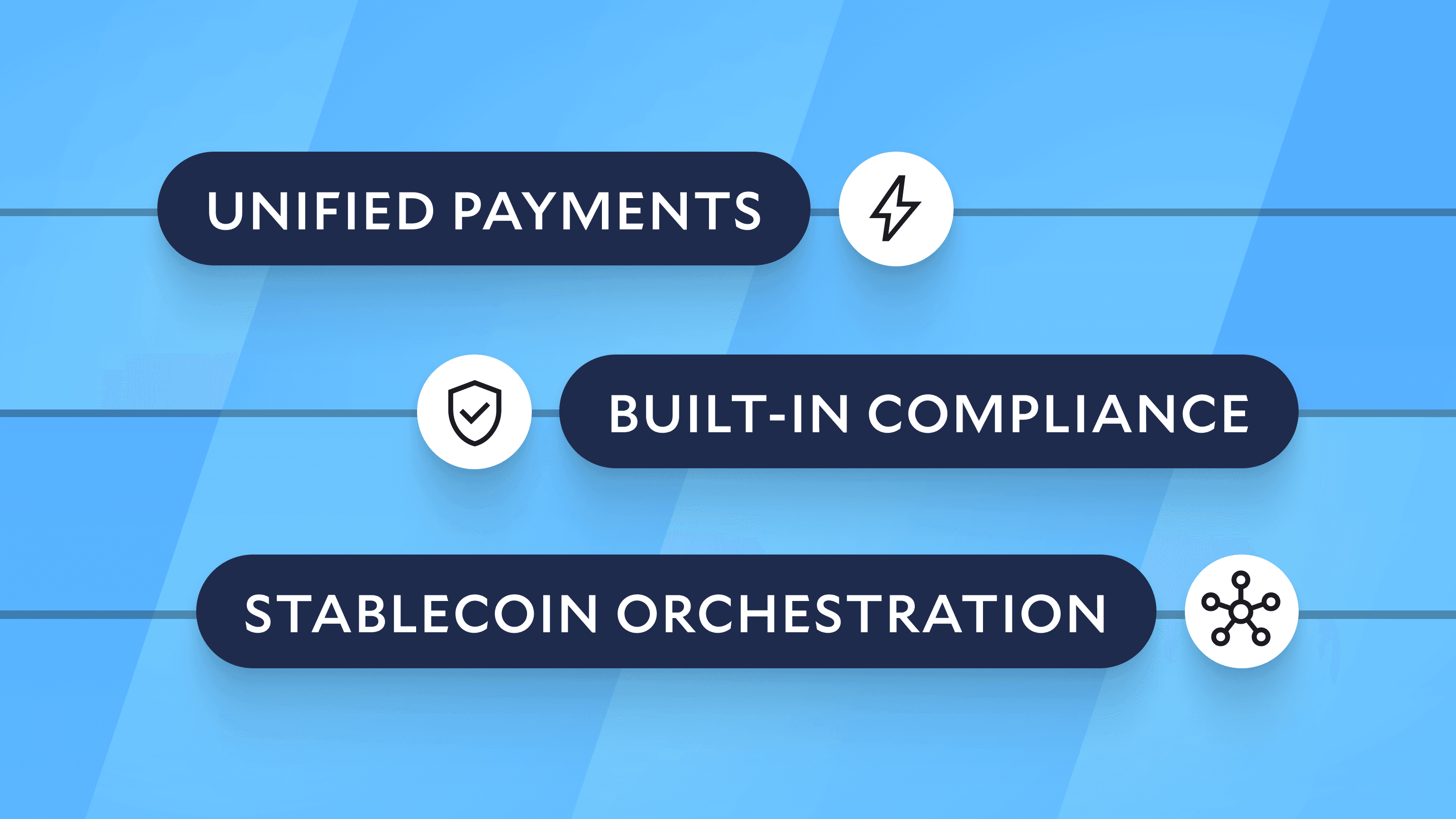

Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

Organizational Resilience: Slope CFO Ashish Jain Explains Why Diversification is Key

In a conversation with Modern Treasury, Slope CFO Ashish Jain discusses why diversification, people, and partners matter when it comes to building organizational resilience.

Ashish Jain learned about resilience early in his career. As the financial crisis of 2008 unfolded, he worked on the structured product desk at Deutsche Bank. He later moved from Wall Street to fintech, working as an SVP at SoFi and at C2FO, an online platform for working capital. A year ago, he became the CFO of the B2B payments platform Slope.

“Our mission is to bring B2B payments online,” Jain said in a recent interview. A typical Slope client may be a wholesaler who is buying products from an enterprise client or B2B marketplace, for example, with Slope handling the payment portion of the transaction. Slope facilitates same-day ACH transactions and real-time payments. “With each client, we’re improving their cash conversion cycle so that they focus on running their businesses, and grow,” Jain said.

In a conversation with Modern Treasury, Jain discussed his approach to building organizational resilience and managing through a crisis.

As a CFO, how do you build organizational resilience while navigating the potential turbulence ahead?

My first priority is always to ensure that the building blocks of the organization are sound. For a finance leader, that means having cash management under control—especially post-bank failures, where there was a huge scramble to pay, and payroll funds were not diversified. While that collapse was an exogenous event, it highlights how swiftly events can transpire.

When your funds are diversified, and not just through money market funds but also with different institutions holding your capital, you have appropriate guardrails in place. It’s important to avoid having one point of failure, like using one bank to make payments to your customers. Make sure you have backups.

Another point of organizational resilience is the talent you hire. Many companies have great ideas. You need people who can execute upon those ideas, and show true grit. This may sound like an obvious statement, but the next couple of years may be challenging. Many great companies formed post-financial crisis of 2008. It’s important to hire the people who understand that, and who can be resilient even in tough times.

That’s interesting. How do you hire for resilience?

We like to ask: What have you learned from different failures? People can learn from bouts of humility. Next, we ask: How did you adapt as a team? And how did you fix things?

Not everyone is going to be doing things right all the time—that’s impossible. We take a first-principles approach in which we question the status quo and aren’t afraid to re-examine everything down to the foundation, and if needed, redesign it completely. So we don’t want someone walking in and thinking they have all the answers.

Instead, it’s about dissecting problems and working with your colleagues to attack them. There are, of course, fundamental ways of tackling problems that have existed for decades, but part of the fun of being at a startup is finding creative ways to deal with them. And navigating through points of adversity can help define a person’s character.

How do you focus on minimizing risk, especially in these times?

Our goal is to facilitate payments in the most seamless way possible. We don’t have money transmitter licenses like Stripe or Checkout because that’s costly, takes time to set up, and involves a fair bit of compliance. We need to work with banking institutions to move the money.

We work with Modern Treasury to make money movement streamlined and safe for our customers and ourselves. It’s a partnership that allows us to work with multiple financial institutions. That’s very important to us because of the diversification I mentioned earlier.

We’re also able to evaluate each bank we work with holistically, in terms of investment banking and corporate coverage. With one of our bank partners, for example, we interact with the trade finance division on potential go-to-market partnerships. Having the ability to see which bank is best for a specific task matters to us when we choose partner banks.

Modern Treasury has also given us better visibility into all our money movement. They let us know when payments will be posted. That’s important from a finance seat because we have to undergo audits, and those timestamps are critical.

For leaders considering the payments landscape, what’s a good place to start?

Think about what your customers are looking for. Our customers had a definite need for faster and more efficient pay-ins and pay-outs. Same-day ACH payments are important to them too. Listen to your customers and to what they want.

Next, take a look at your business model. Do you want to be in the payments space? Is that your core offering, or is it part of some other offering? You don’t want to be doing a project just because other companies are doing it. It may be a distraction.

Looking at your time at Wall Street, what have you learned from past crises?

Things do pass. The global financial crisis was terrible: the stock market crashed, banks went under, people lost homes, the entire economy was affected. But there was a rapid recovery.

And looking at what’s happening now, I think to myself, it was certainly much worse back then and businesses persevered. So I feel optimistic.

I also believe that regulation is a natural part of the healing process. Post-crisis, it makes the system stronger. Can it affect certain businesses? Certainly.

But it can also spawn the creation of new ideas and new ways of working and new businesses. It’s also important to understand how the regulatory landscape will be changing as a result of the events that occurred. And then to identify the opportunities for startups and innovators to excel.