Join our next live session with Nacha on modern, programmable ACH on February 12th.Register here →

Money Movement Matters: A Case for Payment Operations

Payment operations are the workflows surrounding money movement. This journal digs into the nuances and evolving significance of effective payments technology.

Four years after the first article in our Journal, payment operations remain top of mind at Modern Treasury. While the conversation keeps evolving, one through line remains: now, more than ever, the way companies manage money movement has direct and powerful implications for their growth and success.

Findings from last year’s inaugural State of Payment Operations Report affirmed the need for smart, streamlined payments technology. In anticipation of this year’s report, we’re circling back on the fundamentals behind money movement: what are payment operations and why do they matter?

Back to Basics: What Are Payment Operations?

Payment operations refers to the set of workflows companies use to move money. Also called “Payment Ops,” these workflows facilitate and impact money movement from start to finish. Payment operations include:

- Payment initiation and approvals

- Funds tracking

- Payment failure/returns management

- Reconciliation

- Ledgering

- Compliance

(Though listed last, compliance impacts all facets of payment ops—it’s essential that companies ensure their adherence to regulations for money movement at every step.)

You’d be hard pressed to find a business that doesn’t issue or receive some form of payment—and as companies scale, the scope of their payment operations also increases. Even beyond accounts received and accounts payable, more businesses are building payments into their products, even if they don’t traditionally move money as a core product offering (HubSpot payments is a great example).

Companies often manage payment processes across a range of systems and tools, including:

- Spreadsheets

- Bank portals

- Enterprise resource planning (ERPs)

- Accounting software

- Third-party providers (TPPs)

These systems rarely communicate in a seamless way, which means tracking money movement end-to-end can involve cobbling together a series of manual workarounds. The complexity compounds when the systems are outdated or created for bespoke use cases.

That said, oftentimes the biggest investment businesses make towards managing payment operations is in human resources. As one author puts it, companies have tended to “throw more bodies at the problem.” And sadly, adding staff to address the challenge payments can present isn’t always an efficient or sustainable choice, especially where B2B payments are concerned.

Staying Ahead of the Curve: Why Payment Operations

A payment involves so much more than clicking “send” or watching funds land in an account. And it’s precisely this often complex (and overlooked) infrastructure that surrounds a payment’s desired outcome—money successfully sent or received—that makes payment ops vital.

Sending a single payment is nuanced—the process varies by payment rail, direction, financial institution(s), and who sits in the flow of funds.

And so naturally hundreds, thousands, or millions of routine payments (especially to the tune of hundreds of thousands, or millions of dollars) become a conundrum.

Payment operations matter for a myriad of reasons. Namely, the technology behind money movement is particularly significant because (1) data supports the need for better solutions, (2) business survival depends on effective payment ops, and (3) the right technology can offer substantial benefits that foster growth.

1. Data and Trends Highlight the Value of Payment Ops

Let’s examine two data sets related to payments that underscore the importance of getting money movement right.

Looking back

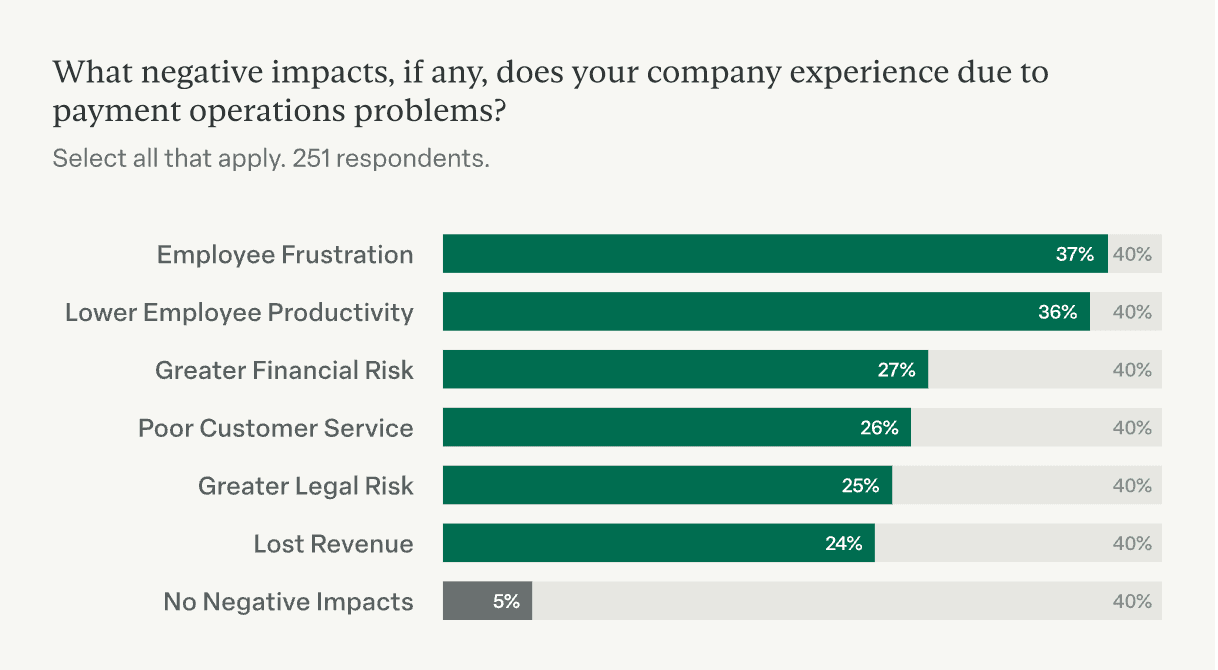

Analysis from our 2021 report reveals that, overall, business leaders find payment operations challenging, time-consuming, and ripe for improvement. In fact, 84% of those surveyed reported payment operations problems related to slowness, payment failures, and data quality errors—that’s four in five companies and a list of costly inefficiencies. Additionally, 99% of leaders said modernizing payment operations would benefit their business.

Framed another way, this data shows that businesses could increase efficiency leading to potentially accelerated business growth with the right payment operations solution.

Additional data from the 2021 report showing negative impacts as a result of inefficient payment operations

Moving forward

Over the last decade, software has dramatically altered the payments space, namely through embedded, third-party payments. Data clearly demonstrates this massive growth with the potential for FIs (financial institutions) to get in on the action to the tune of $7 trillion dollars. And projections indicate more to come—the embedded payments industry is expected to grow to $230 billion in new revenue by 2025 (up 922% from 2020).

So what’s the problem? Unfortunately, to date, a lack of infrastructure has made it hard for growing businesses to support (not to mention scale) these payment flows.

Building an embedded payments product can provide a host of business benefits including increased revenue, better customer retention, and cost savings. For companies looking to pursue these advantages, modern, automated, end-to-end payment operations are essential.

2. Business Survival Requires a Modern Approach to Payments

The pace of digital transformation has raised the bar for consumer and business expectations, accelerating what companies need to keep pace in the market. This is especially true for payments but not necessarily straightforward when you consider the following:

- The bulk of B2B payments happen over bank rails—annually, $750T are moved via ACH and wire as opposed to $4T moved via cards.

- Bank rails use older technology than card networks. Overall, manual funds movement via bank rails is less likely to meet growing enterprise demands for speed and real-time financial insight.

- Payment operations that happen outside banking portals can also be slow, cumbersome, and difficult to analyze.

Business leaders know that embracing digital technology powered by bank rails is the way to go—the median volume of ACH transactions has doubled in the last six years and 73% of organizations are currently moving from paper checks to electronic payments. FedNow is also on the horizon; with the ability to make payments faster and more efficiently online, it seems inevitable the shift from paper to digital will only increase.

Source: 2022 Association for Finance Professionals Payments Cost Benchmarking Survey.

However, in order to leverage the advantages of bank rails while keeping pace with today’s business landscape, outdated, manual workflows won’t cut it. And ultimately, failing to adopt modern technology for payment operations can endanger financial stability and longevity. Businesses with the wrong systems waste time and resources, risk errors and fraud, and lack real-time (and long-term) insight into where they stand.

This isn’t just a problem for established businesses looking to reassess a “sprawling” tech stack, legacy systems, or manual data entry (e.g. Excel)—one of the primary reasons startups fail is cash flow problems (a direct tie-in to payment operations). Luckily, comprehensive payment operations solutions like Modern Treasury can help speed up, streamline, organize, and optimize money movement for businesses at any stage.

3. Quality Payment Operations Afford Key Benefits

A payments solution that connects cash flow, data flow, and workflows can provide a host of business benefits—benefits that help the most innovative companies exceed their goals.

Momentum. Without effective payment operations, companies can play endless financial catch-up. Or if their tools do allow them to keep pace (i.e., they can accurately track what’s happened when they close the books), they’re still facing backwards, so to speak. The right operating system for money movement prioritizes forward-momentum.

With real-time data and continuous accounting, businesses can turn from asking “What happened?” to asking, “What’s next?”

This entails the ability for companies to ship new offerings faster and scale smoothly.

Example: Outdoorsy is looking forward and growing fast—payment operations help support their 4,000% growth rate since April of 2020.

Efficiency. An efficient payment operations system is organized, centralized, and synchronized, keeping teams focused and aligned. Optimized workflows include an integrated tool set and single point of contact for better, stronger, and easier relationships with bank partners. Ultimately, efficiency translates into time and money saved.

Example: Pipe saves over $500K annually with automated payment operations.

Clarity. Transparency into financial operations isn’t just a nice-to-have. The ability to access a comprehensive, real-time picture of your business performance in a single payments dashboard (with a single click) is central to smart strategy, action, and analysis. This facet of payment operations also ensures that everyone is making decisions rooted in the same data set—even when volume is incredibly high.

Example: Sana uses Modern Treasury to process over $40M in payments across 12 bank accounts and 1,000+ reconciled payments per customer per month.

Connections. Efficient payment operations improve customer experience and team performance through ease-of-use. Partnering with experts at Modern Treasury allows businesses to take advantage of strong, existing bank relationships, as well as technical expertise and support. Not to mention the value of modern APIs for seamless, connected experiences at scale.

Example: Wholesail enhances customer experience via payment operations with 4X faster payouts.

Modern Treasury: Payment Ops for Growth and Scale

Why should you care about payment operations? Because you care about your company, your customers, and your future. This often-overlooked technical sinkhole (i.e., the infrastructure surrounding digital payments) doesn’t need to hamper your growth. Learn more about Modern Treasury’s payment operations solution today—and be on the lookout for our 2022 State of Payment Operations Report coming in October.