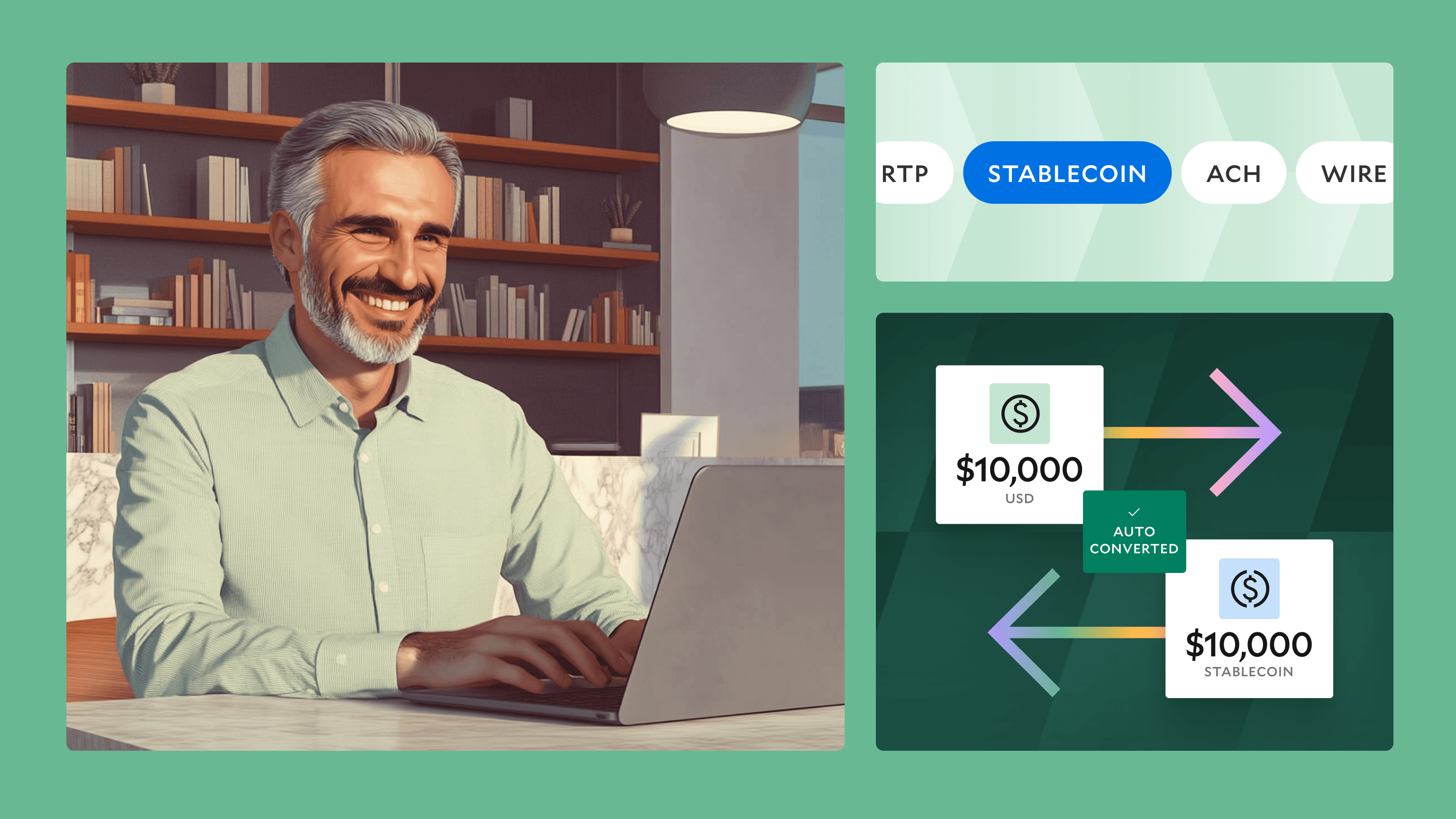

Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

Announcing Virtual Accounts

Today we're excited to announce the launch of Virtual Accounts, which helps businesses automate how payments are attributed and reconciled.

Today we're launching Virtual Accounts, a product to automate payment attribution for inbound fund flows. Virtual Accounts provide useful context on transactions received in a settlement account, and eliminate painful, manual reconciliation of transactions from individual users or vendors. We're thrilled that a number of our customers, like Revolut and Vinovest, are already using Virtual Accounts to build neobanks, investment platforms, digital wallets, and marketplaces.

Background

It can be difficult to reconcile payments at scale because they don't always include enough context to identify and attribute to the right bank transaction, user, and separate funds. Large teams need to piece disparate data together by looking at amounts, timestamps, transaction details and remittance information. This can require manual effort as well as custom internal tools that need significant engineering, maintenance, and scaling. Any issues or delays with reconciliation complicate downstream processes like cash management and reporting.

Our Solution

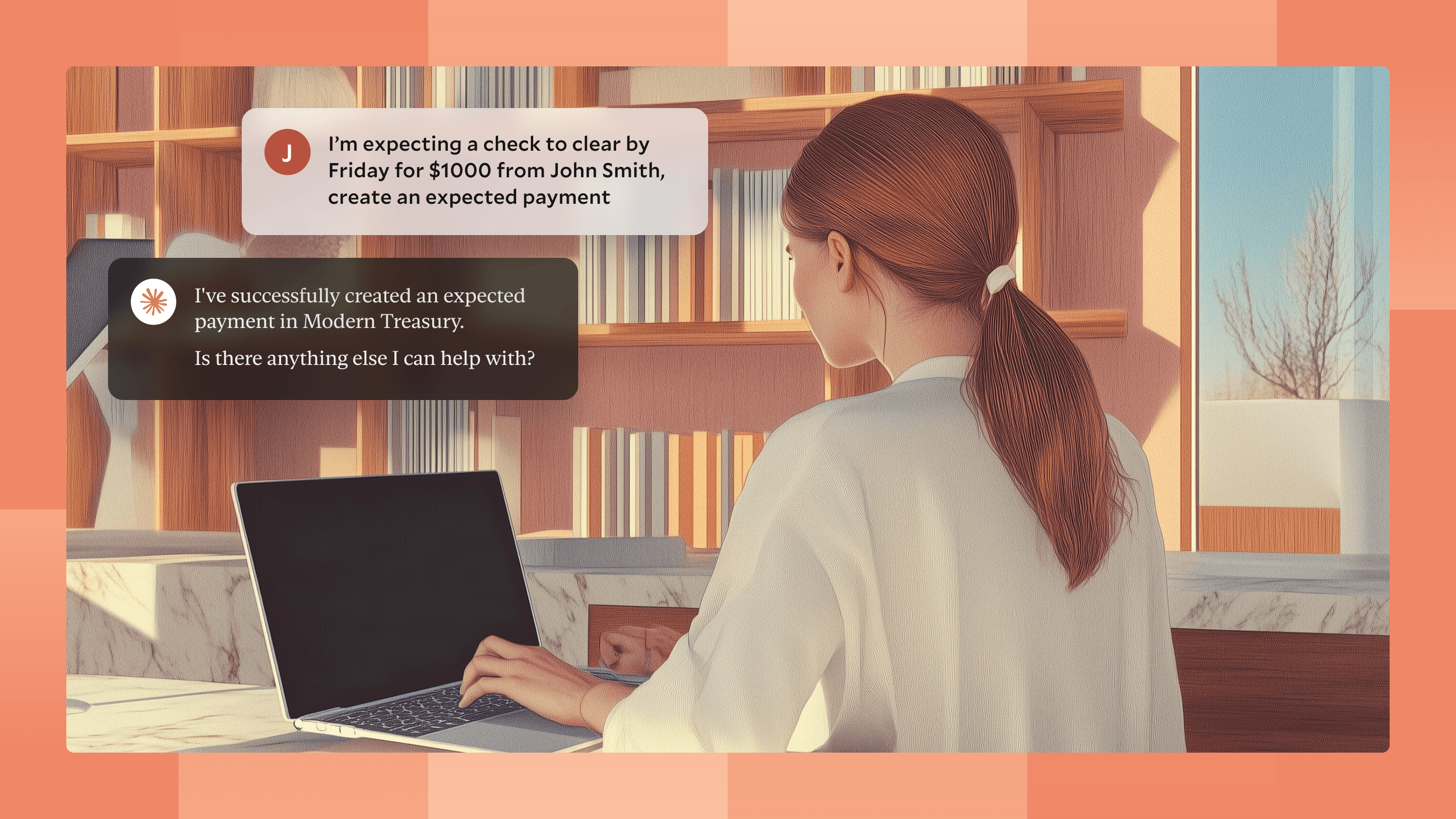

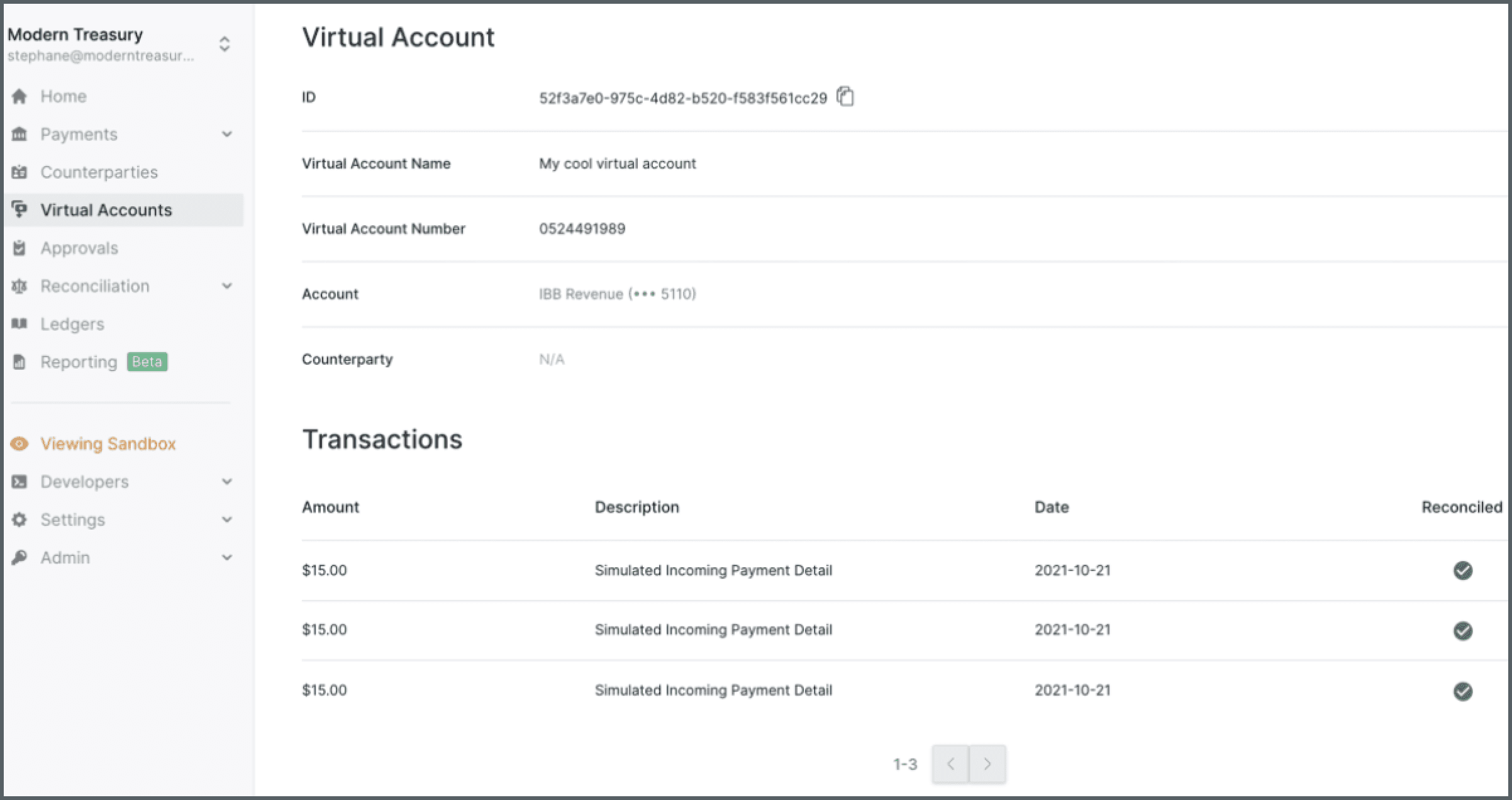

Our Virtual Accounts API solves this by allowing you to generate a unique, externally addressable account number within your bank account. This account can be linked to a customer, vendor, or invoice so that when you receive a payment, you know what it's for and who it's from, thereby automating attribution and reconciliation. The API abstracts away the complexity of integrating with disparate virtual account systems at different banks and for different payment methods like ACH, Real-Time Payments (RTP), and wire transfers.

Virtual Accounts also eliminate the need to have multiple Direct Deposit Accounts (DDAs) or For Benefit Accounts (FBOs), and can be combined with our Ledgers product to track balances for each user.

Empower Your Operations and Finance Teams

This launch also includes a new set of dashboard capabilities to empower operations and finance teams to monitor and view details of incoming payments to virtual accounts. This dashboard is currently read-only, and write capabilities are coming soon.

We currently support Virtual Accounts at Wells Fargo, JP Morgan, and Increase, with support for more banks coming soon.

Try it now

To get started with Virtual Accounts, you can sign up for Modern Treasury and test the in your Sandbox. If you want to find out more, get in touch with one of our payments advisors.

As always, you can reach us at support@moderntreasury.com to get your questions answered or provide any feedback you might have.