Join our next live session with Nacha on modern, programmable ACH on February 12th.Register here →

Unlocking Networks: The Present and Future of Embedded Finance

In today’s market—and well into the future—embedded finance can unlock huge business potential. Learn why and how in this journal.

Embedded finance isn’t new but its acceleration is novel. In large part due to expanded bank and fintech partnerships and the pervasiveness of user-friendly software, more companies are embedding finance (especially payments) into their products. And the data points to continued growth. The revenue projection for third-party payments in 2026 is $138 billion (up from $43 billion in 2021). In fact, by 2030, an estimated 73% of global consumer payments will be processed by non-financial institutions.

Returning from future to present, the power of embedded finance is worth investigating now, especially as market volatility continues. This article will examine why embedded finance (and specifically embedded payments) is important at this moment—and will be for years to come. We’ll also discuss the operational tools required to take advantage of this opportunity.

Why Embedded Finance Can Safeguard and Spur Growth

The current significance of embedded finance results primarily from two factors. First, domestic financial networks are incredibly strong but on-ramps are outdated. Traditional payment technology has been in use for anywhere between 149 years (wire), 72 years (card), and 46 years (ACH). Still, these networks are remarkably effective and solve hard problems—checks are a great example.

Secondly, market dynamics are testing companies across the board. For newer startups, access to capital is more limited; for established orgs, the current environment is threatening growth targets. As a result, companies are being pushed to prioritize efficiency and profitability.

Leaders must also consider exploring new tacks. As Tilli Bannett, Managing Partner at SVB Capital asked, what are creative ways for companies to latch on to new revenue-generating opportunities?

Embedded finance, as Bannett notes, is exactly this type of opportunity. “By embedding fintech, you're improving top-line growth, you're expanding your revenue per client, and creating much better client retention. Ultimately, this translates to better top line numbers and augmented enterprise value,” she says. A good part of this force comes from the “collateral benefits” of embedded finance—and embedded payments specifically.

Customer Focus is Paramount (and Powerful)

In the current moment, solving customer pain points with focused, deep value products is more important than ever. As part of these products, customers want seamless payment experiences that are fast and transparent. A company’s inability to meet this demand can quickly become a pain point—poor payment solutions negatively impact client experience, client conversion, and cash flow.

Embedded finance is about meeting industries and clients where they are with the right solution. And so the rails (or pipes) need to make sense for end users. Software enables this.

Per Vasant Prabhu, Visa’s CFO, “The fact that there is a pipe… doesn’t mean there’s going to be traffic or volume on that pipe. Use cases have specific needs. And if the pipe doesn’t serve those needs, the pipe will not be used.”

The value of embedded finance is the ability it offers companies to take broad network pipes and orient them specifically for any industry. In turn, the industry gets all of the network benefits within a seamless software experience.

Software allows companies to deliver payment solutions that are perfectly catered to their vertical.

Take Silo, for example. Silo helps the agriculture industry automate the perishable supply chain—it is what CEO and Co-founder Ashton Braun calls a “system of record for food around North America.” As he observes, agriculture is “notoriously lagging in technology.” For this reason, the power of embedded finance for Silo has been tremendous, helping the company offer financial service products that deliver deep value to clients. By embedding financial tools, Silo has expanded their network to include over 40,000 businesses in perishable food and agriculture, making their offering increasingly sticky.

Silo began with invoices, accounting, and check processing before moving into digital payments via bill pay, followed by collections, bookkeeping-as-a-service, underwriting and lending, and finally supply chain financing. Embedded finance (beginning with embedded payments) unlocked new data and opportunities at each level, helping to surface additional customer needs Silo could meet via software.

For analog industries especially, embedded finance can be highly beneficial. Braun shares that, according to his Procore partners, “construction is the second least digital industry on earth followed only by agriculture." Like Silo, Procore (a virtual SaaS company that operates in the construction management space) has also embedded finance to better serve its users, as Angelos Anastasiou of Goldman Sachs TxB shares.

According to Jess Levin Conroy, CEO and Co-founder of Carats & Cake, the events industry is on par with both construction and agriculture when it comes to tech maturity. Carats & Cake is the first integrated financial operating system for the events industry, an overlooked $100 billion market. As Conroy says, “Payments are the biggest single piece of friction inside this industry and it's not just the actual payment collection. It's everything that happens after that, from the funds flow back to the venue, as well as the entire client experience.”

As an example, outside of Carats & Cake, there is no system of record for large event payments. “A lot of major properties that don't work with us are sending out PDF credit card authorization forms, and collecting checks for an incredibly meaningful revenue stream inside their hotel operations," Conroy says. Not only is collecting the payment a pain point—companies also need to consider the full cycle of potential issues that can arise, all the way through reconciliation, from errors, to lags, to returned checks.

Conroy calls embedded payments a “customer service operation,” saving time and easing burden for parties on both ends of digital event transactions.

Embedded Finance Benefits Everyone

The advantages of embedded fintech reach everyone involved in these fund flows, including end users and businesses.

1. Consumers and Clients

Embedded payments improve the user experience on the operational level. Consider payment routing (i.e., the ability to mix and match networks). Luke Hammock, Head of Embedded Finance at Goldman Sachs TxB, articulates its logistical value—“A thing that differentiates embedded payments experiences, in addition to the speed and transparency element, is the optimization around what payment rail or method is useful, at what time.”

And even beyond logistics, attributes like software-enabled payment routing can be impactful on a personal and emotional level.

Via embedded finance, Carats & Cake can allow event planners, for example, to pay in installments using BNPL (Buy Now Pay Later). Let’s say a family is planning a big event and makes monthly payments via check for their venue. Carats & Cake then pays out vendors right away with ACH or card (i.e., another network), which allows the venue to get their money upfront.

Not only do both parties benefit from increased cash flow—for the group financing their special event, embedded finance can have profound personal value. “Hearing from a consumer that being able to pay monthly versus all at once fundamentally changed their family experience, that's exciting,” says Conroy.

2. Businesses

Clearly, focusing on benefits to end-users can ultimately serve business goals around revenue and retention. And as customer examples demonstrate, embedded finance designed to meet customer needs can unlock exponential growth while boosting stickiness.

According to Braun, Silo’s expansion into financial services resulted in roughly a 6-times increase to monthly sales, with the value of transactions totaling 20-times higher than SaaS alone.

Although embedding new fintech required Silo to build use-case specific infrastructure, even small changes opened up incredible potential.

Braun refers to “some little payment function” that was relevant for 5-10% of customer payments that in turn “unlocked 100 percent of the payment volume because… folks just want one place to do all their payments and you have to support all of them." These choices have eased burden for sales reps that no longer focus on selling prospects a whole ERP—once customers begin using Silo and experience the all-in-one finance on the platform, they tend to adopt.

This experience is echoed by that of Carats & Cake. Conroy discovered that building features on top of the embedded finance layer (as an example, check tracking to improve transparency) not only met the events industry where it was—it also accelerated growth and made the product stickier.

What to an outsider may seem like a small or niche thing to build, Conroy responds, “that just opened the entire box for us.” As she observes, this is why embedded finance becomes so valuable: “these industries need very specific operational features on top of their financial tools—it's part of what makes it so sticky.”

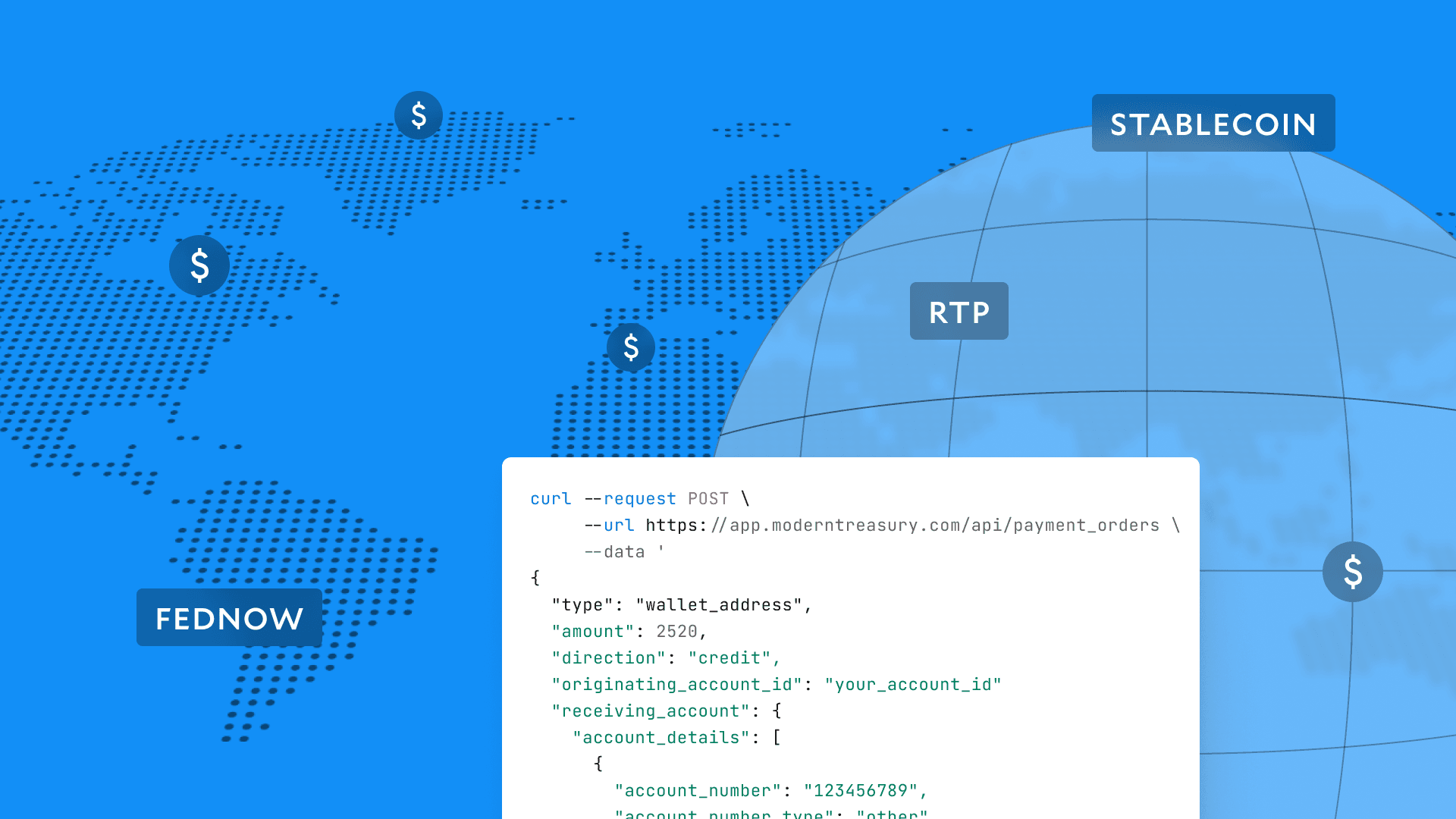

The Operations Behind Embedded Finance

Embedded finance is, by design, highly operational. That’s how it delivers value. Still, these operations—and the resulting infrastructure—can be tricky to get right. Especially when the need for speed and transparency in payments introduce new complexities.

With embedded payments, it’s important to accept a variety of payment types for end-user convenience. However, each payment type is different when it comes to the level of speed and degree of transparency as money moves.

Identifying exactly where a check is (physically and while processing) differs from tracking the movement of an ACH payment, which is distinct from a wire transfer. Timings also vary widely.

Effective payment operations encompass a full lifecycle, well beyond payment initiation, approval, and tracking. It’s also important to resolve payment failures and returns, reconcile transactions to bank statements, and track payments using a general ledger. Handling each of these steps across different payment types—with accuracy, security, and swiftness—can become untenable at scale. Not to mention the challenges compliance and fraud can present.

Modern Treasury was built to shoulder these complexities. As a modern operating system for money movement, our software tools enable companies to implement embedded finance through payments (i.e., network capabilities) with ease, speed, and insight. Reach out anytime to learn more.

From this, it’s possible to assume that faster payment rail adoption will depend, in large part, on embedded finance.

This is the crux of payment operations, managing money from end-to-end.