Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

Reconciling Card Transactions with Modern Treasury

Modern Treasury’s Reconciliation Engine provides customers with real-time, automated cash reconciliation across any payment method and processing partner—here's how it works.

Real-time reconciliation excites us because it helps companies transition from a batched-based financial reality to a streaming reality. It helps:

- Businesses move faster and more efficiently.

- Finance teams track their payments more easily, catch anomalies faster, allocate cash holdings more efficiently, and close the books seamlessly.

- Product teams deliver better products and customer experiences.

In sum, real-time reconciliation gives companies up-to-date payments information at all levels of their organization—this powers better collaboration, better decision making, and improved trust and transparency.

In this post, we’ll walk through Modern Treasury’s Reconciliation Engine and illustrate how it works.

Consider the Fictional Company BoatHero

Companies that move money in their products often rely upon multiple payment methods and processors to run their operations.

Consider BoatHero, a marketplace for boat rentals. Suppose BoatHero’s payment operations involve accepting boat rental payments from users via cards. Once BoatHero receives users’ payments, BoatHero then pays out boat owners via ACH.

To run their payment operations smoothly, BoatHero needs to track and reconcile transactions automatically on both sides of their platform. They must confirm:

- BoatHero’s card processor successfully processed and settled each users’ card payment for a boat rental.

- BoatHero’s bank successfully processed and settled each ACH payout to boat owners.

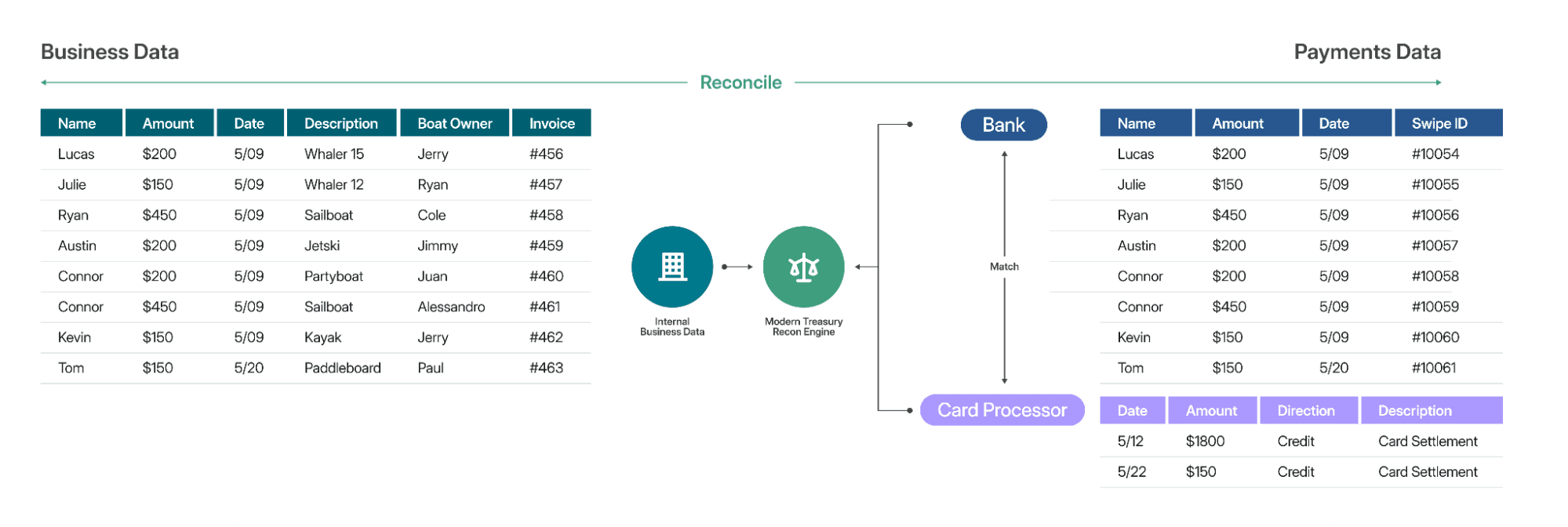

Confirming each of these operations would require that BoatHero match payments data from their payment processors against business data from internal systems. However, this is challenging, especially at speed and scale.

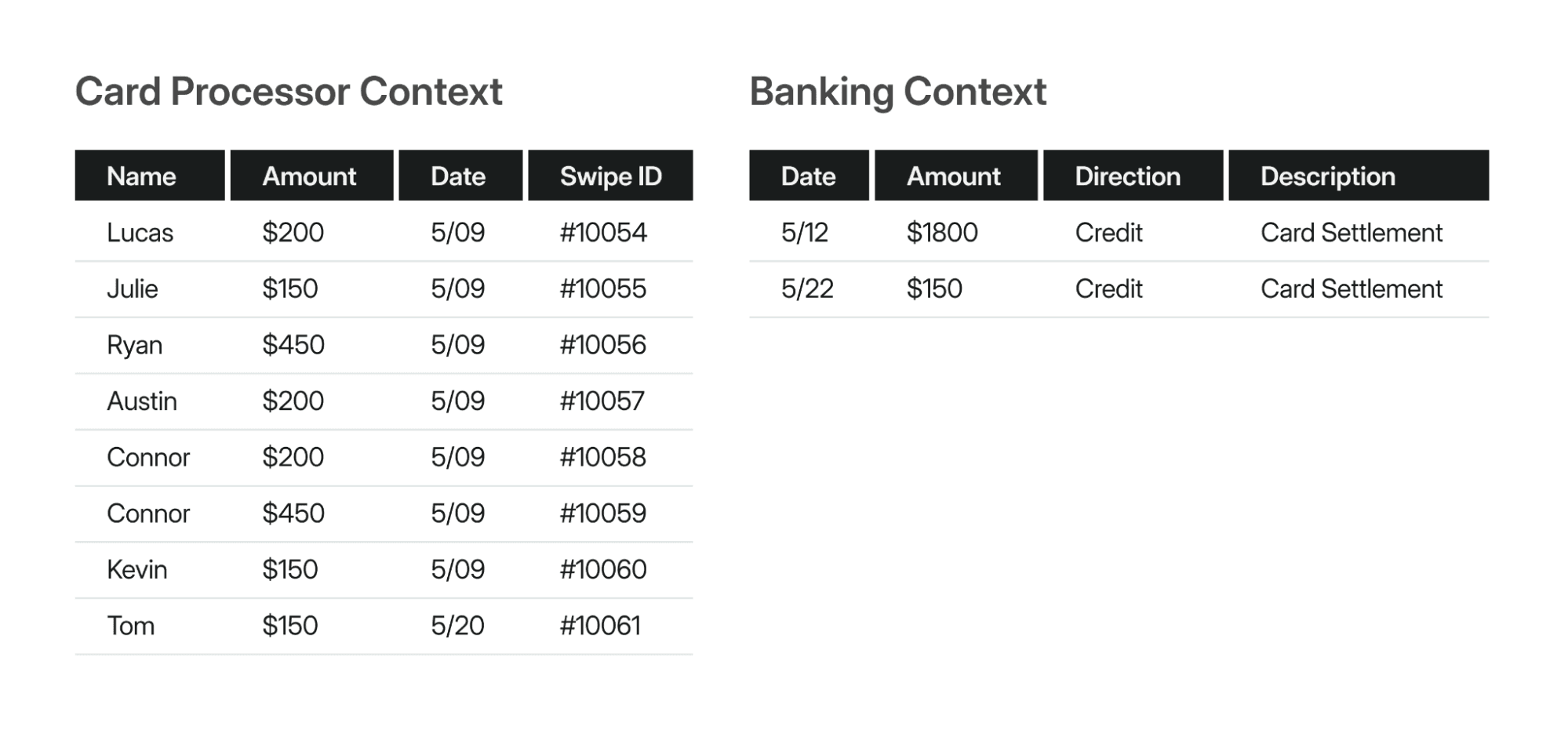

It’s hard because the transaction-level payment data that lives in the card processor context (i.e., a user’s card swipe for a boat rental) is not mirrored on the bank statement, which is batched. Card processors process users’ card transactions and then later distribute a net settlement to the company’s bank.

As a result, it would be difficult for BoatHero to confirm that they’ve received a specific user’s boat rental payment—to do so involves a complicated many-to-one matching process.

Modern Treasury’s Reconciliation Engine addresses this reconciliation challenge automatically.

How It Works

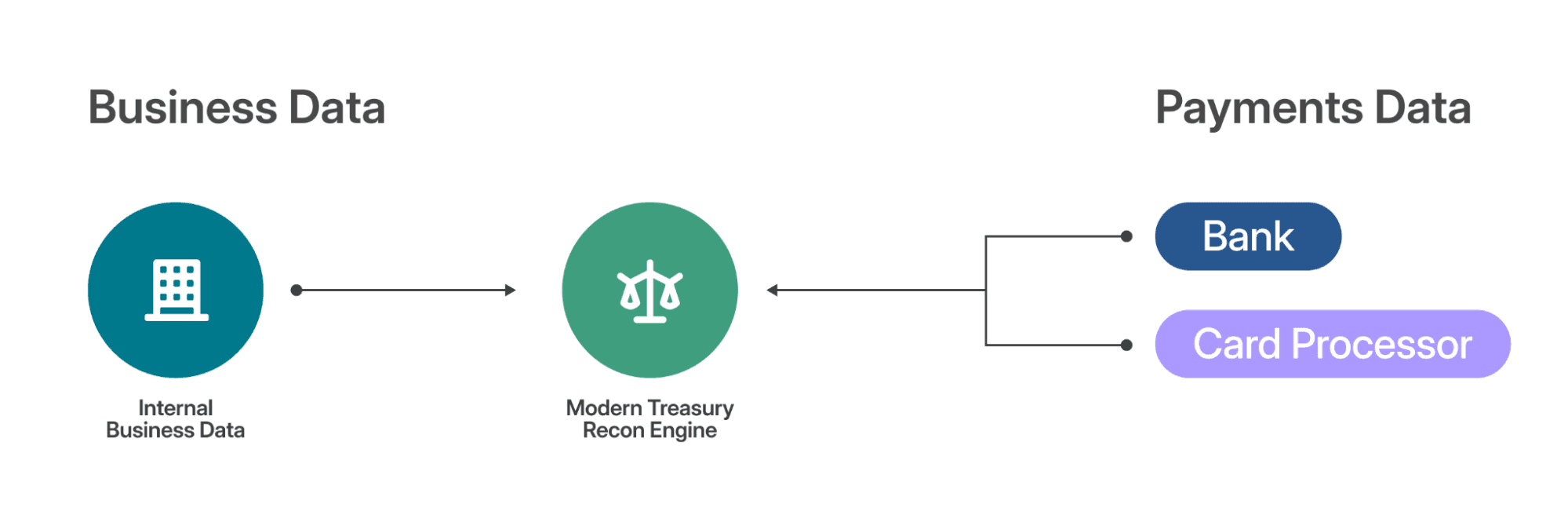

Modern Treasury allows customers to automate cash reconciliation across payment methods and processing partners. To accomplish this, the platform performs a complex, three-way matching exercise across data from:

- Card processors

- Banks and financial institutions

- Business objects in internal systems of record (e.g., Ledgers, ERPs, and SFDC).

To show how this works, it’s helpful to separate the reconciliation engine into three distinct capabilities: data ingestion, data normalization, and data reconciliation.

Capability I: Data Ingestion

Since the company’s founding, Modern Treasury has built direct integrations with 20+ financial institutions to send and receive payments programmatically. Leveraging those direct bank integrations, Modern Treasury is able to proactively retrieve and centralize bank reporting files into the platform for reporting and reconciliation.

Using the Modern Treasury APIs you can represent transactions from card processors. With our expected payments API you can represent individual card swipes as well as the bulk payouts processors execute to bank accounts. By automatically reconciling card processor data with transactions we ingest from our native bank integrations, Modern Treasury becomes a unified platform for reporting and reconciliation.

In addition, Modern Treasury collects internal business data from customers—in ERPs, Ledgers, SFDC, data warehouses, etc.—for automatic cash reconciliation. Customers can share their business data in a variety of ways, such as via pre-built software tools, CSV uploads, or Modern Treasury’s API.

In the case of BoatHero, using Modern Treasury allows them to centralize their data across their banks, card processors, and internal business systems in a single platform.

Capability II: Normalization

Once the payments and business data is in the platform, the Reconciliation Engine normalizes and enriches the data sets to prepare for reconciliation. Specifically, Modern Treasury will:

- Structure and cleanse card processor data as well as tie users’ card transactions to a specific customer bank account within Modern Treasury.

- Parse and enrich the bank payments data by translating the reporting bank files (e.g., BAI2 or MT940) into intelligible transaction line items.

- Format and cleanse business data by mapping the customers’ internal business objects to a users’ confirmed card transaction.

For BoatHero, this would be essential because it makes all the datasets—bank data, card processor data, and business object data—”apples-to-apples” for easy matching.

Capability III: Reconciliation

After all the data is parsed and normalized, the Modern Treasury reconciliation engine employs sophisticated AI-powered models to execute a three-way mapping function, reconciling each payment at the transaction level.

This would allow BoatHero to automatically confirm that each payment completed, and attribute it to the correct user and business purpose.

Ledgering Reconciled Data

Once the transaction has been reconciled, Modern Treasury then records the transaction data in the Modern Treasury Ledger.

With Ledgers, BoatHero would be able to unify transactions across their card processors and their banks in a central and scalable database. This, in turn, would allow BoatHero to:

- Store and query reconciled data. Ledgers normalizes data in a single database, allowing BoatHero to easily surface transaction information within their front-end and internal systems.

- Hold balances using reconciled data. BoatHero could record user balances in the Ledger. These balances would then be utilized in internal operations and presented to the user in the BoatHero application.

Real-Time Finance with Modern Treasury

Many companies that move money in their products have similar payment operations needs as BoatHero—tracking, reconciling, and recording payments data across their banks and processors is central to their platform operations. With Modern Treasury, businesses are able to manage these operations continuously in real-time: tracking incoming payments as they arrive, attributing them to a user and business purpose, and recording them in a scalable ledger for use through the platform.

By offering real-time financial data, Modern Treasury accelerates customers’ businesses by syncing and harmonizing the world of software with the real-world payments networks. In doing so, real-time finance enables companies to provide a consistent, integrated experience to users, a compelling value proposition to customers, and efficient, intuitive payment and finance operations for their internal teams. Reach out to learn more.