Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

Use Cases for Faster Payments

In this journal, we’ll take a closer look at several use cases for faster payments and their applications for businesses, consumers, and government agencies.

As payments technology has grown and expanded, so has the demand for faster payments in the US. Faster payments—also called “instant payments”—have the potential to completely overhaul the way money moves in the US by making it easier and more accessible to do everything from splitting a dinner bill with friends to providing immediate disaster relief for those in need.

Business Use Cases for Faster Payments

For businesses, faster payments offer ways to streamline payments to customers, consumers, and employees, as well as speeding up business-to-business transactions. We’ll take a deeper dive into some examples below.

Business-to-Business (B2B) Payments can be a game-changer in maximizing access to capital for businesses. Requests for Payment (RFP) (or other e-invoices) can be sent that include all the relevant information a customer needs to remit the requested payment. Meaning, a business can send a bill directly to a customer and the customer can approve and send the payment from their banking app in a single step. Being paid for goods and services in real-time—eliminating the time to mail an invoice and wait for the payment to process—speeds up access to working capital and cash on hand for businesses of all sizes.

Business-to-Consumer (B2C) Payments are one place where faster payments can, in particular, create a lot of value across a lot of lives. For example, currently, while claimants typically need insurance claim payouts right away, those payments are not always made quickly, and are usually in the form of a paper check. Insurance payouts can take up to 70 days or even an unspecified “reasonable time,” depending on the state. This is less than ideal when you’re waiting on funds to pay a medical bill, or fix your car or home. The use of faster payment rails for insurance disbursements would improve access to funds for those who need them quickly.

Faster payments can add similar value for workers. Imagine a worker living paycheck to paycheck. They need groceries on Wednesday, but don’t get paid until Friday—even though they’re working Wednesday, Thursday, and Friday of this week. An instant payment could help, in this case, by allowing workers to be paid at the end of every workday or shift instead of waiting for a more traditional payroll cycle to end.

This kind of instant payroll can especially make a difference for gig workers. Food delivery drivers could be paid after every dropoff, rideshare drivers could be paid and tipped after each ride, and tutors could be paid after each session. The same can also be true for workers who receive commissions—they could get commissions via instant payment on the same day they made a sale.

Faster Business Operations for Faster Business Payments

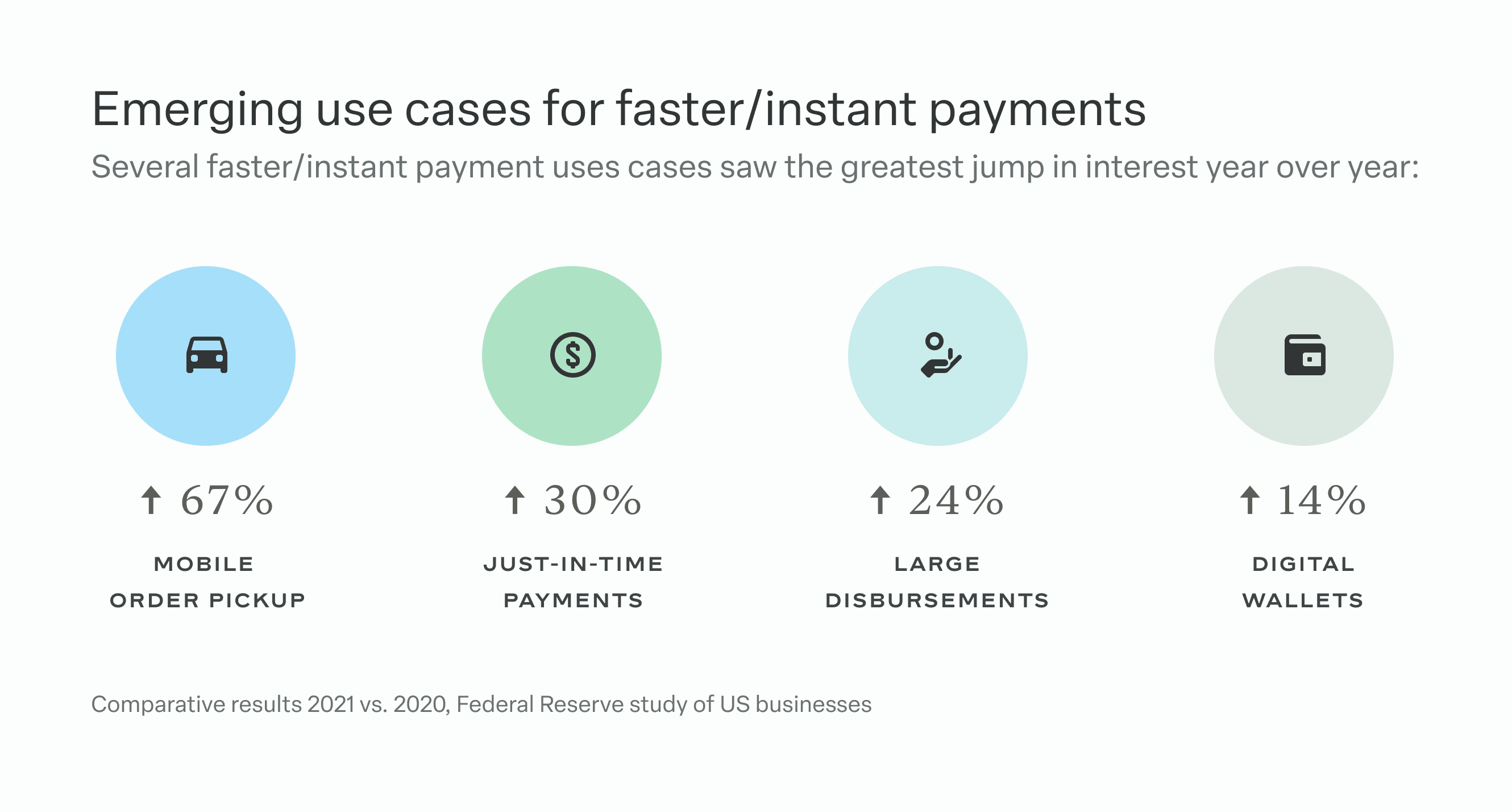

A recent survey by the Federal Reserve has found that businesses of all sizes see an increased need for the use of faster payments for a variety of use cases. While interest for things like e-invoicing and payroll has remained stable with findings from previous years, the survey found that interest in faster payments for day-to-day business operations has grown significantly. Additionally, nearly 9 out of 10 businesses surveyed say they expect to be prepared to support 24/7/365 faster payments operationally within the next three years.

In the case of B2B and B2C payments, businesses will also want to make sure that they have a ledgering system set up to handle and track instantaneous payments. Since faster payments are immediate, you can’t wait to record and reconcile those transactions, as you’ll want to be able to make informed decisions about what to do with the funds you’ve received right away. If your payments are a bullet train, your payment operations can’t be a horse and buggy. Thorough, well-running Know-Your-Customer (KYC) and Anti-Money Laundering (AML) policies are also a necessity.

Consumer Use Cases for Faster Payments

For consumers, faster payments offer instantaneous solutions for sending funds between accounts, paying friends and family, paying bills, and more. Let’s look at a few examples.

Account-to-Account (A2A) Payments allow for the transfer of funds from one account to another, typically between accounts owned by the same customer. Historically, you might have to write yourself a check to move money from one of your bank accounts to another or from a checking account to a brokerage account, for example. With faster A2A payments, that process is streamlined and removes the need for a check.

Peer-to-Peer (P2P) Payments are probably the most ubiquitous of the faster payment options—with consumers being able to electronically send money using services such as Venmo, Paypal, Zelle, or CashApp. P2P payments are useful for paying for services—like babysitting or dog-walking—or for paying friends and family. P2P payments can make something like splitting the check for a meal with friends straightforward.

Consumer-to-Business (C2B) Payments occur when consumers pay a business for their goods and/or services. C2B payments are also useful for making bill payments—imagine paying your cell phone, electricity, and water bills all instantly, rather than mailing a check or waiting several days for an ACH payment to clear. C2B faster payments can also help consumers avoid late fees on payments, because they can be confident that their payment posts to the biller’s account right away.

Government Use Cases for Faster Payments

Government-to-Consumer (G2C) Payments have the potential to vastly change the financial landscape of the United States. Something as routine as getting a tax return could be sped up significantly. Once your yearly taxes are received by the IRS, they could issue your tax return and it would hit your bank account the same day.

Instant G2C payments could also be utilized in times of crisis or disaster. Currently Federal Emergency Management Agency (FEMA) applications for assistance can take up to 10 days to be received and processed. It then takes at least another 10 days to receive a FEMA disaster relief payment, if your application for assistance is approved. That payment sometimes comes via check, meaning affected people then need to either go to a bank to deposit it or go to a check cashing facility. The whole process can involve 20+ days of waiting for funds. Instead, faster payments technology could help get money into the pockets of affected people right away.

Consumer-to-Government (C2G) payments are also an honorable mention here: imagine paying taxes, paying to renew a driver’s license, or paying application fees for a local permit instantly.

Simplify Faster Payments for Your Business

Faster payments have the potential to radically change the payments landscape in the US. But custom-building a payment operations system ready to handle the various faster payment rails (and traditional ones, too) can be time-consuming and costly. Modern Treasury is the operations layer for the new era of payments, and can set your business up to send, receive, and reconcile payments over any payment method quickly and on a single platform.

We want to make sure your business is ready to take advantage of everything that faster payments can offer. Reach out to us to find out how we can help.

Get the latest articles, guides, and insights delivered to your inbox.

Authors