Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

NSF Protection for ACH Debits with Plaid

We have previously shared news of our partnership with Plaid, and our first Plaid integration which enables our mutual customers to instantly verify their counterparties through Plaid.

We have previously shared news of our partnership with Plaid, and our first Plaid integration which enables our mutual customers to instantly verify their counterparties through Plaid. Modern Treasury has now also added support for NSF Protection using Plaid. It works by accessing balance information for verified counterparty bank accounts via Plaid before initiating an ACH debit.

If a Modern Treasury customer initiates an ACH debit from a counterparty account, and that account does not have enough funds to cover the transaction, the counterparty account has non-sufficient funds (NSF). If this happens, the counterparty’s bank might charge the counterparty an overdraft fee. The Modern Treasury customer’s bank will also charge a fee for the ACH return from the attempted transaction. These fees can often be $35. Large banks reported charging consumers $11.45 billion in overdraft and NSF fees in 2017.

Beyond fees, NSFs also cause operational thrash. The customer would have to reach out to the counterparty to authorize a second ACH debit. The customer might also pass on the cost of bank fees and customer support to that counterparty. A simple NSF then becomes an expensive customer experience and operational exercise.

Now, with NSF Protected counterparties, Modern Treasury can check the balance of the counterparty before initiating an ACH debit. If the counterparty does not have sufficient funds to cover the debit, the debit will not be initiated. This protects both the counterparty and our customer from fees, and eliminates a large customer support expense.

An Example

When creating an ACH debit payment order to a Plaid-verified counterparty, a Modern Treasury customer can enable NSF Protection. Then, at processing time, Modern Treasury will check the balance of this counterparty account. If the balance is equal to or higher than the payment order amount, the payment order will be processed and subsequently initiated. If the balance is lower than the payment order amount, then this payment order will not be processed, and Modern Treasury will send a notification via new webhook event (“nsf_deferment”).

Technical Details

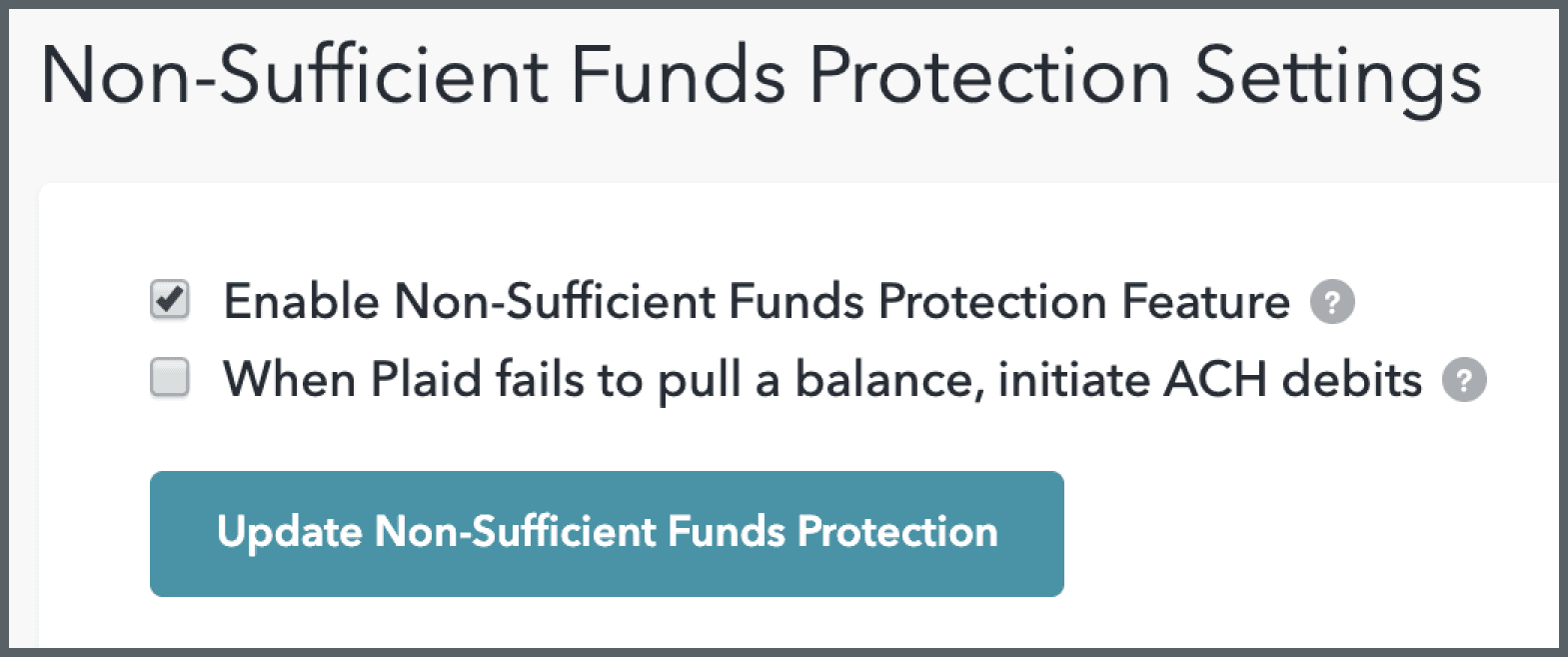

There is now an NSF Protection Settings section under Organization Settings. Within this section, there is a setting that enables the NSF Protection feature.

There is also a setting for what to do if Plaid fails to pull a balance. When selected, we will initiate the ACH debit if Plaid fails to pull a balance.

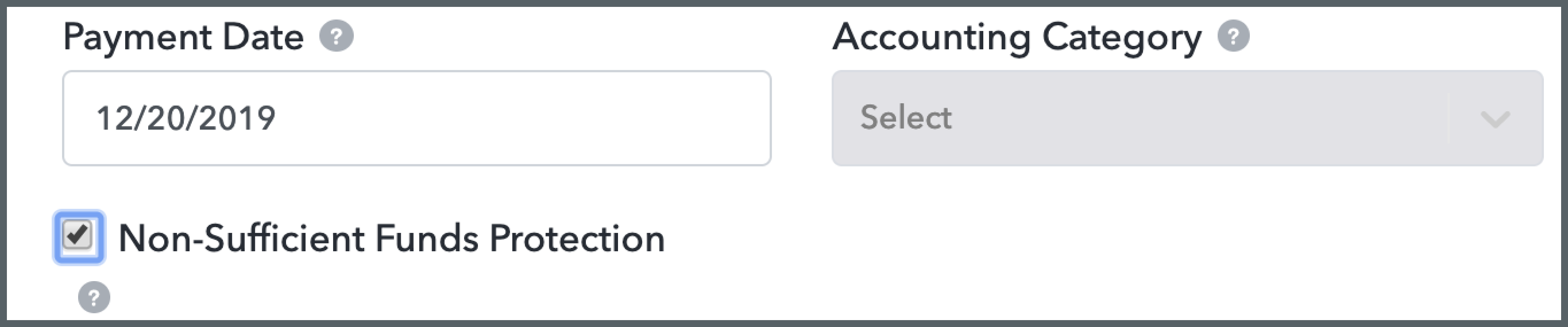

Once the NSF protection feature is enabled, you will see a checkbox for “Non-Sufficient Funds Protection” on the new payment orders page. This will only be selectable when the payment order is an ACH debit and the NSF Protection feature is enabled.

Similarly, you can specify an nsf_protected param when creating and updating a payment order via our API. For example:

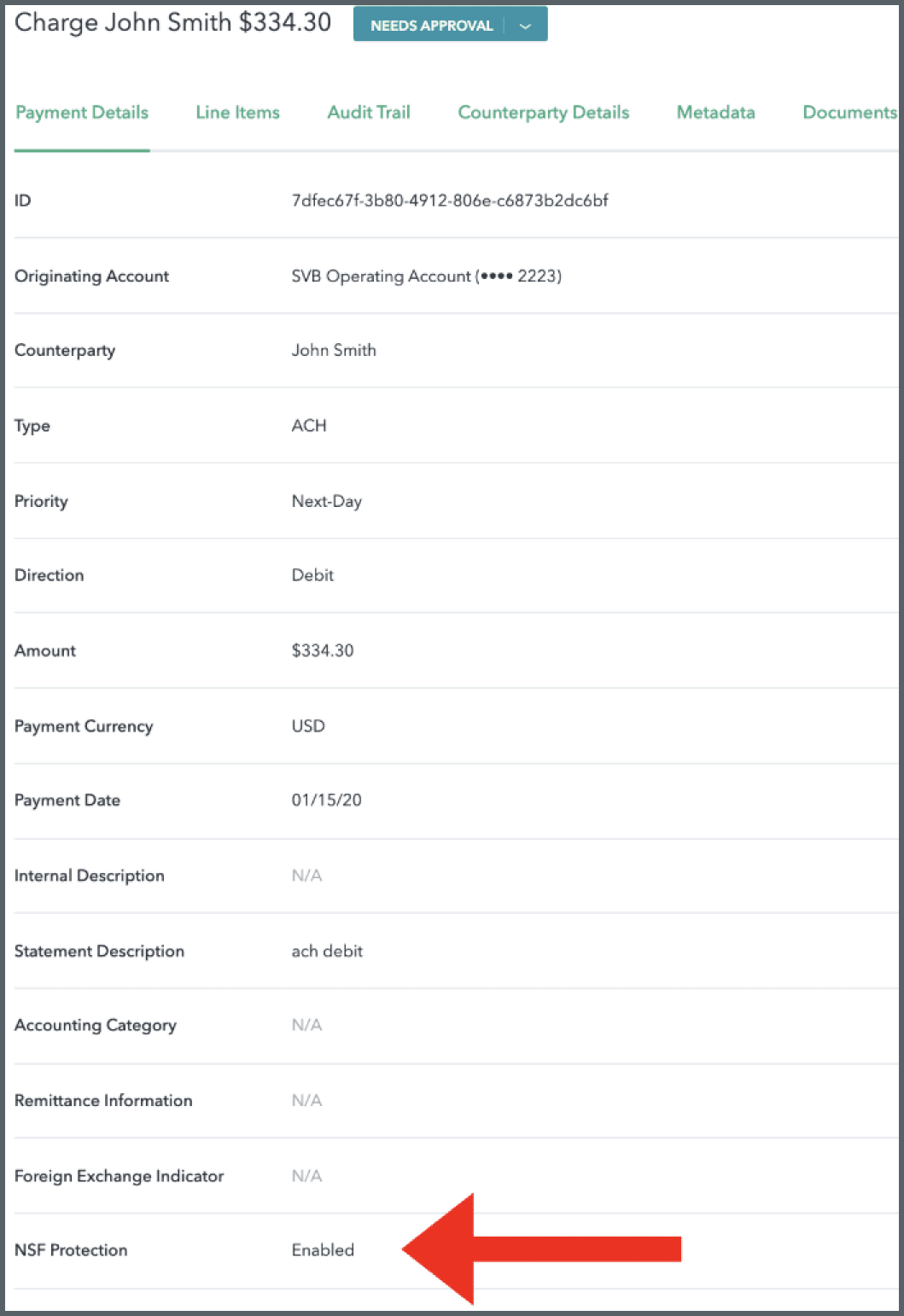

After creating a payment order, you will also be able to see whether it is NSF protected on its payment order details page.

To learn more about building with our Plaid integration, please refer to our guide here. If you’re interested in building products with both Modern Treasury and Plaid, send us a note.

Get the latest articles, guides, and insights delivered to your inbox.

Authors