APIs for Finance Teams

Explore the significance of APIs, especially for those in finance roles seeking to innovate workflows and transform their business.

APIs have become the cornerstone of real-time financial workflows—and will likely grow more prevalent in coming years. Whereas the number of API (or application programming interface) calls made by the finance sector increased 125% in 2020, McKinsey estimated that by 2027 the total number of APIs deployed in the banking sector will double. Data also indicates business growth potential related to APIs—one study found that financial firms using APIs saw 12.7% more growth in market capitalization over a four year period than those that didn't adopt APIs.

An API is a way for two or more applications, programs, or digital services to communicate with one another through a request and response process. Let’s explore why APIs are significant, especially for those in finance roles—in both traditional businesses and in fintechs—who are seeking to innovate workflows and transform their business. While the specific tools in a company’s financial tech stack will vary significantly based on use case and vertical, the following advantages of API connections for enterprises are nearly universal.

Key Benefits of APIs for Fintech Companies

Consider many fintechs where batch processing, manual reconciliation, and legacy custom tools and systems are the norm, limiting potential growth. APIs make it possible for these companies to capitalize on new revenue streams, reduce loss, and become more efficient.

Reducing Leakage and Lost Cash

Limited resources and batched reporting processes can cause a delay in information exchange; the lack of real-time data can then lead to leakage and lost cash. APIs can bolster accuracy, and reduce or even eliminate fragile processes—lessening possibilities for human error, and streamlining workflows when technical resources to manage them are limited.

Streamlining Manual Processes

A top advantage of API-enabled processes is the potential for real-time reconciliation. According to a recent survey of financial leaders, less than 80% of company’s payments are accurately reconciled to bank statements. Further, 97% of those surveyed agreed that automatic reconciliation is important for business. This data in tandem with the rise of instant payments underscores the need and desire for transformation.

Real-time reconciliation simply isn’t possible without APIs that supply on-demand, continuous, and centralized data. With Modern Treasury’s Ledgers API, teams have greater security in their accounting practices and the knowledge that everything is logged and immutable. This helps provide an audit trail to save time when a specific transaction requires scrutiny. Capchase, a global financing platform, provides a great example of streamlined processes enabled by Modern Treasury APIs.

“Our ability to provide required information completely off the shelf during last year’s full financial audit was invaluable. That the auditor could track every single transaction associated with every single loan in our system, and then associate it to every single pay out in our bank, was incredibly powerful,” said Salima Ghadimi, Manager of Platform Operations at Capchase.

The benefits of this model for reconciliation are tremendous, including greater speed and accuracy, easier reporting (reducing risk), and new growth opportunities.

Enabling New Business Models

In addition to cost and time savings, APIs can foster growth by unlocking new revenue opportunities. Embedded finance is only possible via API, wherein a code is generated that talks to a third-party system and that third party-system creates and executes the transaction.

Key Benefits of APIs for More Traditional Business Models

Most finance teams for companies with more traditional business models rely on a hub-and-spoke model centered around an ERP, or Enterprise Resource Planning software. These companies face issues with manual downloads and uploads and siloed data that slow teams down, and don't translate easily across these “spokes” so there are multiple points of failure and potential quality issues.

Ten or more years ago, systems choices were different; teams would make necessarily suboptimal decisions around which tools to use because data integrations were too complicated. The finance team would have continued doing as much as they could through the ERP and multiple systems—and even if this presented difficulty, the challenge was simple relative to building a bespoke integration. Today, APIs make it possible for companies to choose better solutions for any number of workflows—billing, spend management, HR, taxes, and more.

Managing Resources Efficiently

APIs enable connectivity that boosts efficiency and saves time. In the payroll example, running processes via an ERP and manual workflows would have previously required headcount. For scaling businesses, employing an HR API that connects seamlessly to an ERP saves money. The result of multiplying that savings across systems and processes (especially reconciliation) is meaningful. Seen another way, companies can accomplish more with the same level of resources.

Enabling Agility with Component Infrastructure

With APIs, businesses are now able to choose among best-in-class tools (spokes) to integrate with their ERP (hub). APIs also allow teams to switch out these tools as needed in a way that is relatively low cost and low lift. API integrations should be flexible and customizable.

There is no single model for employing APIs that will work for every business. With APIs, finance teams can build a custom tech stack that responds to their needs and can scale more easily. Flexible architecture ensures teams can be responsive to new business models, like embedded payments.

The process of embedding financial workflows, however, can be far from straightforward. As Procore, a construction management firm, discovered while creating its embedded payments offering, card APIs wouldn’t do—the team needed an API and infrastructure that could handle volume, complexity, and high-dollar payment values. Procore’s partnership with Modern Treasury helped the company ultimately grow revenue and get subcontractors paid out faster.

Increasing Reliability

APIs help finance teams have greater confidence in their data and recover strategic time, especially since platforms like Modern Treasury are designed to send alerts when human intervention is required. Modern APIs with reliable connectivity shore up potential points of vulnerability and potential resulting quality issues.

Centralizing Data

Finance teams can access banking APIs for real-time, transaction-level data. A single banking API can centralize transaction data across bank accounts. The availability of data in a central location (or consistently available information in multiple locations) can replace silos, enhance collaboration, and boost visibility.

Via Modern Treasury’s REST APIs, users determine the frequency of calls, with the flexibility to capture and push data as quickly as it appears. The higher the volume of data a company is managing, the more essential this becomes.

Choosing Partners with Reliable APIs

All APIs aren’t created equal. In selecting a vendor with API connectivity, finance teams need to ensure that:

- Setting up the connection is easy. Quality vendors will offer excellent documentation for technical teams, in addition to more hands-on services for complex financial workflows. A testing environment, or sandbox, should offer full functionality so teams can accurately assess the product.

- The API is reliable, secure, and built for scale. Ensure a partner’s APIs are available at four-nines or better (i.e., available 99.99% of the time). Read case studies to get a sense for customer volume and ask about team practices that ensure reliability.

- Your team has control, support, and security. If something goes wrong, finance teams need to know when an internal technical team can assist (and ensure they have the power to troubleshoot) and where to turn for support if they can’t. Look for a strong security policy that includes an Incident Response Plan.

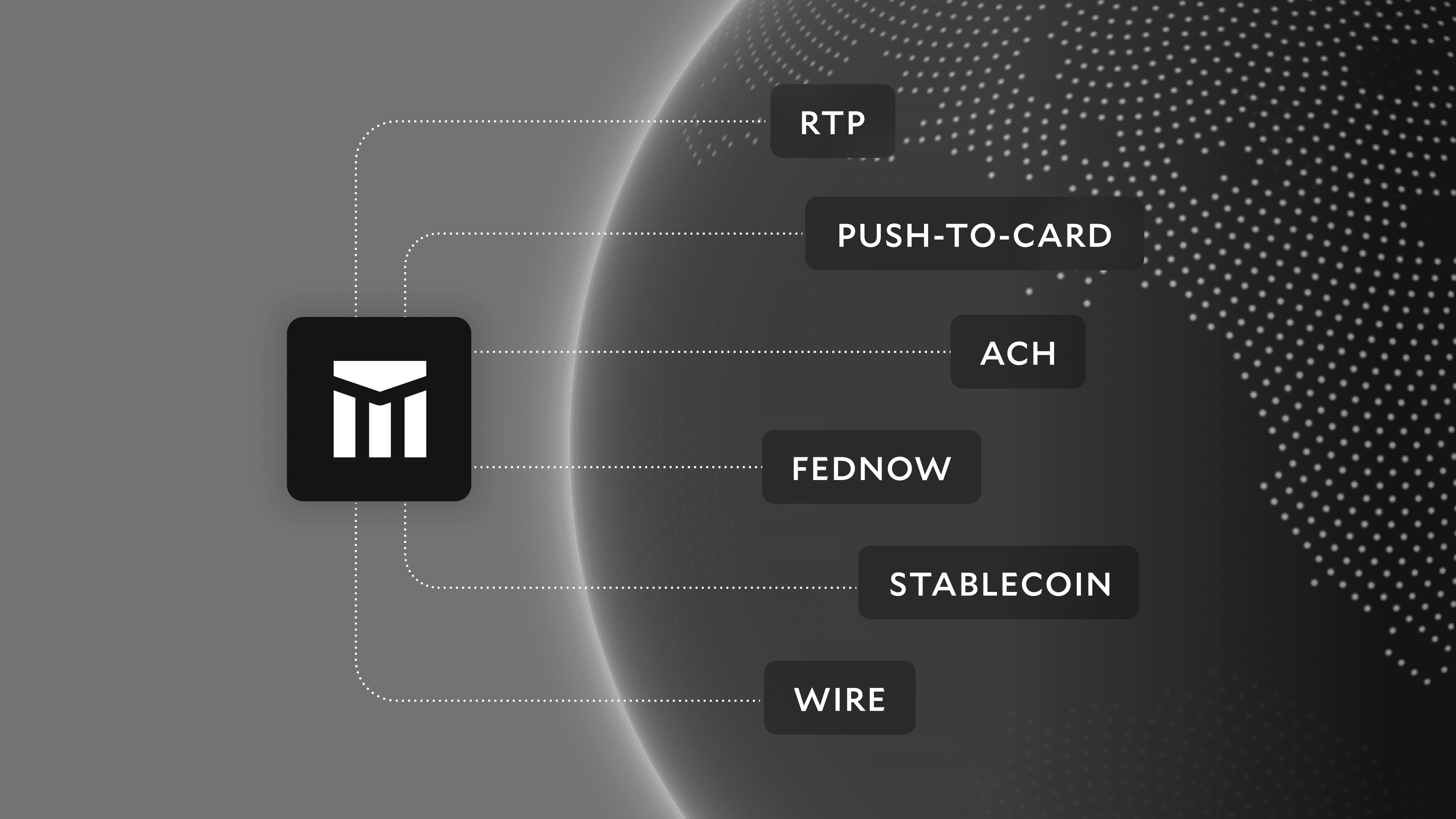

Modern Treasury offers a suite of APIs that enterprises can leverage to integrate with over 40+ across payment rails, providing a single pane of glass for all bank transactions. Discover the power of better connectivity—reach out today.